Stock Market Commentary

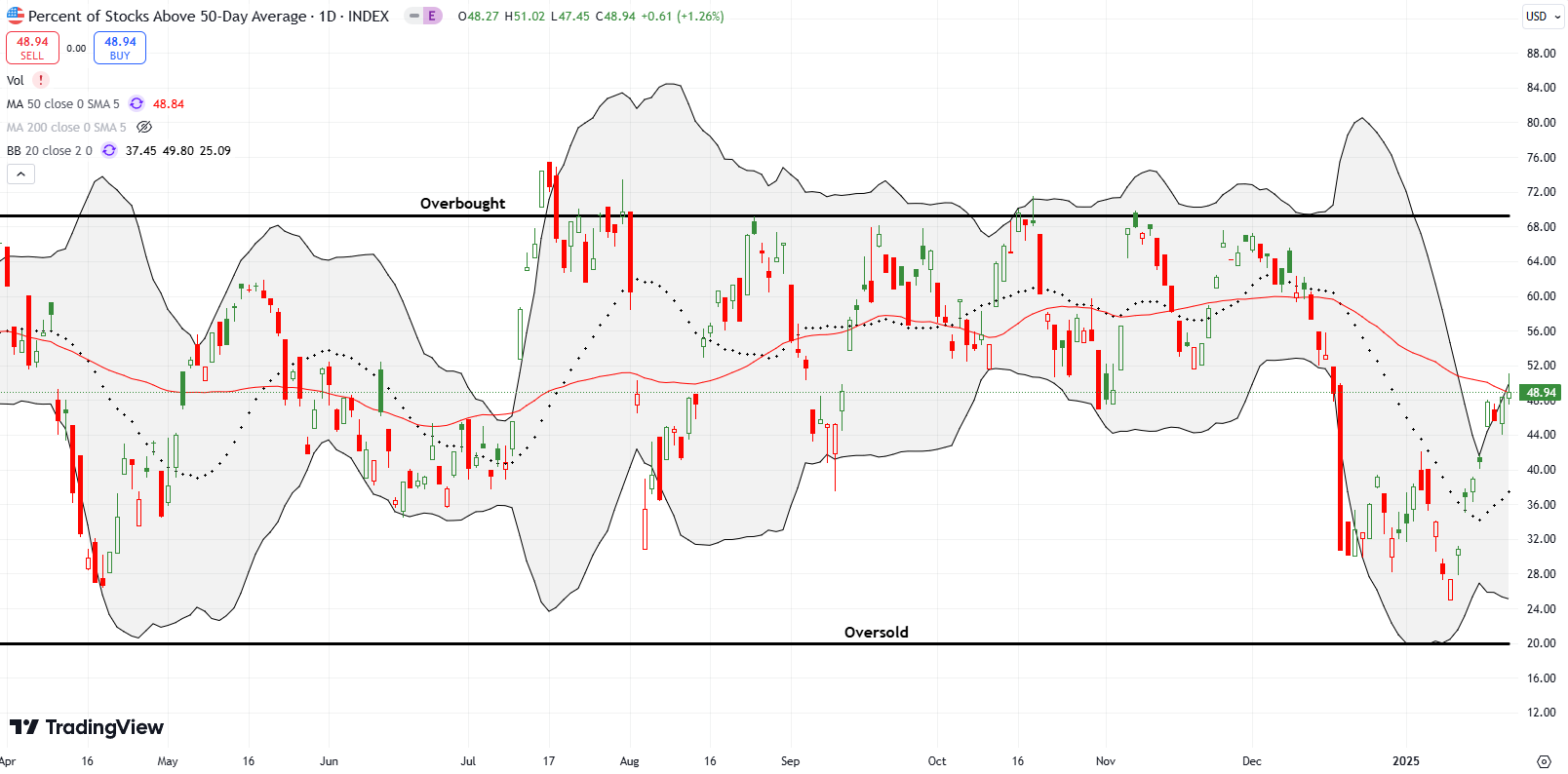

A week ago, I concluded that the stock market had reached “oversold enough” trading conditions. Last week confirmed an oversold low as market breadth rapidly broadened and supported an all-time high redux for the S&P 500. Yet, this revival comes with important caveats. Uncertainty looms over the Federal Reserve’s next moves even as the upcoming meeting is expected to leave rates unchanged. Fresh inflation data and GDP updates could also swiftly shift short-term market sentiment. The market is even trying to digest AI-related news that potentially undermines the loftiest cases for AI spending. Mix in an earnings week in full-swing and traders should have plenty of reason for slowing down in the wake of the sharp bounce from oversold enough conditions.

