(This is an excerpt from an article I originally published on Seeking Alpha on April 25, 2013. Click here to read the entire piece.)

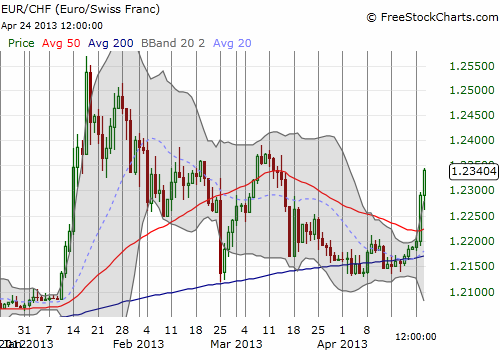

The Swiss franc (FXF) has started another weakening phase, putting an exclamation point on the currency market’s refusal to go along with the shrill, recent headlines claiming another deflation cycle has begun.

{snip}

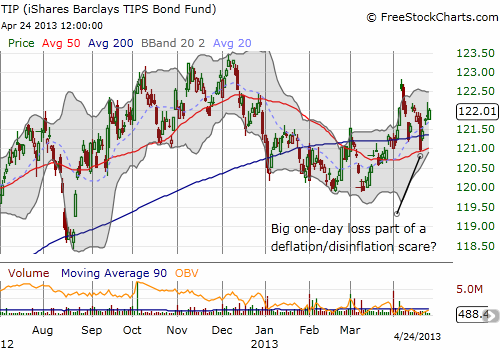

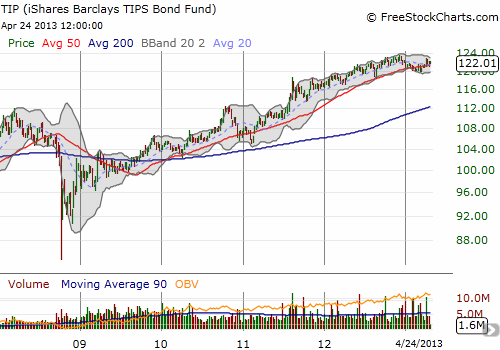

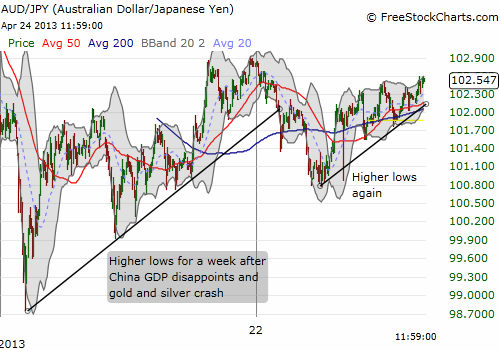

Ever since China reported GDP growth that missed expectations at “only” 7.7% two weeks ago, everything that goes down has somehow indicated deflationary pressures. {snip}

The only reason why last week’s drop was even notable was that it came three days after traders and investors puked up gold and silver in a historic sell-off that capped weakness that was accelerating recently (see “Gold And Silver Enthusiasm Soar To Historic Levels In The Wake Of Collapsing Prices” for my description of the buying opportunity in the sell-off).

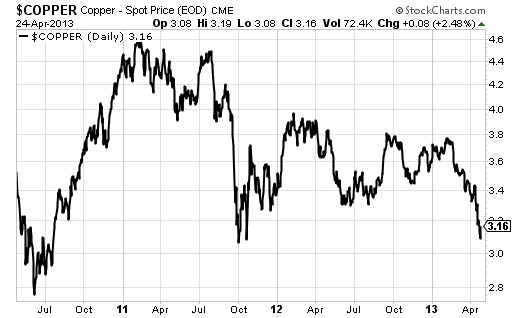

The nervousness is understandable. Most commodities put in tops in 2011 and have been trending lower ever since. The sell-offs have alternated in speed and timing from commodity to commodity. {snip}

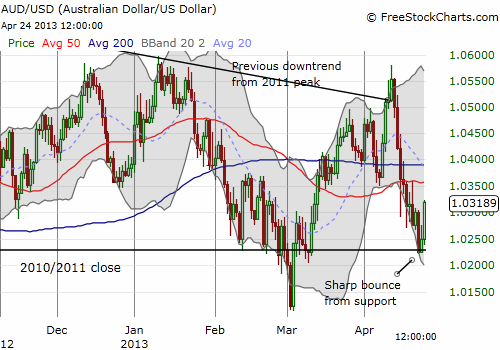

Source: StockCharts.com

While copper is moribund, iron ore has also weakened again. {snip}

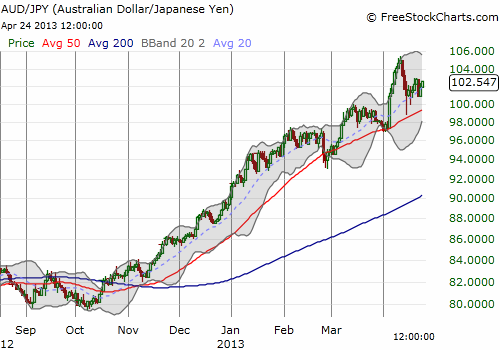

The resilience is seen most keenly in trade against the Japanese yen (FXY), the typical preferred currency for “safety” from deflation.

{snip}

Source for charts unless otherwise stated: FreeStockCharts.com

Having said all this, it remains very possible that the headlines of deflation could get loud enough to create a self-reinforcing loop. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 25, 2013. Click here to read the entire piece.)

Full disclosure: long FCX shares calls, GLD, SLV, net short Japanese yen