“…emerging markets experienced a more recent run-up in indebtedness, which started around the time of the crisis, and is still continuing. In other words, their deleveraging has not even begun. This has the potential to create persistent spending disappointments, if monetary policy is unable to stimulate other spending sufficiently.” – “Debt, Demographics and the Distribution of Income: New challenges for monetary policy” – Gertjan Vlieghe, Member of Monetary Policy Committee, Bank of England, January 18, 2016.

This observation from Vlieghe of the Bank of England (BoE) should ring alarm bells for anyone expecting further increases in Chinese demand and consumption in the near future. China is reportedly transitioning from an export-driven to a consumption-driven economy. This economic adjustment is supposed to lead to more sustainable and stable economic growth. Yet, debt levels are exceptionally high in China and still rising. Unless the Chinese government has figured out how to create a perpetual motion machine of debt and consumption, China’s transition to a consumption-driven economy should soon hit a significant roadblock.

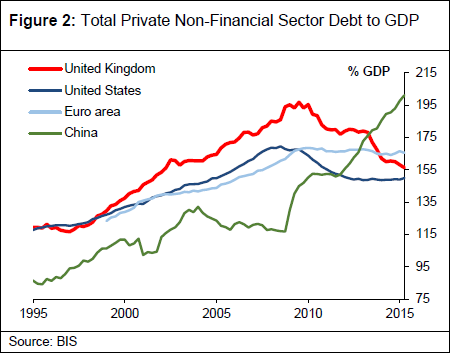

The chart below puts China’s debt run-up in global context. Total private non-financial sector debt has increased rapidly since the financial crisis. As a percentage of GDP, China has surpassed even the pre-crisis peak seen in the United Kingdom.

Source: “Debt, Demographics and the Distribution of Income: New challenges for monetary policy” – Gertjan Vlieghe, Member of Monetary Policy Committee, Bank of England, January 18, 2016.

This high-level of debt help explains why the Chinese government has struggled to get much response out of a long series of stimulus measures over the past year or so. The capacity for piling up yet more debt must be reaching some kind of limit. While that specific limit cannot be known in advance, especially since China’s economy is in a much higher growth mode than its Western competitors, I strongly suspect the limit is near. Companies that are continuing to rely upon the China growth story to support their own growth story over the next few years will (continue to) stumble as China approaches and then breaks down from this debt limit.

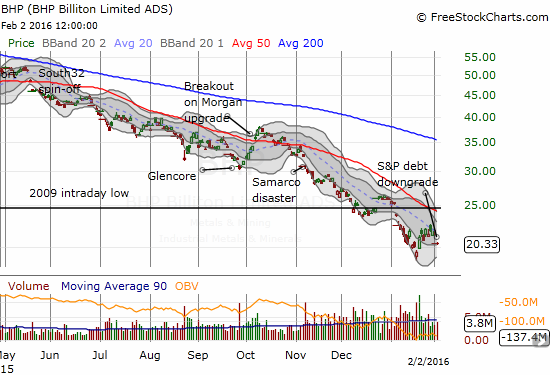

Commodity-related companies generally peaked in 2011. Companies trapped in industries where supply has yet to respond to the realty of future Chinese demand, like iron ore, have suffered accelerating pain in the past 18 to 24 months. Apple provided the most high-profile example of a glitch in the Chinese growth story. As most investors and traders knows by now, Apple (AAPL) finally reported some “softness” in China, mainly in Hong Kong. Apple’s observation could be the last sign of the beginning of the end of China’s great debt run-up.

Source for charts: FreeStockCharts.com

These three charts – BHP, AAPL, and SSEC – display an almost alarming convergence of troubles. Time could soon tell whether this is more than a coincidental correlation.

Be careful out there!

Full disclosure: long BHP put options