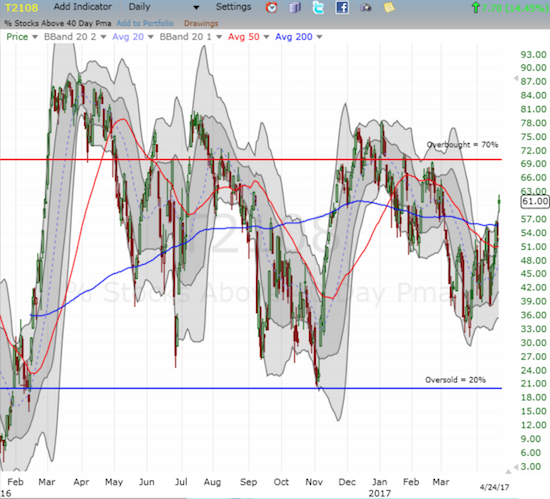

AT40 = 61.0% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 63.0% of stocks are trading above their respective 200DMAs

VIX = 10.8 (volatility index)

Short-term Trading Call: bullish

Commentary

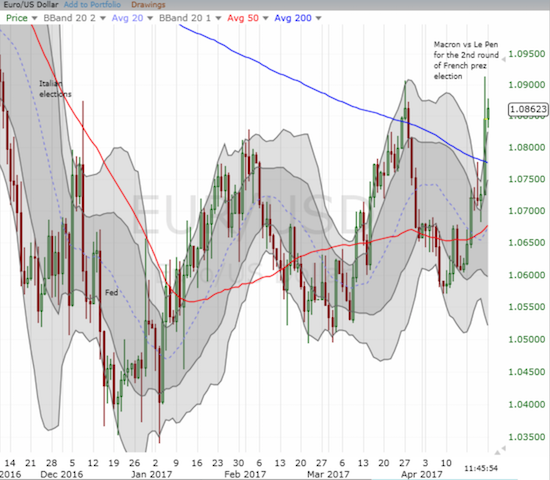

Going into the first round of the French Presidential election, I figured the best case scenario was the absence of a market sell-off. I never even considered the possibility that the prospect of the election was actually weighing on the stock market. After all, the euro (FXE) was in recovery mode from its latest dip against the U.S. dollar (DXY0). EUR/USD showed no immediate concern with the election.

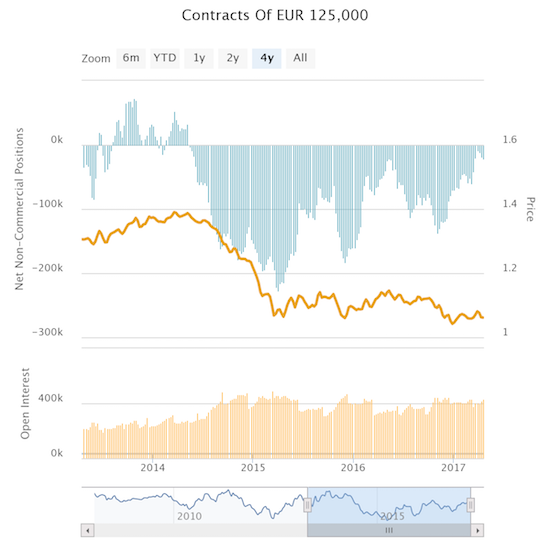

Despite a small recent rise in net euro shorts, speculators were overall in the middle of their most extended retreat from net short positions since they last switched to euro bears almost three years ago.

Source: Oanda’s CFTC’s Commitments of Traders

So, going into the weekend, while I remained bullish on the euro, I surely did not expect a tremendous surge on whatever would be interpreted as good news from the first round of the Presidential election. I am nicknaming this burst of euphoria the “French Fly.”

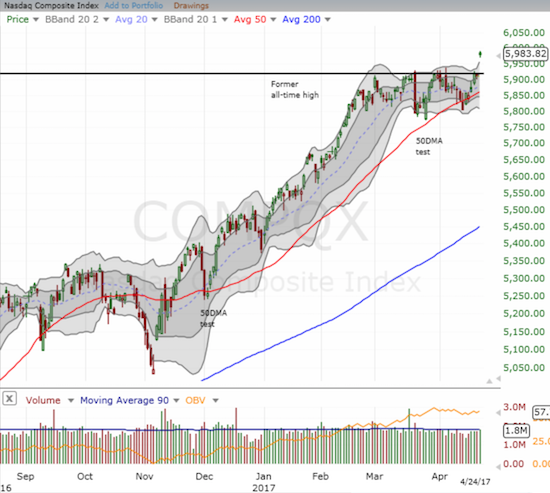

The French Fly was definitively bullish with important breakouts on the major indices. I even dropped “cautiously” from my short-term trading call. Traders smashed the short-term downtrend on the S&P 500 (SPY) and scoffed at resistance from the 50-day moving average (DMA).

