After reading the February 6th Address to the National Press Club of Australia by Philip Lowe, Governor of the Reserve Bank of Australia (RBA), I am not so sure the market “got it right.” The following statement alone was used to suggest that the RBA might cut rates in the near future:

“Looking forward, there are scenarios where the next move in the cash rate is up and other scenarios where it is down. Over the past year, the next-move-is-up scenarios were more likely than the next-move-is-down scenarios. Today, the probabilities appear to be more evenly balanced. ”

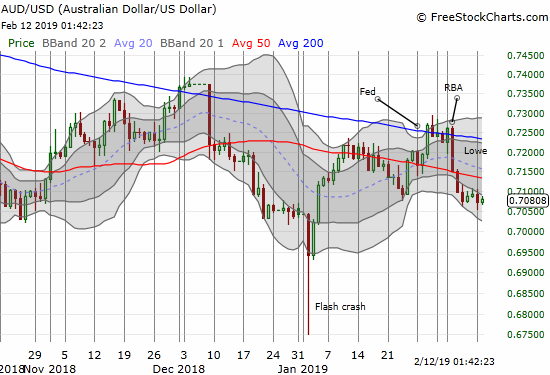

Yet, given this statement came near the end of a speech where Lowe was mainly positive about the prospects for Australia and global growth, I think this single statement requires a lot more context. I concluded that Lowe purposely floated this idea into the public sphere to temper any tendency for the Australian dollar (FXA) to rally in the wake of the “capitulation” of the Federal Reserve on its program of monetary tightening. The day before this speech, the RBA delivered economic assessments nearly identical to the ones Lowe delivered as part of its decision to leave interest rates unchanged. The Australian dollar rallied on the news. A more direct declaration about the path of monetary policy made all the difference. The Australian dollar sold off steeply and has been weakening ever since.

Source: FreeStockCharts.com

In other words, Lowe’s statement was a tool to make the RBA’s desire to cap the Australian dollar a lot more obvious and plain to currency markets.

In total, I am highly skeptical that the RBA is even thinking about cutting rates outside of a true monetary emergency. For example, while Lowe acknowledged that “some of the downside risks have increased,” he still contended that “the central scenario for the world economy still looks to be supportive of growth in Australia.” Taken at face value, this assessment must mean that a rate cut is nowhere near the horizon.

In another example from the speech, Lowe scolds the market for over-reacting to what were small decreases in the forecast for global growth (emphasis mine):

Some slowing in global growth was expected, given that labour markets are fairly tight and the policy tightening in the United States was aimed at achieving a more sustainable growth rate. So, I have been a little surprised at some of the reaction to the lowering of forecasts for global growth, which has been quite negative. We need to remember that the IMF’s central forecast is still for the global economy to expand by 3.5 per cent in 2019 and by 3.6 per cent in 2020 (Graph 2). If achieved, these would be reasonable outcomes and not too different from the recent past.

Again, these are not the words of a central banker contemplating rate cuts. Lowe is sufficiently satisfied with the current economic climate. Indeed, Lowe noted that the RBA barely shaved its expectations for Australian economic growth.

For 2019 and 2020, the forecasts have been revised down by around ¼ percentage point, largely reflecting a modest downgrading of the outlook for household consumption and residential construction.

Finally, Lowe outright declared that the RBA will not change rates in the near-term. The idea is just to end any expectation from the market for rate hikes or a relatively positive differential with the U.S. dollar.

The Board will continue to assess the outlook carefully. It does not see a strong case for a near-term change in the cash rate. We are in the position of being able to maintain the current policy setting while we assess the shifts in the global economy and the strength of household spending

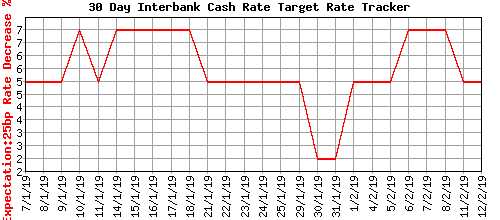

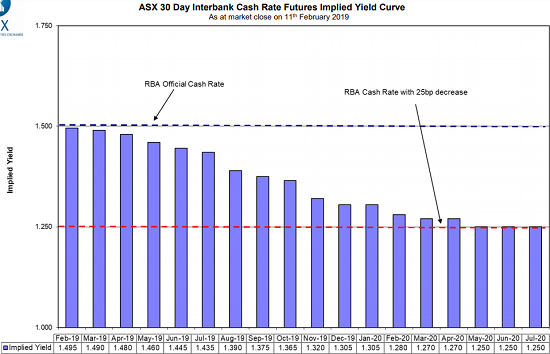

Financial markets agree in the very near-term but see a rate cut coming in little over a year (which is an eternity in currency trading!).

Source for charts: ASX RBA Rate Indicator

Having dismissed the notion of an RBA rate cut, I DO expect more volatility ahead based on Lowe’s cautious words describing an “accumulation of downside risks.” Many of these risks are related to political developments: the trade battle between the United States and China, the Brexit decision pushing to the very brink of its deadline, a global rise in populism, and “the reduced support from the United States for the liberal order that has supported the international system and contributed to a broad-based rise in living standards.” These were words of rare geopolitical candor, especially the expressed disappointment over the conduct of America on the global stage. While a decision over Brexit should come soon, the other downside risks are not going away anytime soon and will provide plenty of fuel for future bouts of market angst.

I am short AUD/USD to ride what I think is a path to test the 2019 low (minus the flash crash day). This short sits “inside” my long AUD/JPY which is a play on the bullish bias in financial markets, small carry, and the strength of the Australian economy.

Be careful out there!

Full disclosure: short AUD/USD, long AUD/JPY