(This is an excerpt from an article I originally published on Seeking Alpha on September 16, 2012. Click here to read the entire piece.)

For those who have paid attention to the words of Federal Reserve Chairman Ben Bernanke, it is no surprise that money-printing continues to be the response to persistently poor economic performance. I became aware of Bernanke’s now famous 2002 speech “Deflation: Making Sure “It” Doesn’t Happen Here” in late 2008. In response, I wrote “America Will Print As Much As It Takes.” This piece solidified my bullishness on gold (GLD) and silver (SLV). {snip}

Now, we are closer than ever to some kind of “end game” for paper money, an ultimate test of monetary resolve. The Federal Reserve has now written a blank check for the American economy, promising to apply quantitative easing until the economy responds:

{snip}

Under such a regime, holders of cash have almost no choice but to find inflation hedges or otherwise bear down the threat of on-going dilution by the printing press. The Federal Reserve’s resolve is all the more clear in its willingness to ease policy even with the S&P 500 (SPY) sitting around 4-year highs. {snip}

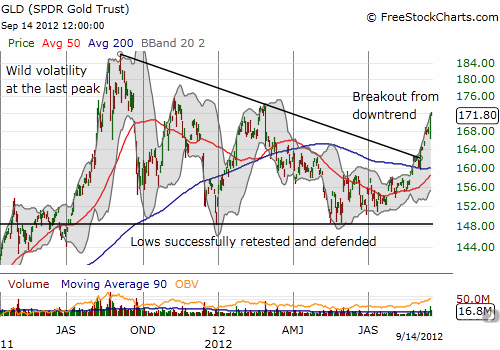

Under these conditions I think gold and silver should get more popular than ever. Fresh highs are around the corner. {snip}

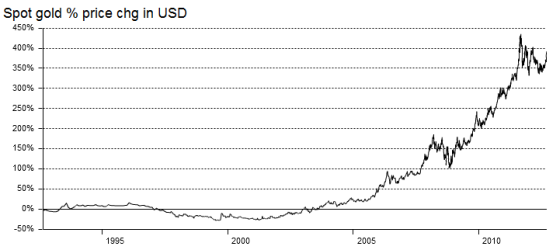

Here is a reminder of gold’s bull market using a 20-year chart of gold from the World Gold Council:

Source: 20-year The World Gold Council

{snip}

{snip}

Given silver is not yet performing as well as gold, it might present an even better buying opportunity. My favorite silver miner, Pan American Silver (PAAS) has also achieved important price milestones…{snip}

Source for charts: FreeStockCharts.com

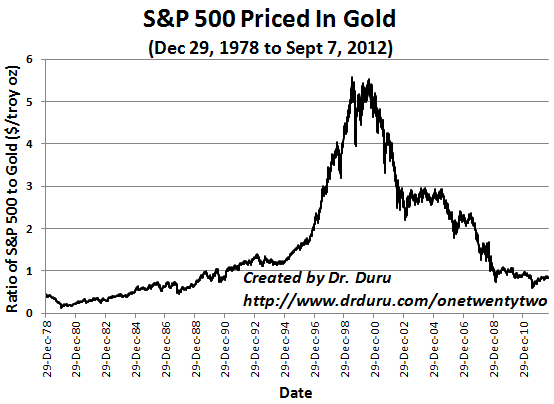

It might be tempting to think that stocks are the best place to hide. In general, they should do well as fresh money inevitably finds its way into the stock market. However, when priced in gold, we see that stocks have been a relatively poor store of value since the bubble burst in 2000. In fact, when priced in gold, the bubble in stocks looks particularly egregious.

Source: S&P 500 prices from Y! Finance, gold prices from The World Gold Council

Zooming into recent years makes it clear that the S&P 500 has barely recovered from the historic crash in 2008 and 2009. {snip}

Source: S&P 500 prices from Y! Finance, gold prices from The World Gold Council

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 16, 2012. Click here to read the entire piece.)

Full disclosure: long GLD, SLV, PAAS