“Fed May Launch New Round of Stimulus.”

The Federal Reserve seemed poised to launch another round of quantitative easing if only it had a weak economy to generate the proper excuse.

An Associate Press article about steel stocks suggested that the market’s rally was specifically about the prospect of potential stimulus:

“Bernanke didn’t give an explicit promise that the Fed would provide more economic stimulus, but the Dow Jones industrial average nearly doubled its morning gains in ten minutes.”

We have to find some reason, right? Too bad it does not also explain the erasure of all those gains into the close.

After a friend pointed out “quasi-hawkish” comments near the end of Ben Bernanke’s testimony regarding the Federal Reserve’s “Semiannual Monetary Policy Report to the Congress” I got confused. I did not see any headlines that focused on the prospect of monetary tightening suggested by this comment:

“…the economy could evolve in a way that would warrant a move toward less-accommodative policy.”

The media and the market seemed to stop reading or listening to Bernanke’s testimony after discovering the “news” that the Federal Reserve is ready to ease again if needed. Perhaps it is hard to believe the Federal Reserve when it talks about tightening given the monetary haze that develops when policy is loose “for an extended period.”

It is not surprising that Bernanke repeated the possibility of further easing in the face of further deterioration in the economy. He even reiterated that such action poses risks and would need careful consideration:

“…the possibility remains that the recent economic weakness may prove more persistent than expected and that deflationary risks might reemerge, implying a need for additional policy support. Even with the federal funds rate close to zero, we have a number of ways in which we could act to ease financial conditions further…However, prudent planning requires that we evaluate the efficacy of these and other potential alternatives for deploying additional stimulus if conditions warrant.”

I would have stopped here and ignored the whole over-hyped episode except that currency markets sent the dollar down all day long and gold and silver soared. (Even the hapless euro got stronger against the U.S. dollar!). Gold and silver made important moves telling me that something may indeed be different this time; gold hit new highs and silver broke out above its 50-day moving average and looks ready to launch out of a two-month consolidation phase:

Source: stockcharts.com

Source: stockcharts.com

Meanwhile, the S&P 500 looks ready to continue selling off from its failed attempt to reclaim multi-year highs. On Monday, the S&P 500 swiftly fell from overbought conditions. Wednesday’s close puts the index back at a precarious perch atop its 50DMA.

*Chart created using TeleChart

The market clearly liked what it heard (or at least liked the weaker dollar) for a while and the experienced a sharp change in heart with the weak close. Sure Moody’s threatened the U.S. with a debt downgrade, but these announcements rarely generate a lasting reaction: these warnings rarely tell markets anything they do not already know.

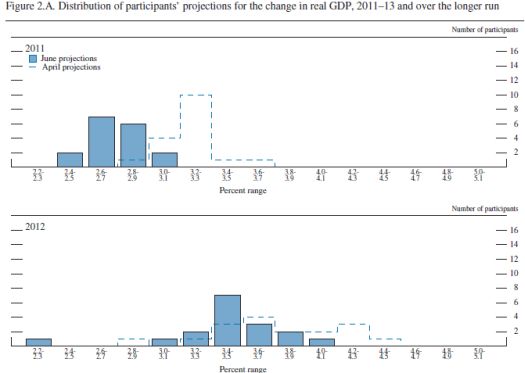

So, I turned to the Fed’s estimates for GDP growth. The forecasts have been scaled back, especially for 2011, but, overall, the Fed still expects decent growth (forecasts for 2013 not shown – I have a hard time believing such projections with so much uncertainty in the economy).

Source: Monetary Policy Report to the Congress (July 13, 2011)

The Fed expects unemployment to remain over 7% for the next 2 1/2 years:

“The central tendencies of participants’ forecasts for the unemployment rate were 8.6 to 8.9 percent for the fourth quarter of this year, 7.8 to 8.2 percent at the end of 2012, and 7.0 to 7.5 percent at the end of 2013.”

Moreover, the overall employment situation remains extremely poor:

“To date, of the more than 8-1/2 million jobs lost in the recession, 1-3/4 million have been regained. Of those employed, about 6 percent–8.6 million workers–report that they would like to be working full time but can only obtain part-time work. Importantly, nearly half of those currently unemployed have been out of work for more than six months, by far the highest ratio in the post-World War II period.”

We should marvel that GDP growth can be sustained above 3% with such protracted unemployment. It is a reminder that companies have little need to pick up the pace of hiring.

This brings us all the way back to what the Federal Reserve could hope to accomplish with another round of quantitative easing. Bernanke reminds us that the Fed expected to create 700,000 jobs over two years by purchasing $600 billion in longer-term Treasury securities, or 30,000 jobs per month. Growth in private sector jobs has averaged 160,000 in 2011 compared to 80,000 per month in the months preceding the announcement of QE2. Even if the incremental contribution of the Fed is the 38% suggested by these numbers, on an absolute basis quantitative easing is simply not making a substantial dent in employment…and the costs for pushing on this string could be extremely high. However, Bernanke seems to think these numbers have demonstrated the effectiveness of QE2.

So, in my final assessment we face a situation where large parts of the economy will continue to earn healthy profits and create material GDP gains. Meanwhile poor employment numbers could motivate the Federal Reserve to print more and more money. The implications are for higher gold prices and more periodic episodes of significant market weakness as fears that the weaker parts of the (global) economy will drag down the healthier ones. One of these periods will likely be strong enough to swing the Federal Reserve into action. As I have mentioned in previous posts, the gains from QE2 provide the benchmark. I suspect the Federal Reserve will defend them with every power of the printing press it can bring to bear.

Be careful out there!

Full disclosure: long GLD, GG, PAAS, SLV