For weeks and longer I read key pundits write about the need for rate cuts in Australia. I was quite skeptical: I even concluded in February that a rate cut was NOT imminent. In a move that surprised me, the Reserve Bank of Australia (RBA) Governor Philip Lowe effectively promised an imminent rate cut in a speech in Brisbane in his address to the Economic Society of Australia titled “The Economic Outlook and Monetary Policy“:

” A lower cash rate would support employment growth and bring forward the time when inflation is consistent with the target. Given this assessment, at our meeting in two weeks’ time, we will consider the case for lower interest rates.”

The subtle use of the word “consider” gives the RBA some flexibility to decide to leave interest rates alone at the June 2nd meeting. However, the context of the speech suggests that this phrasing was just typical “central bank speak.” Lowe reminded the audience that the RBA was already in the process of shifting down a more dovish path:

“Earlier this year, our assessment of the balance of probabilities around the likely direction of the next move in interest rates shifted a little. At the Reserve Bank Board meeting in February, we assessed that the probabilities of an interest rate increase and a decrease had become more evenly balanced than they were through 2018.”

Finally, the RBA provided the clear rationale for cutting interest rates based on the dynamics of the labor market:

“In the event that the unemployment rate does not move lower with current policy settings, there are a number of options. These include: further monetary easing; additional fiscal support, including through spending on infrastructure; and structural policies that support firms expanding, investing and employing people. Relying on just one type of policy has limitations, so each of these is worth thinking about.

The Reserve Bank Board recognises that monetary policy has a role to play here. Earlier today, we released the minutes of the Board’s meeting two weeks ago. At that meeting, we discussed a scenario in which there was no further improvement in the labour market and the unemployment rate remained around the 5 per cent mark. In this scenario, we judged that inflation was likely to remain low relative to the target and that a decrease in the cash rate would likely be appropriate.”

