(This is an excerpt from an article I originally published on Seeking Alpha on September 17, 2012. Click here to read the entire piece.)

I am still working on a revision for the commodity crash playbook to take into account the new QE3 regime, but the trading action is already moving faster than I can reformulate.

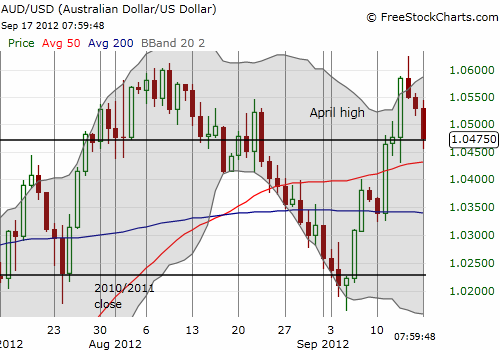

The Canadian dollar (FXC) and the Australian dollar (FXA) have already reversed their QE3 gains against the U.S. dollar in just two trading days.

Source of charts: FreeStockCharts.com

This reversal is potentially an important signal that many commodities will also soon reverse whatever gains were achieved in the immediate aftermath of the official announcement of QE3 last Thursday, September 13th. {snip}

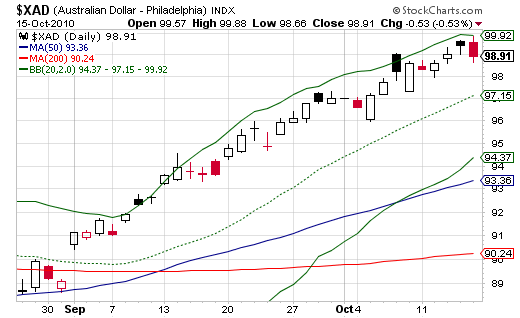

Note well that the Australian and Canadian dollars also quickly reversed their gains after Ben Bernanke unofficially announced QE2 on August 27, 2010. {snip}

Source for charts: Stockcharts.com

{snip}

For now, the simple trading signal going forward is to avoid getting bullish until these currencies regain their QE3 lift. The lows from the current reversal can serve as a convenient trigger for stopping out of these trades.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 17, 2012. Click here to read the entire piece.)

Full disclosure: no positions