The Stock Market Indices

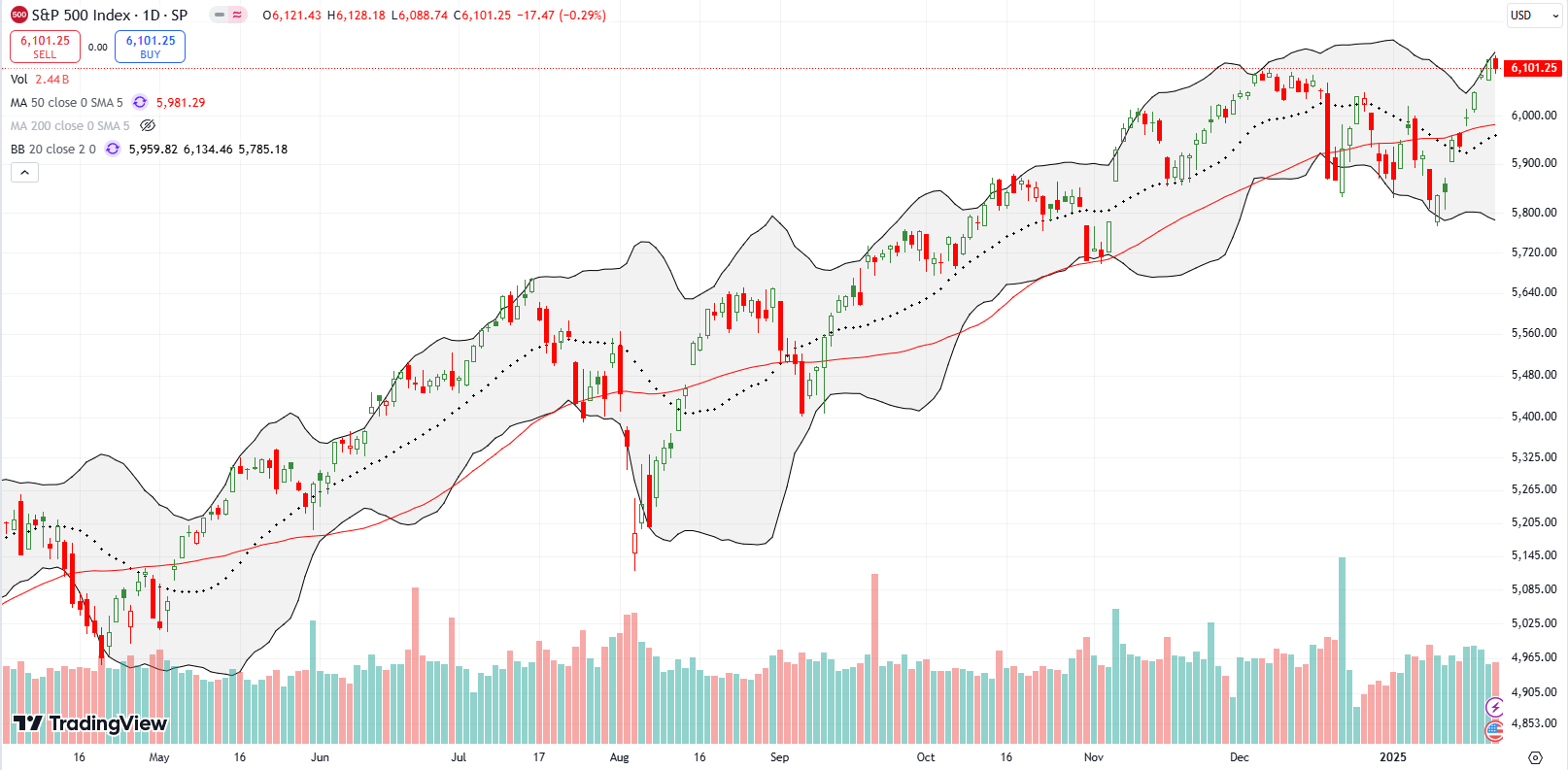

The S&P 500 (SPY) has rallied nearly straight up since going oversold enough. The result last week was an all-time high redux. All-time highs basically seem to be the index’s destiny. Last week’s trading confirmed a 50DMA breakout after bringing a short-term downtrend to an end.

