{updated to include commentary on The Guggenheim Canadian Energy Income ETF (ENY)}

On Monday, June 12, 2017, Senior Deputy Governor of the Bank of Canada Carolyn A. Wilkins delivered a speech at the Asper School of Business in Winnipeg, Manitoba that was firmly bullish on the Canadian economy. The market’s reaction was swift and equally convincing. The Canadian dollar (FXC) rallied, and USD/CAD in particular confirmed resistance at its now downtrending 50-day moving average (DMA) and broke down through important support at its 200DMA.

Source: FreeStockCharts.com

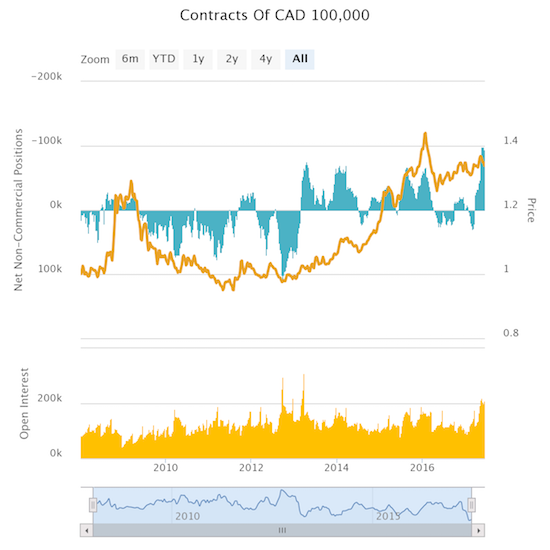

This move is particularly significant because, as of a week ago, speculators were still extremely net short the Canadian dollar. While levels have come down slightly for the last three weeks in a row, net shorts are still at their highest level since at least 2008. The bears are crowded onto a platform that is shifting in a new direction.

Source: Oanda’s CFTC’s Commitments of Traders

Once these shorts start covering, a new strengthening trend for the Canadian dollar should be underway. With oil now trading down to the mid $40s, I strongly suspect dynamics in the oil patch will not cause significantly more drag to the Canadian dollar. Indeed, a striking component of Wilkins’s assessment was her claim that the drag from oil is now largely over for Canada’s economy. From the prepared remarks titled “Canadian Economic Update: Strength in Diversity“:

“As you will remember, the Canadian economy was hit hard by the collapse in oil prices in 2014. The adjustment to lower oil prices is now largely behind us, and we are looking for signs that the sources of growth are broadening across sectors and regions. As I will explain, the signs are encouraging.”

Even investment in the oil and gas sector has greatly improved.

“…the figures show business investment growing again. This is in large part because capital expenditures in the oil and gas sector have bounced back. That is good news. That said, investment growth in this sector is likely to moderate if oil prices stay around where they are today.”

In a comeback scenario, for both the oil patch and the Canadian dollar, the Guggenheim Canadian Energy Income ETF (ENY) becomes a lot more interesting to me. This ETF currently pays a 3.1% dividend and is well off its post-recession high. It hit an all-time low in early 2016. The weekly chart below shows substantial potential upside if and when more bullish conditions return.

Source: FreeStockCharts.com

This comeback from the oil patch has precipitated a potential rethink in monetary policy at the Bank of Canada. Rates are more likely to go up in the near future. This change marks a dramatic shift from the previous concentration of dovishness form the Bank of Canada.

“An important aspect of our inflation assessment is that the economic drag from lower oil prices is now largely behind us. And the 50 basis point reduction in our policy rate in 2015 has facilitated this adjustment. As growth continues and, ideally, broadens further, Governing Council will be assessing whether all of the considerable monetary policy stimulus presently in place is still required.”

The breadth in economic growth is quite impressive. Wilkins observed that “the data show that more than 70 per cent of industries have been expanding—a rate we have not seen since the oil price shock. That is the kind of diversity that helps support strong and sustained overall growth.” In parallel, employment growth is also spreading across Canada’s provinces.

I was previously hesitant to get aggressively bullish on the Canadian dollar. I am now a lot more comfortable doing so, especially now that USD/CAD has failed to produce a net post-Fed rate hike gain. Yet, a remaining wildcard is how the Bank of Canada will react to a strengthening currency. Arugably, Wilkins did not intend to send the loonie into an extended rally. For example, she notes that exports are still a surprising source of under-performance:

“If there was one disappointment in the first-quarter figures, it was exports. We actually saw a decline of exports of services, which had been performing very well. At the same time, goods exports were flat. We have been working hard to understand the forces behind the data.”

A stronger currency will only exacerbate these issues. Moreover, the Trump administration has introduced policy uncertainty that complicates the Bank of Canada’s estimates and will make a strong currency even less desirable.

“We are all acutely aware of the uncertainty around the policies of the US administration—whether it is about trade, tax or the regulatory environment.”

In the meantime, I favor fading the next rally in USD/CAD, however shallow. I will be looking for the downtrend channel formed by the lower-Bollinger Bands (BBs) to hold – the top is currently around 1.3317.

One side note – in the Q&A period, Wilkins answered a question about Canada’s real estate bubble (the 29:00 point in the video recording). Wilkins responded that overall fundamentals in the housing market remain strong. She reserved caveats for Vancouver and Toronto. Wilkins noted that the fundamentals cannot explain price growth in Toronto; a price correction is a real risk. It is hard to know what, if anything, will trigger such an event. Last year, Vancouver served as a test case where housing activity started to decline ahead of policy changes. “Natural forces” slowed down housing activity. Yet, that correction did not produce macroeconomic consequences for Canada as a whole.

Be careful out there!

Full disclosure: no position