(This is an excerpt from an article I originally published on Seeking Alpha on April 23, 2012. Click here to read the entire piece.)

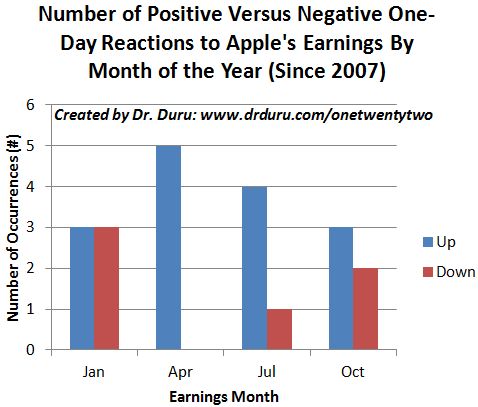

If recent history has any relevance to the upcoming (and much anticipated) earnings announcement on April 24th from Apple (AAPL), odds favor a very positive reaction the following day.

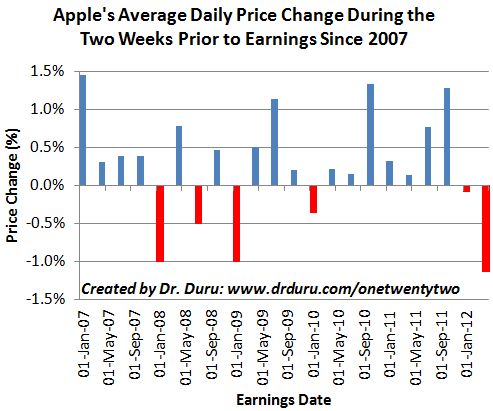

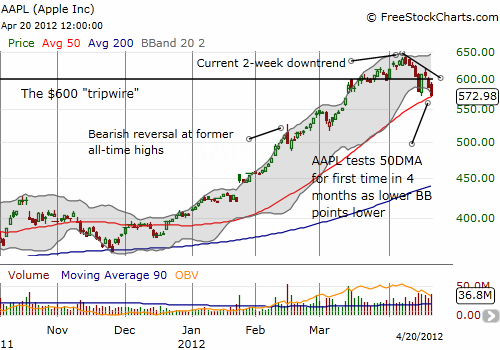

I generally prefer to ascertain the best response to a post-earnings reaction since the news is known at that time – for example, see post-earnings strategies for Amazon.com and Best Buy (click the links). However, in AAPL’s case, the strong and persistent selling ahead of earnings caught my attention. I simply could not recall such obvious negativity ahead of any recent AAPL earnings report.

It turns out that this selling is indeed the worst in recent years. {snip}

{snip}

It almost seems obvious that a large segment of traders and investors are dreading Apple’s coming earnings report and want to get out of the way ahead of time. Ironically, this same negativity is likely creating a buying opportunity and paving the way for a post-earnings rally. {snip}

{snip}

{snip}

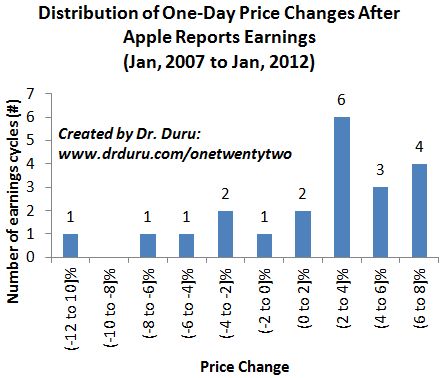

Now it seems like these data are sufficient to get the pre-earnings bullish juices flowing. Surprisingly, the “fun with numbers” does not end here. It turns out that AAPL’s one-day post-earnings performance is, fortuitously, inversely correlated with the stock’s 2-week pre-earnings performance as measured by the average daily price change. This inverse relationship has been getting stronger in recent earnings cycles. {snip}

{snip}

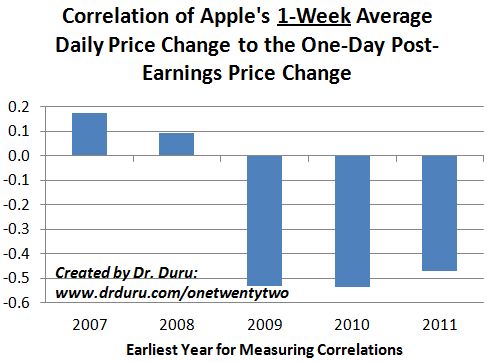

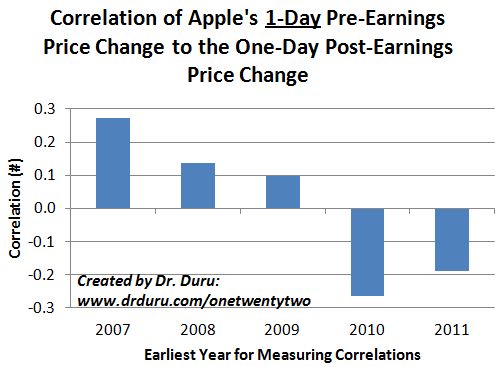

The inverse correlation with Apple’s 1-week average daily price change is relatively strong but nowhere near the convincing pattern created by the 2-week average daily price change. The correlation between the day before and the day after earnings is particularly uninformative.

Data sources for all bar charts: Earnings dates from briefing.com; AAPL stock prices from Yahoo! Finance

I am guessing that since Apple’s stock is dominated by institutional investors and traders, event-driven trades must play out over many days ahead of the event. {snip}

So, putting it all together, odds strongly favor a positive reaction to Apple’s earnings on April 24th. The current selling is likely a buying opportunity. {snip}

StockTwits provides a heatmap that definitively confirms how closely investors and traders are watching Apple and discussing Apple. {snip}

Click for larger image…

Source: StockTwits heatmap

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 23, 2012. Click here to read the entire piece.)

Full disclosure: long AAPL call spread