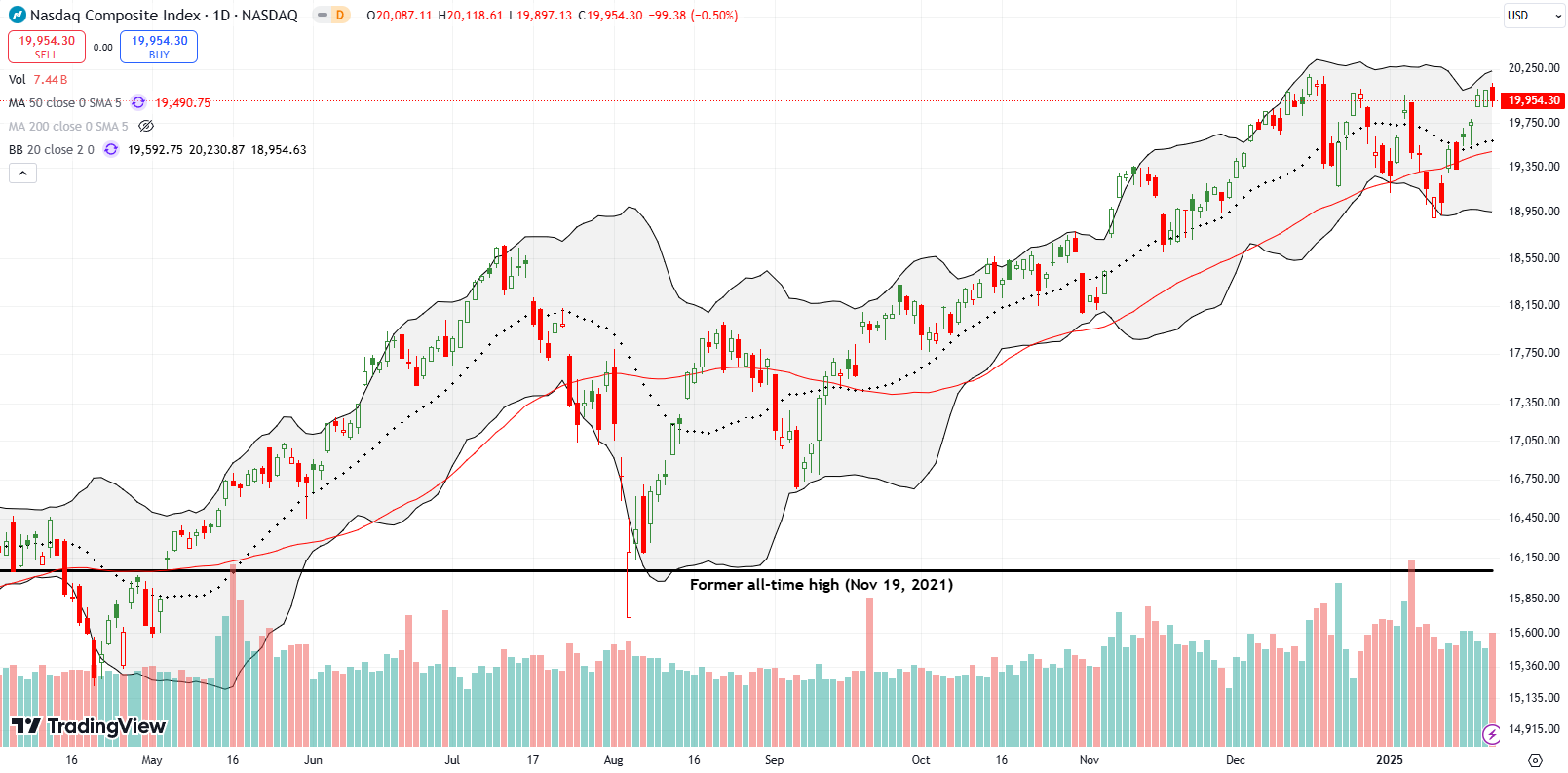

The NASDAQ (COMPQX) came into last week having confirmed a 50DMA breakout but still on the edge of a short-term downtrend. A gap up on Wednesday ended that downtrend, but the tech-laden index proceeded to stall right under its all-time high.

An all-time high redux may have to wait for quite some time after weekend news about a Chinese AI start-up called DeepSeek. At the time of writing NASDAQ futures are down 1.9%. Apparently the DeepSeek platform/product is built on open source technology and does not require vast amounts of spending on tech like stockpiles of NVIDIA (NVDA) chips. From Yahoo Finance:

“The DeepSeek product “is deeply problematic for the thesis that the significant capital expenditure and operating expenses that Silicon Valley has incurred is the most appropriate way to approach the AI trend,’ said Nirgunan Tiruchelvam, head of consumer and internet at Singapore-based Aletheia Capital. “It calls into question the massive resources that have been dedicated to AI.””

