(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 73.8%

T2107 Status: 45.4%

VIX Status: 16.3

General (Short-term) Trading Call: neutral

Active T2108 periods: Day #41 over 20%, Day #40 over 30%, Day #37 over 40%, Day #34 over 50%, Day #30 over 60%, Day #29 over 70% (overbought)

Commentary

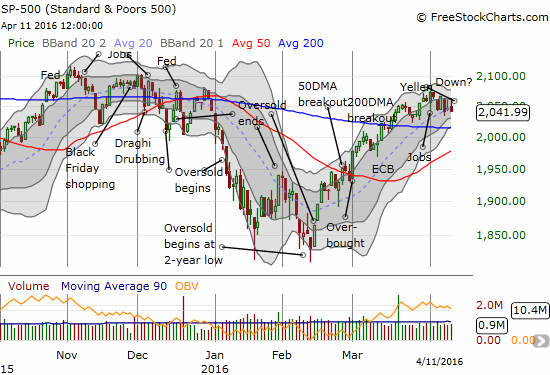

The latest Fed play that I described in the last T2108 Update worked out pretty well. The market once again reacted with post-Fed soothing after CNN’s Fareed Zakaria hosted a discussion with the four living chairs of the U.S. Federal Reserve. ProShares Short VIX Short-Term Futures (SVXY) gapped up, and I sold (a bit too soon granted). However, that trading action is already old news. Since that small gap up, the S&P 500 (SPY) has logged two weak closes in a row. The index is starting to look like it is building a slippery slope with the past 7 trading days or so forming a small downtrend through the 20-day moving average (DMA).

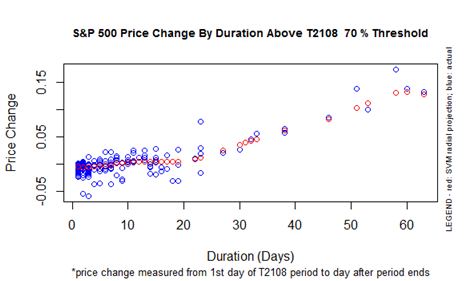

T2108, the percentage of stocks trading above their respective 40-day moving averages (DMAs), closed at 73.8% as it tenuously holds onto overbought status. This is now day #29 of the overbought period, and the S&P 500 is starting to lag expected performance. The S&P 500 is up 3.2% for the overbought period. If the overbought period ended today, projections suggest around a 4-5% gain. To align with historical performance, the S&P 500 will either need to end right away, or resume in earnest its extended overbought rally.

While T2108 is slipping, T2107, the percentage of stocks trading above their respective 200DMAs, remains strong. At 45.4%, T2107 has managed marginal gains the past two days and is still just below recent highs. So while some of the fastest moving stocks are losing altitude, the longer-term underpinnings of the stock market remain strong for now.

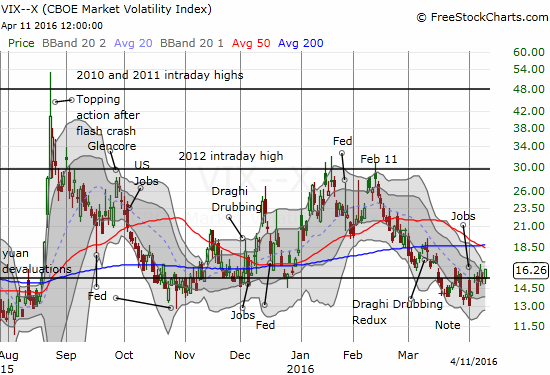

The volatility index, the VIX, perked up again with an increase of 5.9% and its highest close since March 15th (by a hair). I will not get concerned until/unless the VIX shows the potential to pull away from the pivot by closing above the last intraday high.

Of course, an increase in the VIX ahead of earnings should not cause too much surprise.

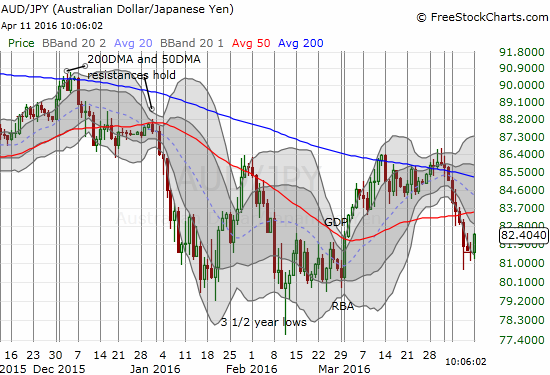

AUD/JPY jumped on the day and essentially nullified any alarm I might have otherwise felt from the gains on the VIX.

