(This is an excerpt from an article I originally published on Seeking Alpha on September 19, 2012. Click here to read the entire piece.)

In “Enhancement of Monetary Easing” the Bank of Japan (BoJ) rushed to match the Federal Reserve’s renewed commitment to printing money to resolve economic malaise. This is not the intervention I have been anticipating soon after a Fed easing – for example, see “Now That Bernanke Has Made His Move, It Is Azumi’s Turn” – but it had a related effect on the Japanese yen (FXY).

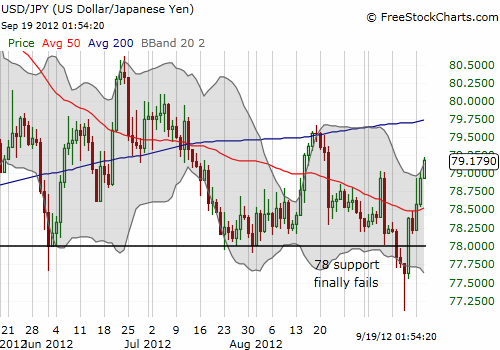

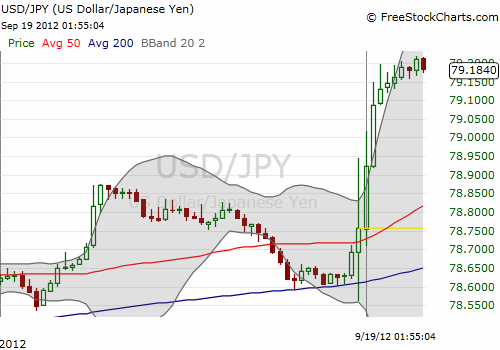

The USD/JPY popped further away from its 50-day moving average.

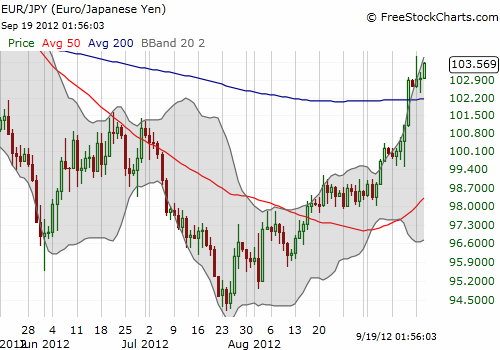

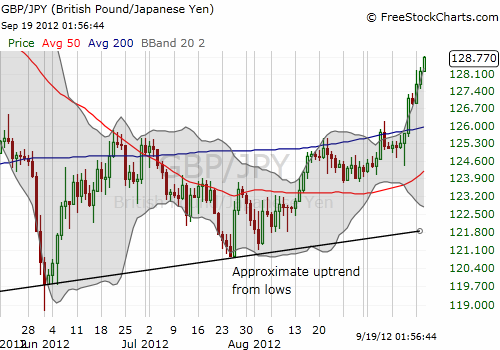

It is easier to see the anticipation of further BoJ easing in the EUR/JPY and GBP/JPY pairs.

Source: FreeStockCharts.com

I only had a small position long EUR/JPY ahead of this announcement, and I sold into the pop. I think these yen pairs in particular are buys on dips in the future, especially in moments where the market panics and reaches for Japanese yen out of habit. {snip}

In its latest statement on monetary policy, the BoJ “…decided to increase the total size of the Program by about 10 trillion yen, from about 70 trillion yen to about 80 trillion yen.” In doing so, the BoJ cited a “somewhat deeper…deceleration phase” in the global economy…

{snip}

Similar to the Federal Reserve’s promise to continue purchasing assets until the U.S. economy responds, the BoJ will also “…proceed with the monetary easing in a continuous manner by steadily increasing the amount outstanding of the Asset Purchase Program.”

The global printing campaign in paper currency continues apace. Keep a tight grip on your gold and silver. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 19, 2012. Click here to read the entire piece.)

Full disclosure: long GLD, SLV