Assuming the fear holds into Monday’s open, look for a wide swath of pick and shovel AI plays to take deep dives. I will be looking to buy something at or near support levels as well as look for the companies who stand to benefit from cheaper LLM (large language models).

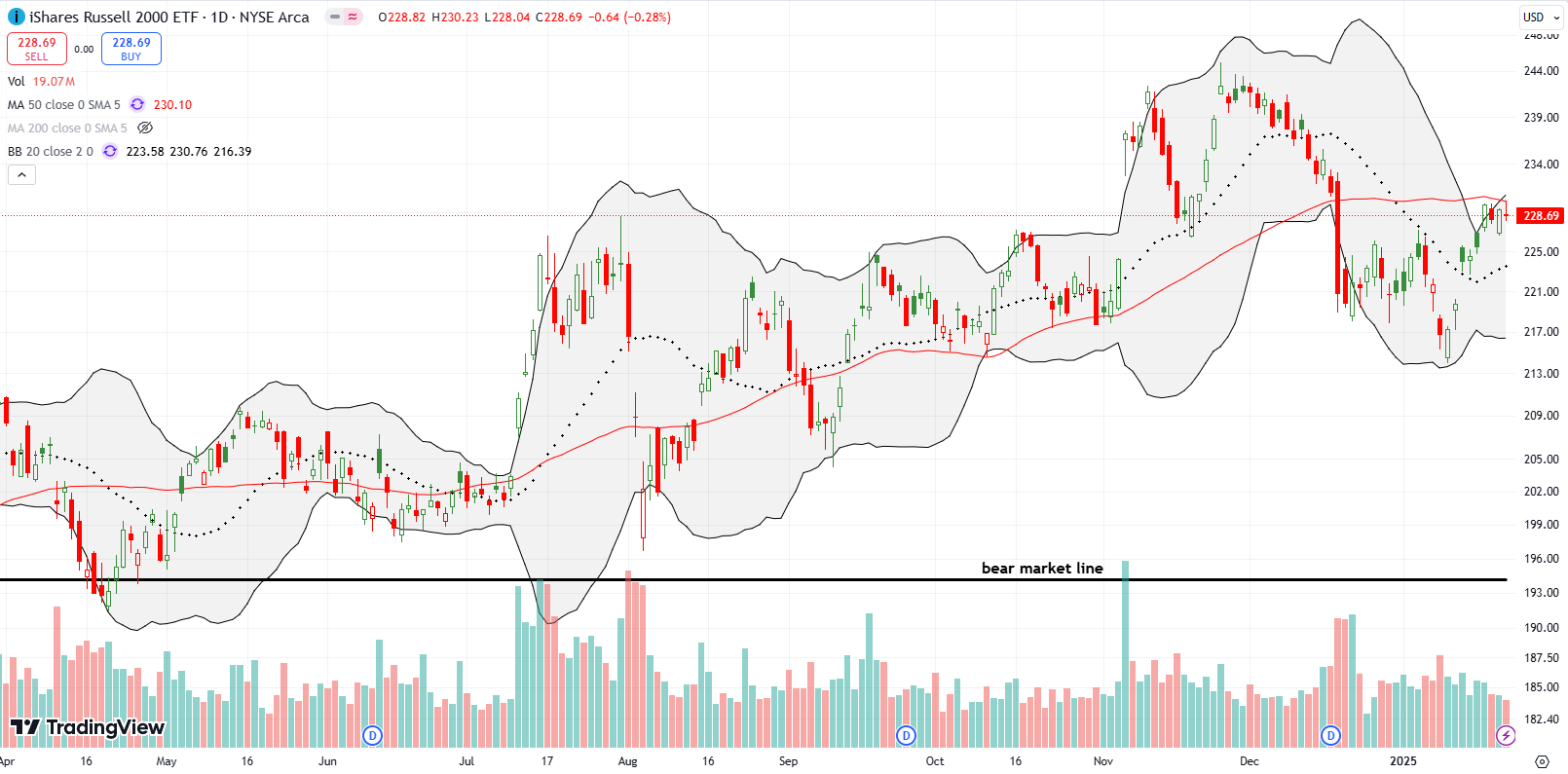

The iShares Russell 2000 ETF (IWM) continues to struggle. After opening the week with a 1.9% gain, the ETF of small caps just churned under 50DMA resistance. I plan to resume call buying on a 50DMA breakout. I do not expect IWM to get impacted by DeepSeek missiles.

