Apple (APPL) has officially announced the launch of its latest product, the iWatch.

Source: Yahoo! Finance

Source: Apple.com

This makes a great juncture to provide a quick technical update on Apple and update the classification trees for the Apple Trading Model (ATM). For those of you who are new to the ATM, please read up on it here: The Apple Trading Model (Re)Explained.

Here are the links to the classification trees that define the day-to-day trading rules on Apple. They are updated through March 6, 2015, thus ushering in a new module for 2015.

Trade from the previous close – Closing Sub-Models

2010

2011

2012

2013

2014

2015

Trade from the open (intraday) – Opening Sub-Models

2010

2011

2012

2013

2014

2015

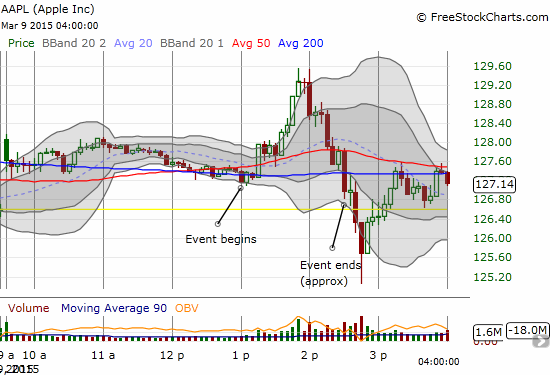

Unlike previous product announcements, AAPL did not rally into the big event. Instead, it sagged from the moment the rumors broke that AAPL would make the launch announcement in early March. The stock only showed some life on an intrady basis after the Watch event began. After an hour of excitement, AAPL sank to new lows and then ended the day right about where the event began – a perfect net non-event from a trading perspective. On the daily chart, AAPL looks like it has traded into a perfect stalemate.

Source: FreeStockCharts.com

With the Watch event out of the way, AAPL’s stock is actually in decent shape. The 20-day moving average (DMA) has held as approximate support for the last three days. A close over $130 could launch the next leg up. On the other hand, a close below the recent support would set up a potential 50DMA retest.

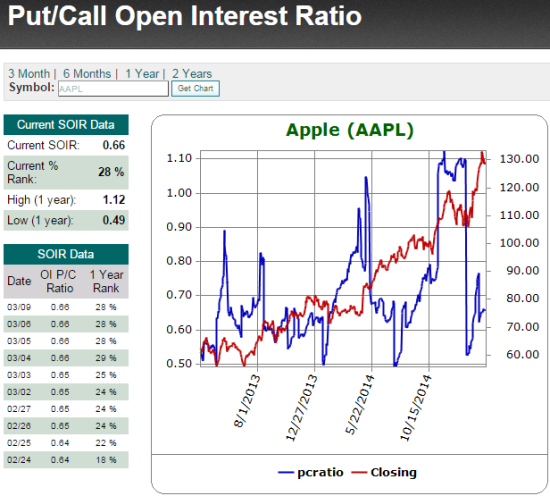

The optimism remains extremely high on AAPL and this is my main concern from a technical perspective.

The open interest put/call ratio is down at a 1-year rank of 28%. The ratio fell dramatically ahead of earnings, and has ever so slowly crept higher ever since.

Source: Schaeffer’s Investment Research

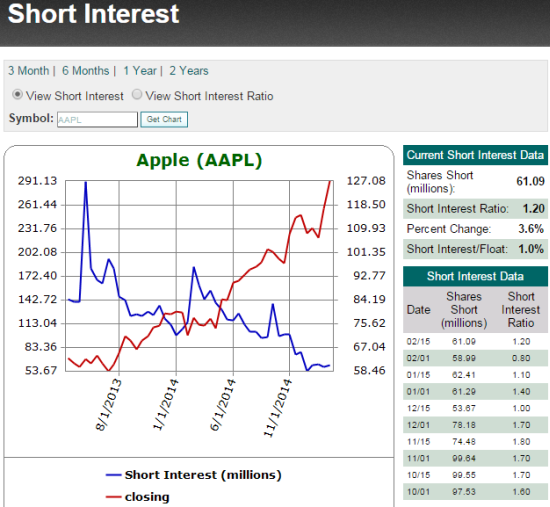

Short interest is at rock bottom levels although it stopped declining in December. Short interest is a paltry 1% of float. Note how in the last two years that brief increases in short interest have coincided with pullbacks in AAPL.

Source: Schaeffer’s Investment Research

Finally, according to Schaeffer’s Investment Research, analysts are just about as giddy as possible about AAPL. Collectively, analysts currently have 19 strong buys, 4 buys, 6 neutrals, and no sell ratings on AAPL.

In other words, there is very little room overall for incremental optimism and enthusiasm for AAPL…even with the forward P/E still sitting at a reasonable 14. The Watch-related pullback still leaves AAPL with an incredible 15% year-to-date gain while the NASDAQ is up just 4% and the S&P 500 (SPY) is barely staying above water at 1%. Given Apple’s size (largest market cap in the world and roughly double the #2!), it is hard to imagine such large out-performance being sustainable. Something needs to “catch-up.” In the meantime, I am sticking to the day-to-day trades recommended from the ATM (still mostly bullish) and keeping an eye out on the bearish warnings looming over the general market.

Be careful out there!

Full disclosure: no positions