(This is an excerpt from an article I originally published on Seeking Alpha on September 3, 2013. Click here to read the entire piece.)

{snip}

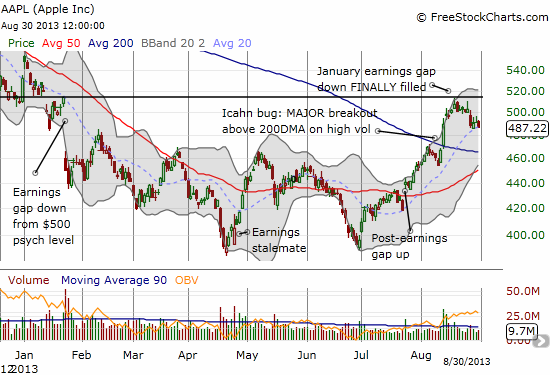

Source: FreeStockCharts.com

This pullback comes ahead of what should be an exciting several weeks for Apple fans. {snip}

Perhaps thanks to Carl Icahn’s famous tweets, the enthusiasm for September’s news got an early start. As I noted in my blog piece where I claimed that Icahn’s involvement secured Apple’s bottom, the action in the options market seems to experience extended cycles where it provides a good gauge of sentiment. {snip}

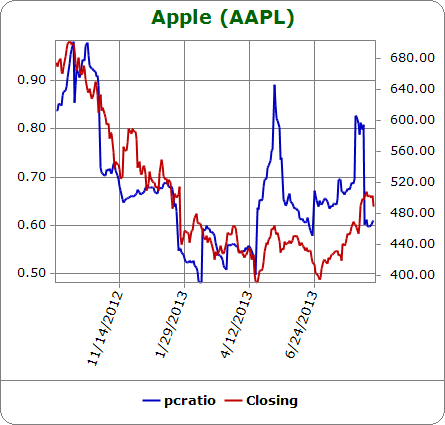

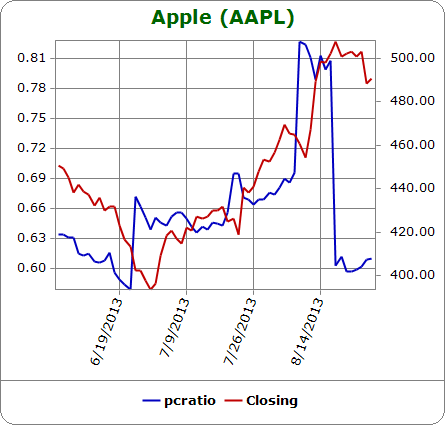

The two charts below from Schaeffer’s Investment Research show that soon after Icahn’s pronouncements, the put/call ratio sank like a stone in one big move. {snip}

{snip}

Source: Schaeffer’s Investment Research

Using data from Etrade.com for options expiring on September 21st, I find that the call options for the $500 strike are by far the most popular options whether calls or puts. As of August 30th, the open interest for these calls is 18,862. Here is how the open interest grew right after Icahn’s announcement (very rough):

- August 12th: 7,500

- August 13th: 10,000

- August 14th: 15,000

- August 15th: 19,000

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 3, 2013. Click here to read the entire piece.)

Full disclosure: long AAPL