The Short-Term Trading Call With All-Time High Redux

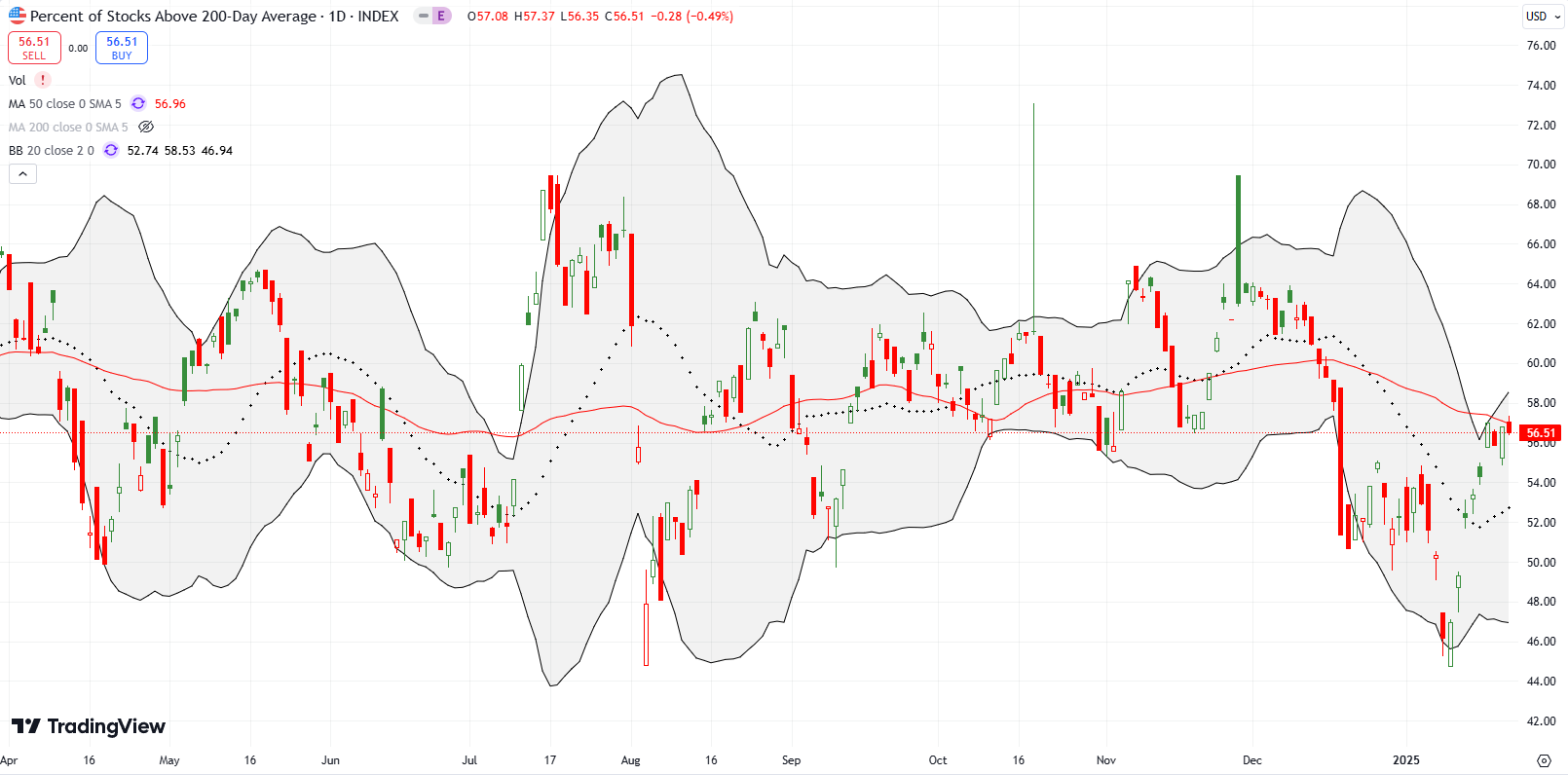

- AT50 (MMFI) = 48.9% of stocks are trading above their respective 50-day moving averages

- AT200 (MMTH) = 56.5% of stocks are trading above their respective 200-day moving averages

- Short-term Trading Call: cautiously bullish

AT50 (MMFI), the percentage of stocks trading above their respective 50DMAs, closed the week at 48.9%. The oversold enough trading conditions set up my favorite technical indicator for a robust rebound. AT50 is now up 7 days out of the last 8 while supporting all-time high redux on the S&P 500. Accordingly, I flipped the short-term trading call from neutral to cautiously bullish. With earnings season underway, I am not favoring any particular pre-earnings plays. However, I AM prepared to buy IWM calls as mentioned earlier. I am also willing to buy QQQ on a retest of 50DMA support.

