(This is an excerpt from an article I originally published on Seeking Alpha on April 23, 2012. Click here to read the entire piece.)

Commodity stocks have generally underperformed the stock market in 2012. I still cannot decide whether this weakness represents a leading indicator of broader weakness to come or a fortuitous relief to inflation pressures that keeps economic growth just barely strong enough to stay out of recession. Regardless, this post describes the few opportunities I have found this year to refresh some commodity trades.

{snip}

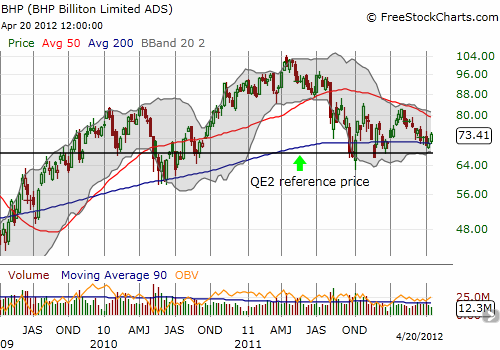

I list below the trades I have executed year-to-date excluding gold and silver. {snip} The most important concept for the commodity crash playbook is to start purchasing commodity stocks once they have erased all their gains since the U.S. Federal Reserve telegraphed the coming of a second round of quantitative easing at the end of August, 2010. I have tended to sell most of these on subsequent rallies expecting additional opportunities to re-establish positions at lower prices as the global economy worked its way closer to a China-related slowdown. At this late stage in the game, I am much more likely to hold for a longer period since the next rally could be the start of the next major move upward.

iPath DJ-UBS Coffee TR Sub-Index ETN (JO) (March 7, 2012)

{snip}

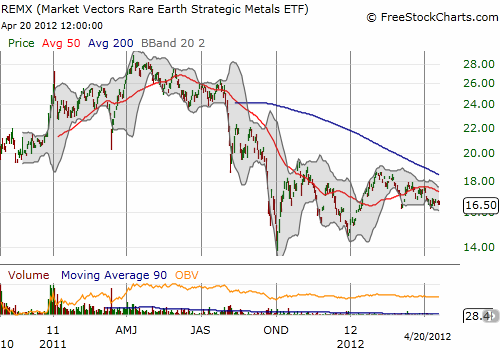

Market Vectors Rare Earth/Strategic Metals ETF (REMX) (March 19, 2012)

I am a long-standing fan of {snip}

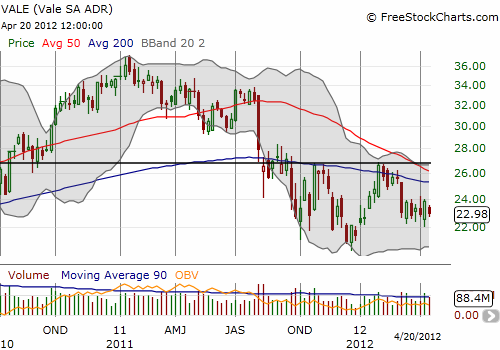

Vale S.A. (VALE) (March 23, 2012)

{snip}

BHP Billiton Ltd. (BHP) (April 4, 2012)

{snip}

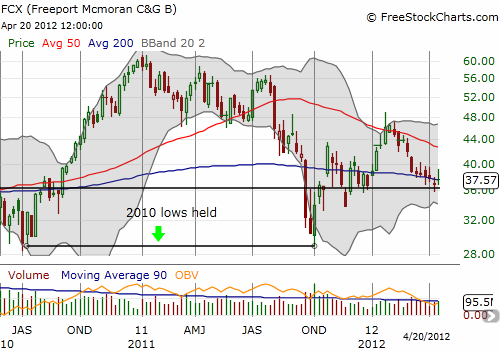

Freeport-McMoRan Copper & Gold Inc. (FCX) (April 16, 2012)

Copper prices are about 18% off their post-recession highs in 2011. {snip}

iShares MSCI Brazil Index (EWZ) (April 17, 2012)

EWZ hit a long-standing rule I have in place to buy EWZ anytime it drops to 20% below its 52-week high. I last bought in November and sold into 2012’s rally. {snip}

Hedges: Caterpillar (CAT) and ProShares UltraShort FTSE China 25 (FXP)

{snip}

Overall, I see commodities at an important crossroads. Sluggish economic growth and sovereign debt issues have kept major central banks in accomodative monetary policies. Easy money is always an important catalyst for improving the risk/reward of owning commodities. If these policies fail to maintain a floor on economic activity, then commodities will certainly weaken further from here. However, a response with further monetary easing will make lower commodity prices even more attractive. For now, I am not as actively fretting about the downside risks as I am eagerly anticipating the upside opportunities from an eventually more robust global recovery.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 23, 2012. Click here to read the entire piece.)

Full disclosure: long JO, REMX, VALE, FCX, BHP, EWZ, CAT, CAT puts, FXP, MCP

Dr Duru,

Fleck is indeed a great analyst as well as a great guy.

However, in light of the coming “triple bottom” potential in both gold and silver, and the EU crisis deflationary down wave, we must be vigilant. But if gold an dsilver FAIL to hold the triple bottom, we will be entering bear territory on an accelerating slippery slope.

I have held physical for the last 7 years, and it is only now that I am having serious doubts whether we may have overestimated the

demise of USD, as well as underestimated the true abilities of the Fed et al. to be totally in control of markets. They are successfully pushing down oil, gold and silver. I suspect this trend will continue until elections in November and beyond if possible.

Here’s an article that shows the perils ahead fro gold and silver.

The Silver vs. NASDAQ chart pretty much depicts that silver is already on its way to return to “nominal” prices of 10 years ago.

Not sure what Fleck will think of this, but like to get your take.

Concerned physical holder since 2005 contemplating sale in light of new information and technicals…

Here’s the link:

http://www.resourceinvestor.com/2012/05/21/short–medium–long-term-technicals-for-gold-sil?ref=hp&page=7

Woah – ok. The comparison to the NASDAQ bubble is pretty compelling for silver, but gold is not quite following the pattern, right? I hate to get too technical for gold and silver because I have very fundamental reasons for wanting to stay in both. With Fleck as confident as ever, I am even more loathe to depart from the gameplan. I do agree with you that a break to fresh lows (a break of support) WILL be a technically important event and cause me some consternation as well. Until that happens, I am full steam ahead. One option to consider is hedging a bit with something like a little ZSL or even selling calls (or buying puts) against existing positions.

I would love to hear Fleck’s gameplan if China collapses into a deflationary funk. It seems to me such an event could be very destructive for gold and silver in the short-run but incredibly bullish after the collapse, just like 2008-2009…

Thanks for dropping this note!