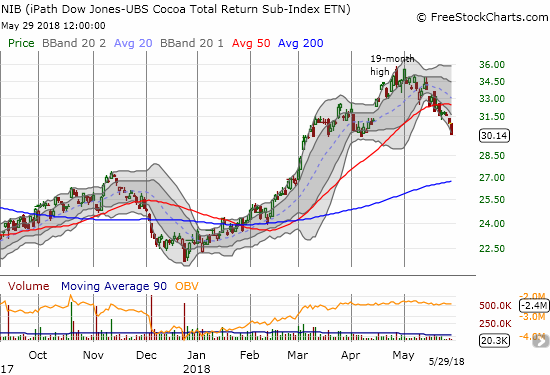

It did not take long. Two days after I identified a Bollinger Band squeeze on iPath Bloomberg Cocoa SubTR ETN (NIB), the technical chart pattern resolved to the downside. NIB has lost 11.9% over this time.

Source: FreeStockCharts.com

At current levels, NIB has confirmed a top from its 19-month high: a breakdown below the 50-day moving average (DMA) and a complete reversal of April’s breakout. I used the extremes in bullishness around the 19-month high as a reason to get cautious and avoid buying back into NIB after having recently taken profits. Looking back, those signs really stand out as classic pointers for a top in a commodity.

The headlines during this decline have been surprisingly thin on the fundamentals.

On May 15th, NIB lost 4.3% and traded down to its 50DMA. Reuters observed at the time “…layers of automatic sell orders, potentially signaling that this year’s strong advance may be starting to run out of steam.” Interestingly, and perhaps a telling extreme, the day before traders were reportedly buying up West African beans for export to the U.S. to take advantage of the highest New York market premium in over 40 years.

Last week, May 22nd, Reuters published a weather update indicating that conditions looked good in Ivory Coast to generate strong mid-crop production. Reuters even quoted one farmer confirming this assessment: “We will have significant volumes of cocoa near the end of the mid-crop…”

While cocoa experiences short-term weakness, I am keenly aware of longer-term issues that could eventually drive fresh price rallies. For example, illegal gold mining in Ghana is killing cocoa plantations. Some Ghanaian cocoa farmers may be turning to rubber production despite the difficulties faced in making such a sharp transition. And then there is Derek Chambers, the head of cocoa at Sucres et Denrees SA who recently ended a 50-year career trading cocoa. In an interview, he noted that Ghana and Ivory Coast sold forward so much cocoa that there will be little left to sell later in the season. I pointed to this aggressive selling in a previous post noting how these countries likely sold their farmers short. Until now, I did not think much about the implications for future inventory availability.

The Bloomberg article on Chambers ended on a theme I am increasingly giving attention: the large disparity in the fortunes of the farmers versus the rest of the cocoa supply chain:

“The business that has grown up around the need for sustainability does not benefit the farmers anywhere near as much as it does the NGOs, companies and individuals involved in the circus…It is a great regret of mine that farmers in West Africa were poor when I came into the business and are still poor, probably even poorer now.”

DOVE® Chocolate Extends CARE® Partnership To Empower Women In Cocoa Farming Communities

Be careful out there!

Full disclosure: no positions