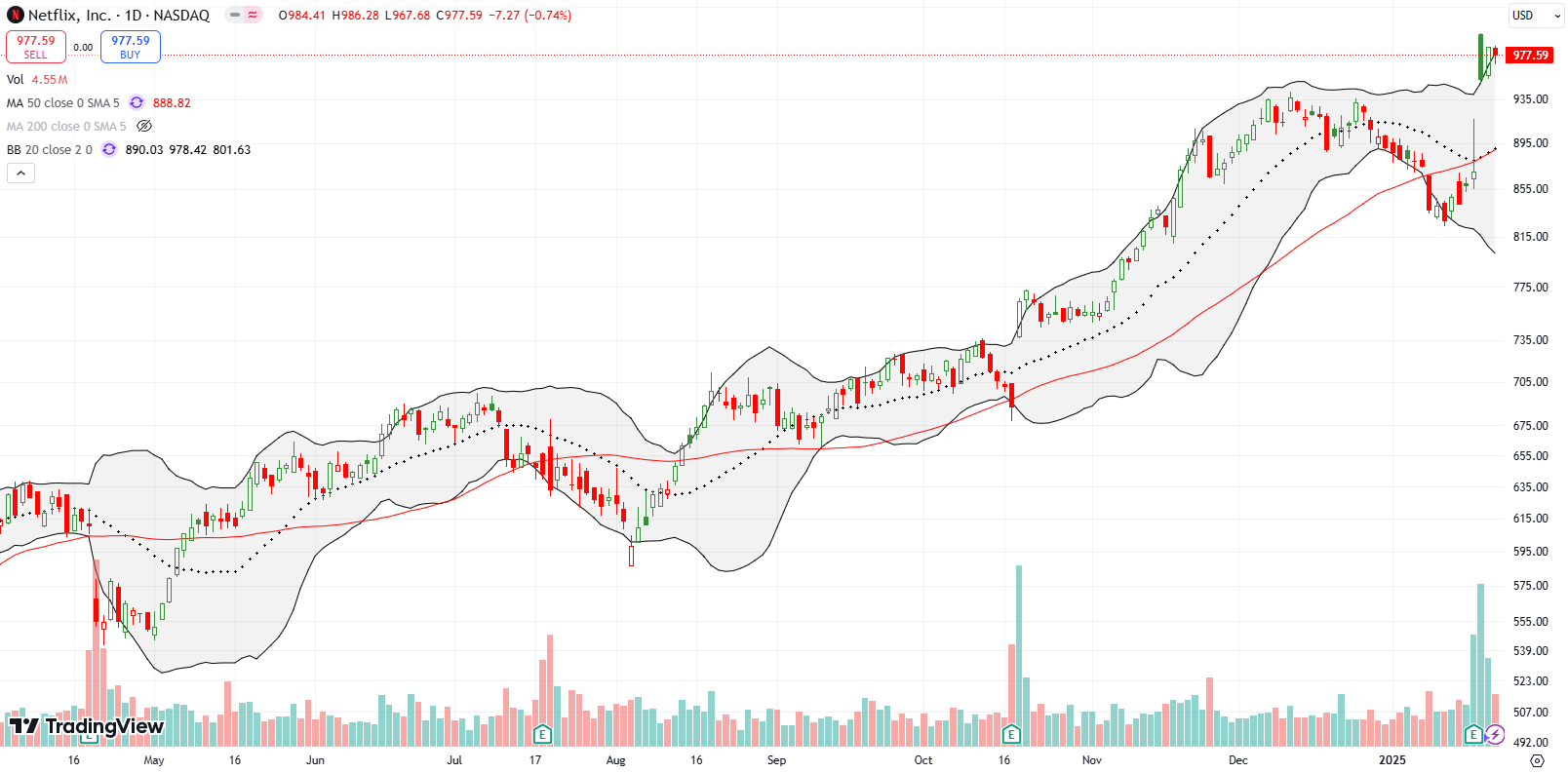

Netflix, Inc (NFLX) put on a post-earnings show. The streaming giant gained 9.7% post-earnings despite a steady fade from its intraday high. Buyers stepped back into NFLX the next day. Pricing power makes NFLX more attractive than ever as the company rolls out broad-based price increases. The all-time high redux on NFLX makes it a buy on dips again. The bearish 50DMA breakdown earlier in the month is already old news.