The NASDAQ (QQQ)* gapped up to a gain of 1.2% and closed above its upper-Bollinger Band (BB).

AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, confirmed the breakouts with one of its own. AT40 jumped from 53.3% to 61.0%, a new 7-week high.

The volatility index, the VIX, rounded out the signs of the latest collapse by the sellers and bears with a definitive return to the area of extremely low volatility (below 11.0). The VIX was absolutely smashed with a 25.9% drop.

Recall that the immediate implications of extremely low volatility are bullish, not bearish. I am not sure whether the clock on a May pullback is still ticking or whether I have to hit the reset button. Regardless, I am a bit surprised that the steady elevation in the VIX up until today ended so dramatically…again, because I simply did not appreciate just how much the French election was actually weighing on sentiment.

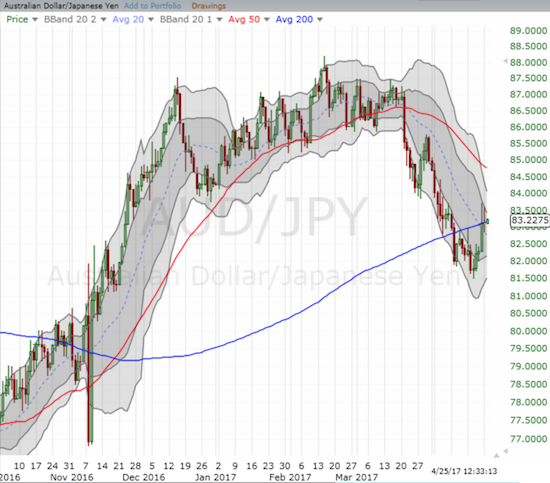

Note that the currency market has not given its “all clear” just yet. The Australian dollar (FXA) versus the Japanese yen (JPY) has yet to break free of 200DMA resistance. I am sticking with my shorts against the Australian dollar.

The timing of this breakout means that I missed out big with my call options on ProShares Ultra S&P500 (SSO) expiring on Friday and getting stopped out of a swing trade on ProShares Short VIX Short-Term Futures (SVXY) a week and a half ago. SVXY gained 10.8% today – ouch. I was still holding put options on ProShares Ultra VIX Short-Term Futures (UVXY) and sold those for a small gain (I sold at the open). The market was generous enough to let me back into a fresh tranche of SSO call options at my bid price. Hopefully this tranche fares better than the last.

I also bought call options on iShares MSCI Emerging Markets (EEM) assuming that risk-on is back with a vengeance.

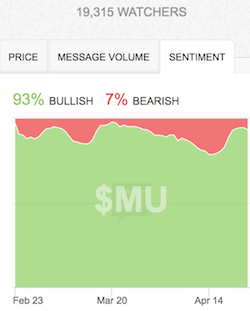

The day was far from roses and wine. One of the few purchases I made last week was Micron Technology (MU). I even loaded up on shares and call options as the stock started to bounce from a gap fill. Inexplicably, the stock faded from its high of the day to close with a loss of 2.8%. This is a pretty bearish move that suggests a direct test of 50DMA support is coming. I will not be surprised if support gives way.

Source: StockTwits

Now we stay tuned for more political drama on the domestic front with the potential for a government shutdown, wrangling over tax reform, and then back to the second round for the French Presidential election on May 7th…

Be careful out there!

— – —

FOLLOW Dr. Duru’s commentary on financial markets via email, StockTwits, Twitter, and even Instagram!

“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #296 over 20%, Day #116 over 30%, Day #6 over 40%, Day #3 over 50%, Day #1 over 60% (overperiod ending 36 days under 60%), Day #68 under 70%

Daily AT40 (T2108)

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Weekly AT40 (T2108)

*All charts created using freestockcharts.com unless otherwise stated

The charts above are my LATEST updates independent of the date of this given AT40 post. For my latest AT40 post click here.

Related links:

The T2108 Resource Page

You can follow real-time T2108 commentary on twitter using the #T2108 or #AT40 hashtags. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag.

Be careful out there!

Full disclosure: long SSO shares and call options, long MU shares and call options, long FXE call options, long EEM call options, short AUD/JPY, long EUR/USD

*Note QQQ is used as a proxy for a NASDAQ-related ETF

Love “French Fly”. Alliteration; a pun; and I picture an insect gesturing with a tiny cigarette as it insults customers at a Paris street cafe. “Eh, all ziss noise about za election! You are zo foolish! I don’t care!”

—

You’re not the only one scratching your head about MU. A pullback in spot DRAM prices is being blamed, which makes sense… two years ago. Institutional traders might still have that reflex, I suppose.

I love that image in Paris!

At least MU made a rebound from the intraday low which just missed the 50DMA.