(This is an excerpt from an article I originally published on Seeking Alpha on July 27, 2015. Click here to read the entire piece.)

This month’s acceleration in the now 4-year sell-off in commodities seems to indicate that markets are getting serious about bracing for a tightening cycle from the Federal Reserve. I have mainly bought and traded gold as a hedge on Federal Reserve monetary policy. From this perspective, I can understand why gold (and commodities in general) is sliding in what SHOULD be the last few months before a first rate hike. However, based on the behavior of the futures markets in the past six weeks or so, I have concluded that there is a good possibility the Fed could capitulate on its pledge to hike rates in 2015 – especially given the case for a rate hike remains very mixed given weakness in global economies that now include Canada’s official entry into the club of advanced economies moving backward on rates.

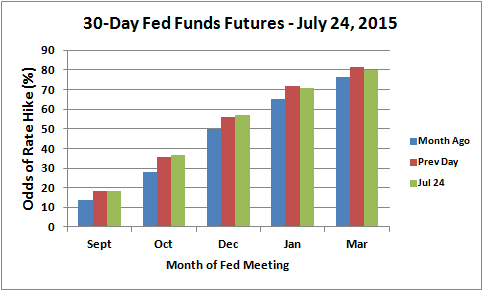

While many analysts continue to insist that Fed is determined to start hiking rates in September, the 30-Day Fed Funds Futures as published by the CME Group Fed Watch have consistently produced different conclusions. {snip}

Source: The CME Group Fed Watch

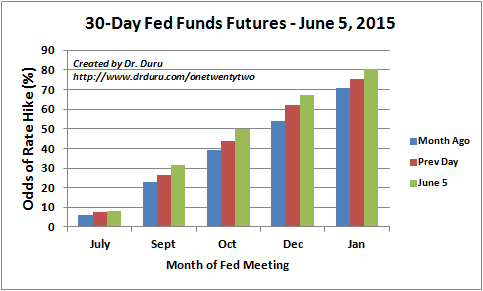

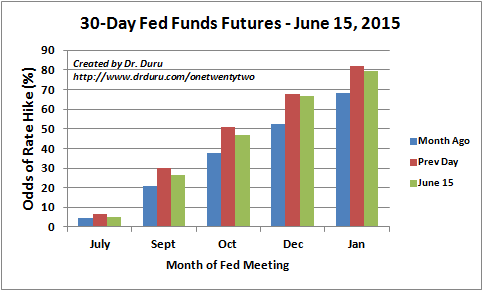

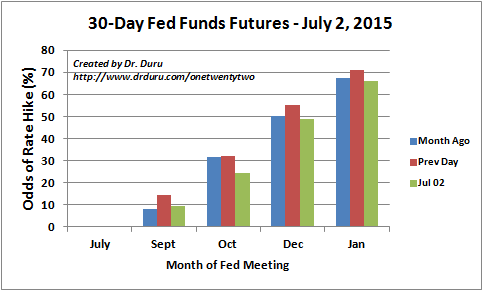

{snip}

Sources: The CME Group Fed Watch

So while commodities are sliding sharply this month, the possibility of a Fed surprise makes current levels very enticing. The time to buy insurance is when the market provides it at a heavy discount and not when it is dear. I now see some signs in the SPDR Gold Shares (GLD) and in Google Trends that favor starting or adding to positions.

{snip}

Source: FreeStockCharts.com

My commodity crash playbook does not cover gold directly because of its role as a currency, but the principles of respecting trends and momentum have aptly applied. {snip}

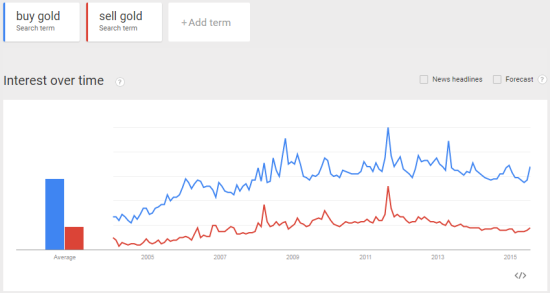

While Friday’s bounce is encouraging, I am even more intrigued in the possibility of a bottom because of a shift in market sentiment as shown by Google Trends. {snip}

Source: Google Trends

{snip}

Be careful out there!

Full disclosure: long GLD

(This is an excerpt from an article I originally published on Seeking Alpha on July 27, 2015. Click here to read the entire piece.)