(This is an excerpt from an article I originally published on Seeking Alpha on February 1, 2016. Click here to read the entire piece.)

On Wednesday, January 27th, the U.S. Federal Reserve stared down volatile conditions in financial markets and decided to avoid addressing them directly. {snip}

When the Bank of Japan (BoJ) came up to bat almost two days later, the BoJ made very clear its concerns about global economic and financial developments. From “Introduction of ‘Quantitative and Qualitative Monetary Easing with a Negative Interest Rate’“:

{snip}

This concern convinced the BoJ to add interest rates to the monetary policy formerly called Quantitative and Qualitative Monetary Easing (QQE). The vote was a close 5-4 decision that sent interest rates negative in a tiered fashion similar to the method used by the Swiss National Bank:

{snip}

In other words, the BoJ has added its own confirmation that this is indeed a low-rate world. The ripples from this confirmation are far-reaching and particularly important for traders in financial markets.

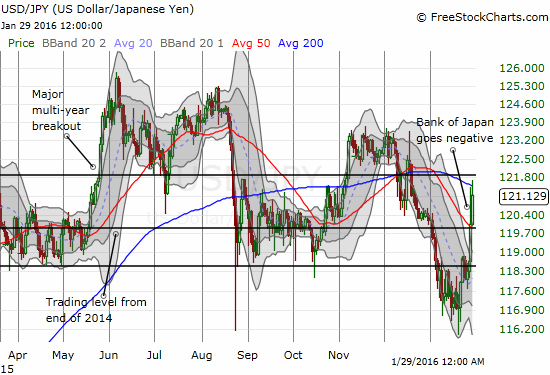

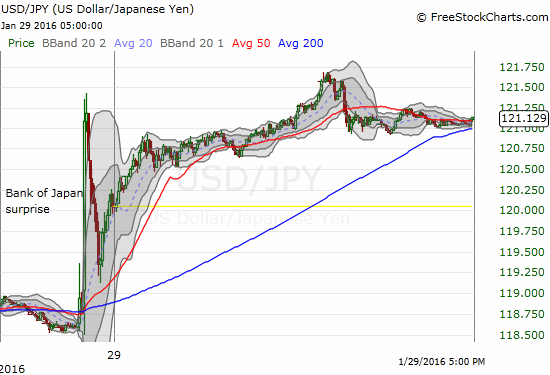

The impact on the Japanese yen (FXY) was immediate but yen-buyers tried to put up a fight. After all, the BoJ cannot wipe away all the panic and fear in the market that drives traders and investors to prefer “safety” in the yen.

{snip}

Source for charts: FreeStockCharts.com

With the BoJ taking action, the U.S. Federal Reserve is even more isolated on the island of policy divergence. It is hard to imagine that the Fed will continue hiking rates when all its peers in major central banks are officially in or have been in full retreat on monetary policy. {snip}

Source: CME Group FedWatch

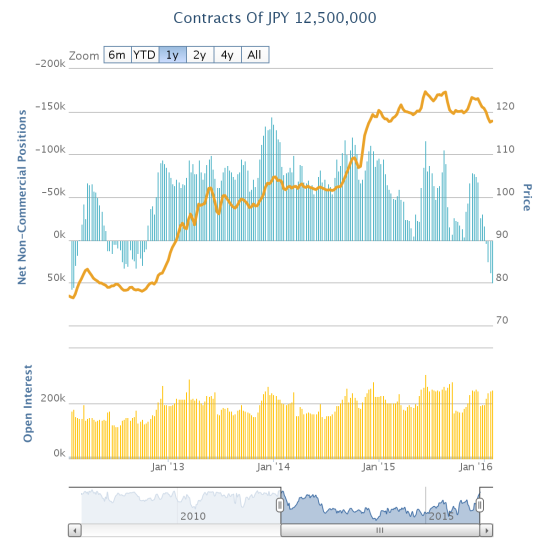

Currency speculators also found themselves trapped on an island – this one an island of yen bullishness. {snip}

Source: Oanda’s CFTC’s Commitments of Traders

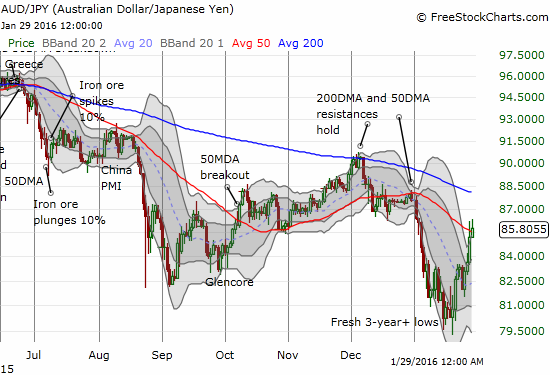

This episode hits the “pause button” on the warning I wrote at the beginning of the year in “The Japanese Yen Flashes Red for 2016.” {snip}

Source for charts: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on February 1, 2016. Click here to read the entire piece.)