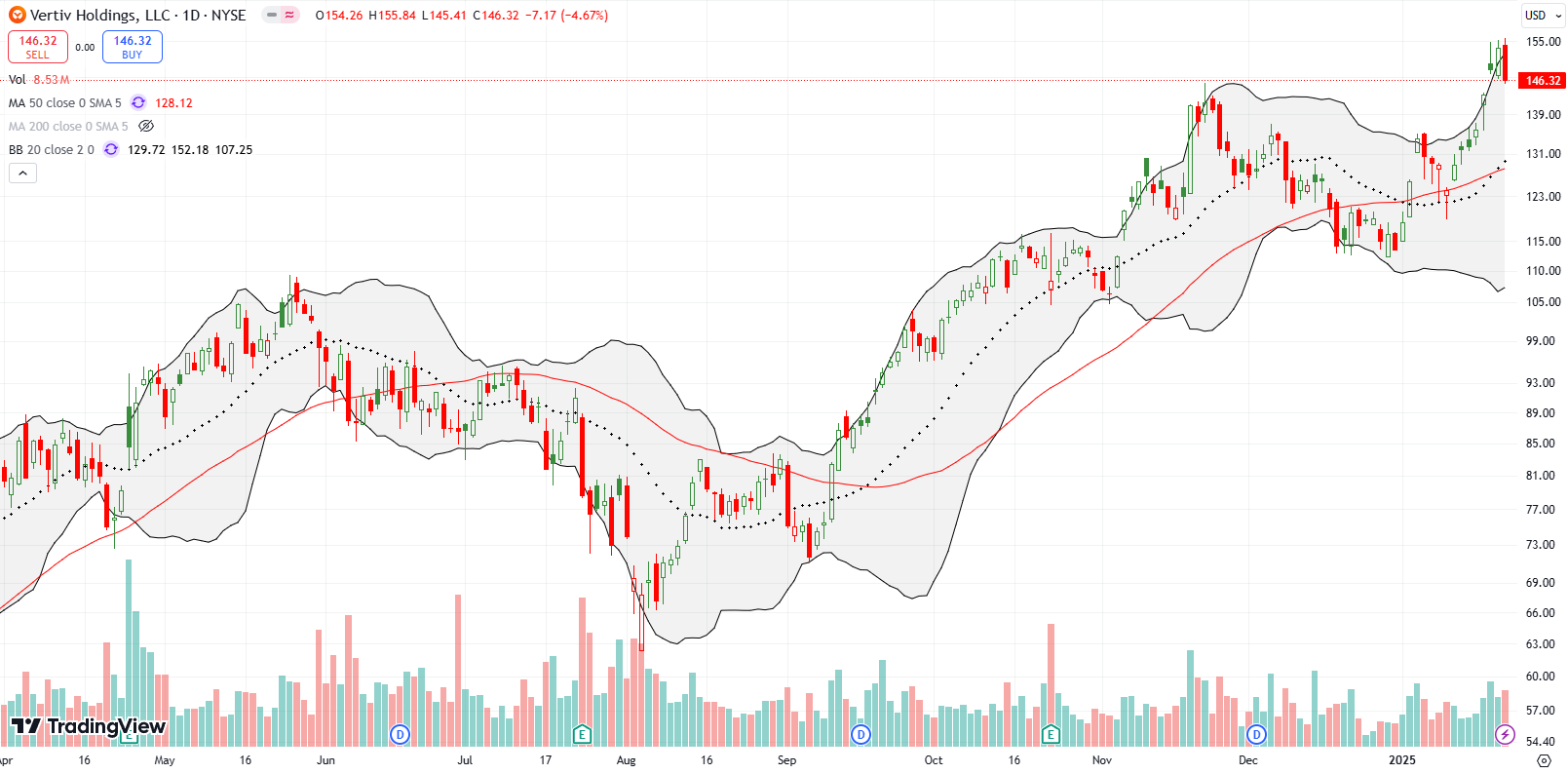

In December I got cautious and took profits on AI infrastructure software company Vertiv Holdings, Inc (VRT). That point was VRT’s last low. The stock quickly recovered from there with a fresh 50DMA breakout followed by a successful test of 50 and 20DMA support. The rally from there was just as impressive as any VRT rally. However the all-time high redux ended with a bearish engulfing top. Needless to say I will be watching closely for earnings February 12th if the DeepSeek news does not first confirm the topping signal.

Digital marketing software company SEMrush Holdings, Inc (SEMR) now calls itself an “online visibility management and content marketing SaaS platform”. At the lows this month, SEMR hit a 9-month low. Buyers got excited from there. The stock shot straight up until breaking out to a near 3-year high. Still, the stock looks like it still has momentum to push higher in the coming week. This new life has me interested in nibbling even ahead of earnings (presumably next month).