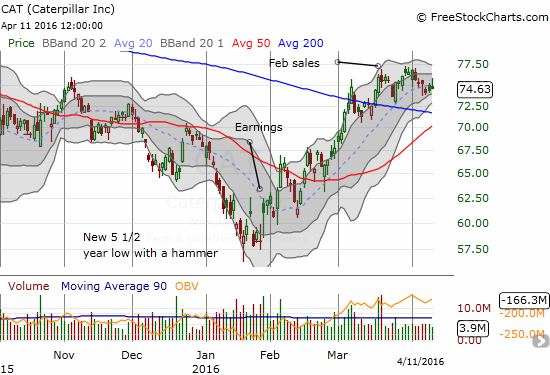

Caterpillar (CAT) is still milling around in what looks like consolidation above its 200DMA. This position keeps CAT in a bullish 200DMA breakout. I find it hard to get bearish with CAT trading so calmly.

Overall, my trading call remains at neutral given T2108 has the potential to make a bearish drop out of overbought conditions at any moment. Recall that such a bearish change in market character has to be confirmed by a notable drop in T2107 as well.

I am following several interesting charts for profitable trades and/or useful signals…earnings not withstanding. These charts are a telling mix of bullish and bearish signals.

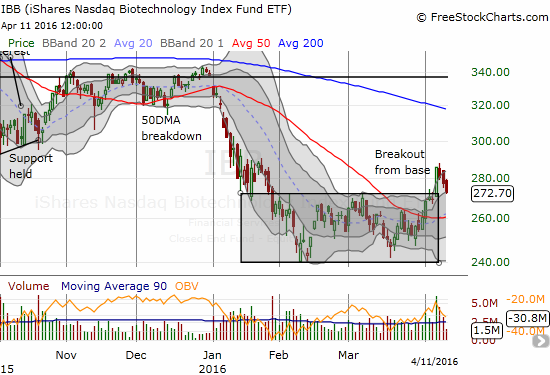

The iShares Nasdaq Biotechnology ETF (IBB) immediately put to test my bullish call to buy its breakout with confidence. Since sell-offs often end after the third day, Tuesday will be a critical test of the breakout in several ways. Note that IBB closed right at the bottom of the channel formed by the upper-Bollinger Bands (BB). Selling volume has steadily declined – a bullish sign that the selling may be coming to an imminent end.

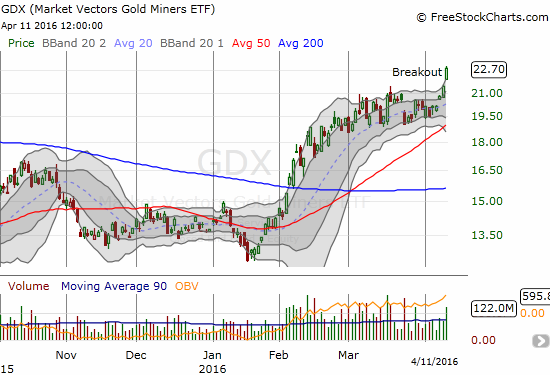

The rush is on into Market Vectors Gold Miners ETF (GDX). While the chart is VERY bullish, today’s pop is pushing GDX into an unsustainable parabolic move. While I have plenty of gold and silver plays already in hand, I am overdue to get exposure to GDX. I am buying the dips.

— – —

For readers interested in reviewing my trading rules for an oversold T2108, please see my post in the wake of the August Angst, “How To Profit From An EPIC Oversold Period“, and/or review my T2108 Resource Page.

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

U.S. Dollar Index (U.S. dollar)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

IBB (iShares Nasdaq Biotechnology).

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

The charts above are the my LATEST updates independent of the date of this given T2108 post. For my latest T2108 post click here.

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

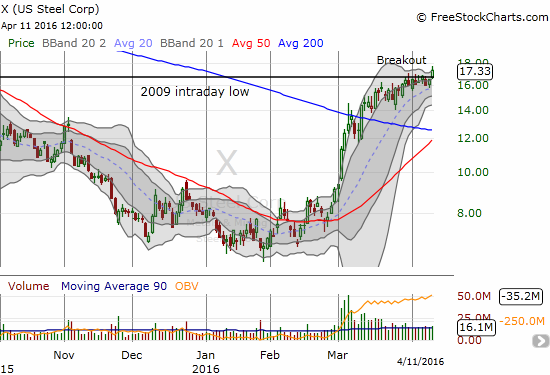

Full disclosure: short AUD/JPY, short GWPH, long GWPH calls, long FXCM, long X call options, long IBB call options, short FB