(This is an excerpt from an article I originally published on Seeking Alpha on July 26, 2012. Click here to read the entire piece.)

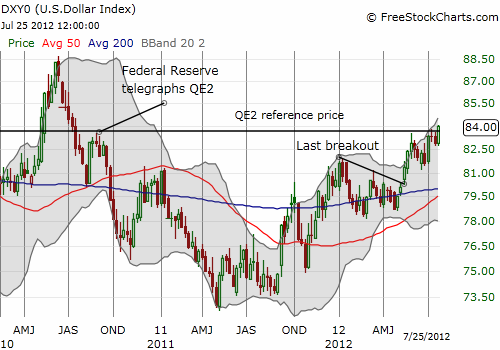

I did not think it would happen, but the dollar index finally closed above its “QE2 reference price.” {snip}

I have contended that if the dollar index reached current levels, the Federal Reserve would feel even more pressure to do something to drive the dollar back down. The strong dollar is applying increasing pressure on the financial results of companies with business overseas. I am noting in the earnings reports of several companies that a strong dollar has become a small burden on sales, revenues, and/or profits. Intel (INTC) noted in its most recent earnings call that the strong dollar is driving up the prices of computers in some countries…{snip}

Here is W.W. Grainger, Inc (GWW) an international parts distributor…{snip}

Finally, here is Caterpillar, Inc. (CAT), an international heavy machinery company, in its earnings report from July 25th:

{snip}

It is very telling that CAT claims that it has “…not detected much benefit to economic growth from the central bank’s policy of lengthening the maturity of its securities.” Indeed, the company expects “…the U.S. Federal Reserve will resume expanding its balance sheet…”

I believe the Federal Reserve is taking note of these pressures as it surveys its contacts in industry. The expectation for Fed action is not unique to Caterpillar (CAT). {snip}

One corner of the financial universe has not shown much anticipation for renewed weakness in the dollar: gold (GLD). {snip}

Source for charts: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 26, 2012. Click here to read the entire piece.)

Full disclosure: long GLD, CAT