(This is an excerpt from an article I originally published on Seeking Alpha on August 30, 2013. Click here to read the entire piece.)

{snip}

Before Mark Carney took over as governor of the Bank of England (BoE), the main question buzzing in financial media seemed to focus on figuring out just how dovish Carney would be. {snip}

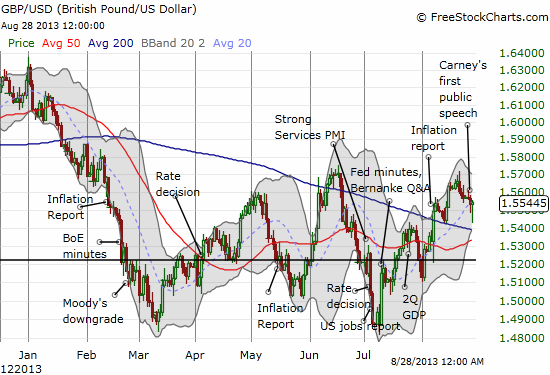

Fast forward to August 28th for Carney’s first public speech as Governor and suddenly Carney looks a lot less dovish. He is certainly not hawkish, so I will call him non-dovish. As this reality sinks in for the market, the British pound is not likely to retest recent lows…at least not as long as economic conditions continue to improve. I think an effective floor is now in place. {snip}

Source: FreeStockCharts.com

{snip}

The “non-dovish” side of Carney really shines with two points: 1) he is perfectly comfortable hiking rates when needed, and 2) his assurance that the BoE is determined to bring inflation DOWN to target:

{snip}

Carney granted an interview to a local paper that provided the icing on the cake. In the Nottigham Post Carney firmly established that he is no Mervyn King. Specifically, he is not interested in devaluing the currency for competitive advantage (emphasis mine):

{snip}

With this simple observation, Carney effectively squashed any notion that he would provide a catalyst for a lower currency. Absent new bearish catalysts, it seems to me the pound has a firm floor beneath it now.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 30, 2013. Click here to read the entire piece.)

Full disclosure: net long British pound