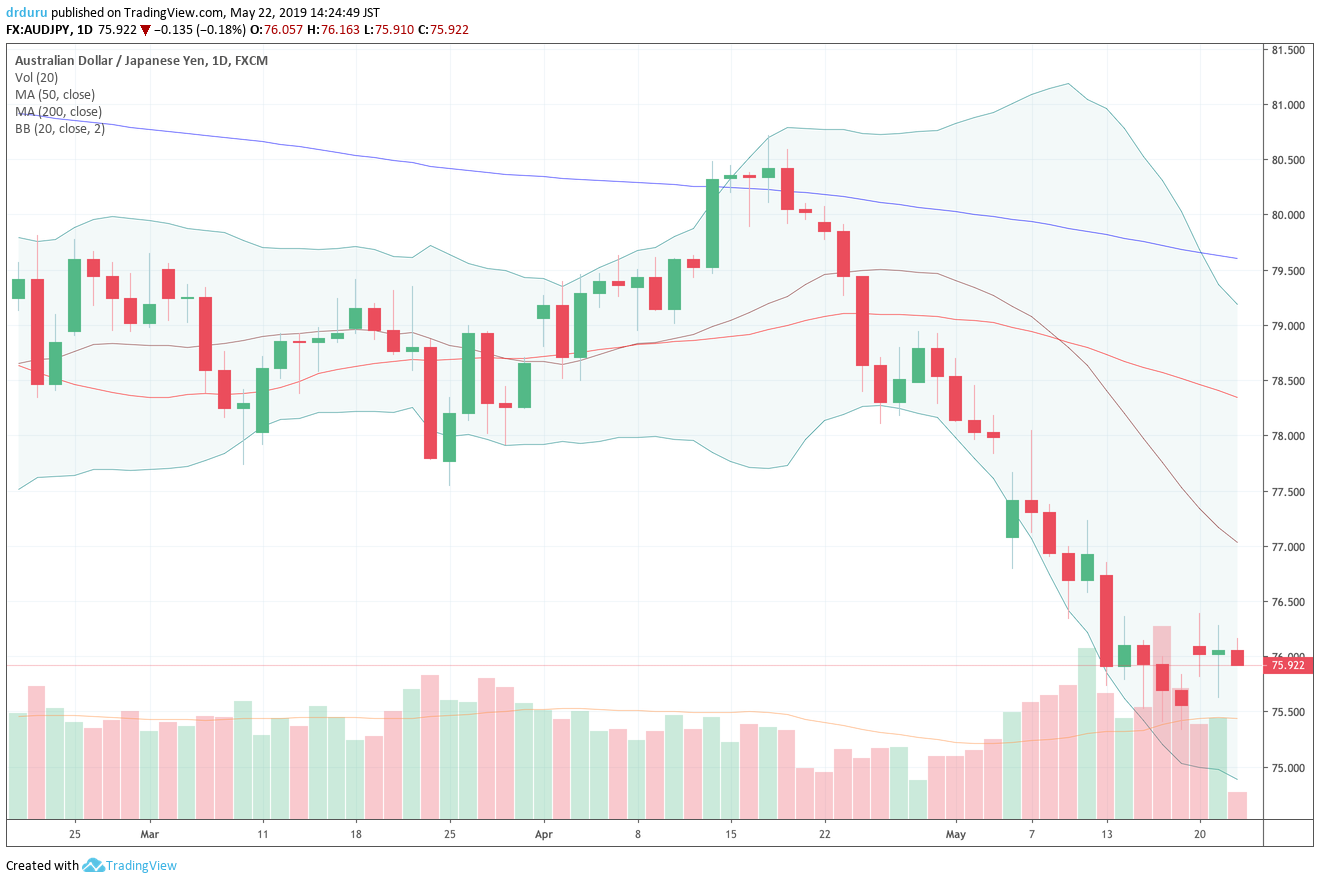

Typically, an announcement like this one would cause a sharp move in the currency. Instead, the currency market essentially yawned on the news as the Australian dollar (FXA) barely budged against major currencies. In fact, the daily charts of AUD/USD and AUD/JPY show little sign of big news. Indeed, the bigger news occurred over the weekend with the election of Malcolm Turnbull as Prime Minister…and the market promptly faded the initial excitement.

Source: TradingView

Source: TradingView

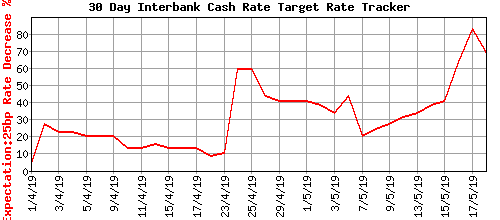

Looking back, I can see how the month-long decline in the Australian dollar was partially about pricing in the increasing prospects for a rate cut.

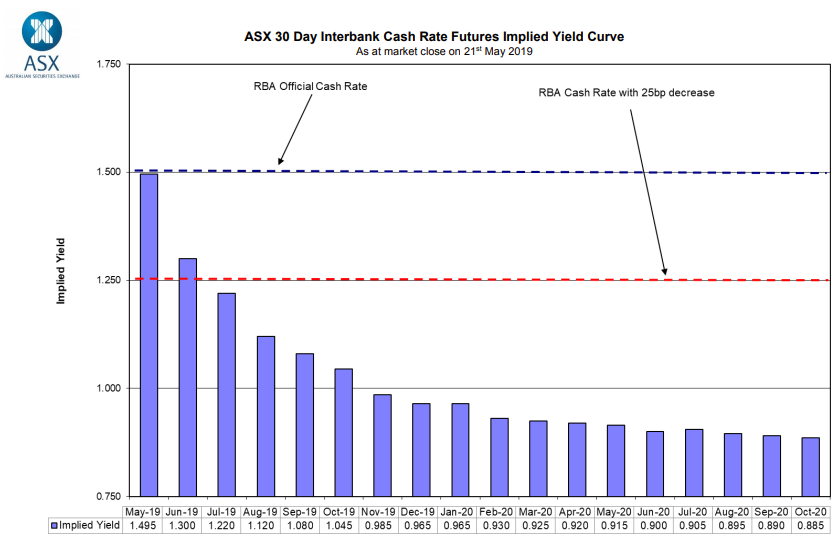

Source: Australian Securities Exchange RBA Rate Indicator

The rate momentum is so strong to the downside that the market is even anticipating a second rate cut by the end of this year.

Source: Australian Securities Exchange

I will be closely watching the market’s reaction to the June 2nd policy meeting. I fully expect the RBA to either cut rates or issue a guarantee of a rate cut in July. In either case, the Australian dollar should not budge much based on the pricing action to-date. The market will already be looking ahead to clues on the rate move AFTER the first cut. To the extent the RBA tries to dissuade the market from expecting a second rate cut, I expect the Australian dollar to strengthen if even just as a relief bounce.

Be careful out there!

Full disclosure: long AUD/JPY