(This is an excerpt from an article I originally published on Seeking Alpha on August 14, 2013. Click here to read the entire piece.)

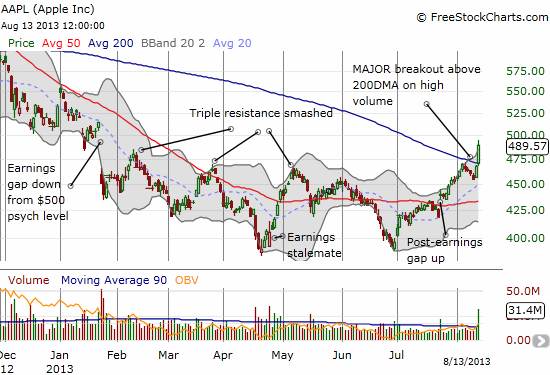

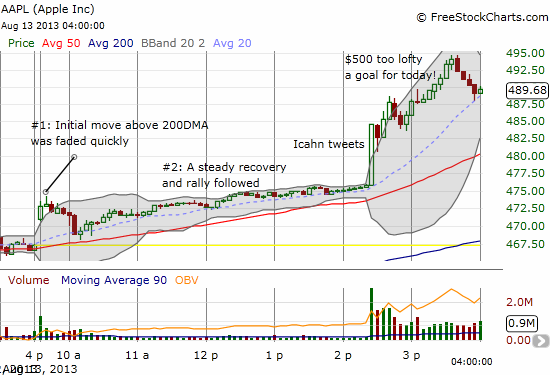

For a little over three months I have made the case for an Apple (AAPL) bottom (see for example “An Apple Bottom As Sentiment Finally Turns Southward (Put Buying Soars)” and/or “Apple Is Between A Bottom And A Hard $500“). When Carl Icahn sent AAPL’s stock soaring on news of a substantial position and direct discussions with CEO Tim Cook, I concluded that he managed to secure Apple’s bottom. {snip}

Source: FreeStockCharts.com

Icahn’s tweets perfectly fit with my recent theme and claim that Apple would serve as a perfect “catch-up stock” for hedge funds scrambling to chase performance as the stock market stubbornly moves higher. {snip}

Two patent-related events likely served as catalysts priming the market for the strong post-Icahn response. {snip}

The stock market responded favorably to the first patent news, sending AAPL to a new 6-month closing high. {snip}

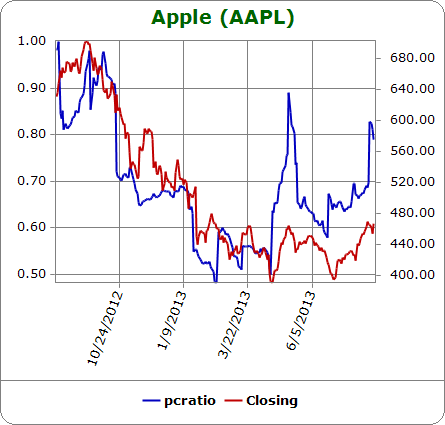

Other positive catalysts have coincided with the apparent Apple bottom: a steady retreat in short interest and a sharp rise in the open interest put/call ratio as the stock has rallied off the June lows.

{snip}

Source: Schaeffer’s Investment Research

{snip}

I believe going forward, calls will get a lot more interest than puts again. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 14, 2013. Click here to read the entire piece.)

Full disclosure: long AAPL