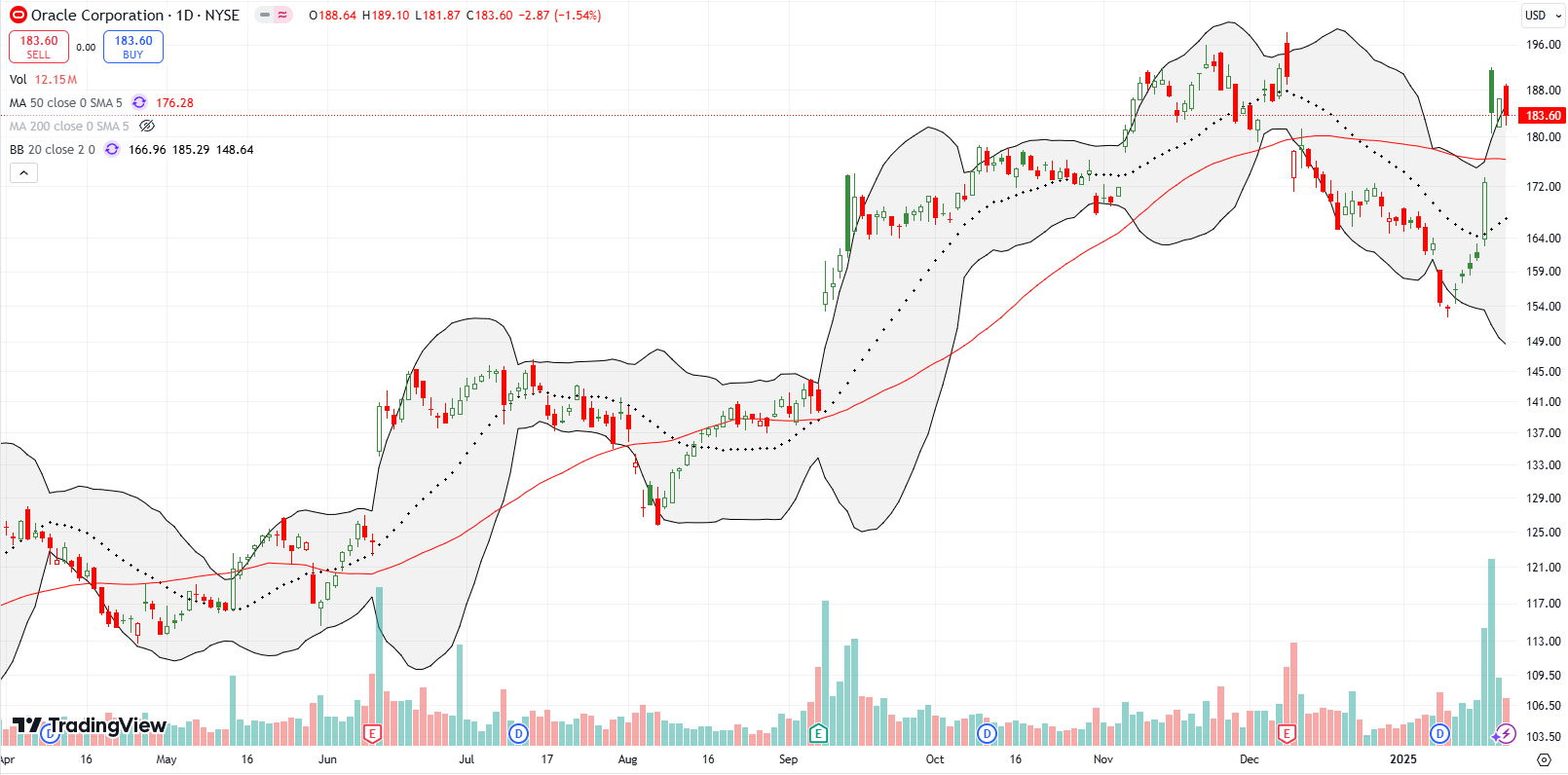

Database software company Oracle Corporation (ORCL) received fresh headlines from Stargate, a $500 billion joint venture to build AI infrastructure. ORCL gained 7.2% in the immediate aftermath of the news and followed up with another 6.8% gain that ended 50DMA resistance. While ORCL fell short of an all-time high redux, it is back in position for buys on the dip. Before Stargate, ORCL was looking toppy and on its way to fill the gap from September earnings.

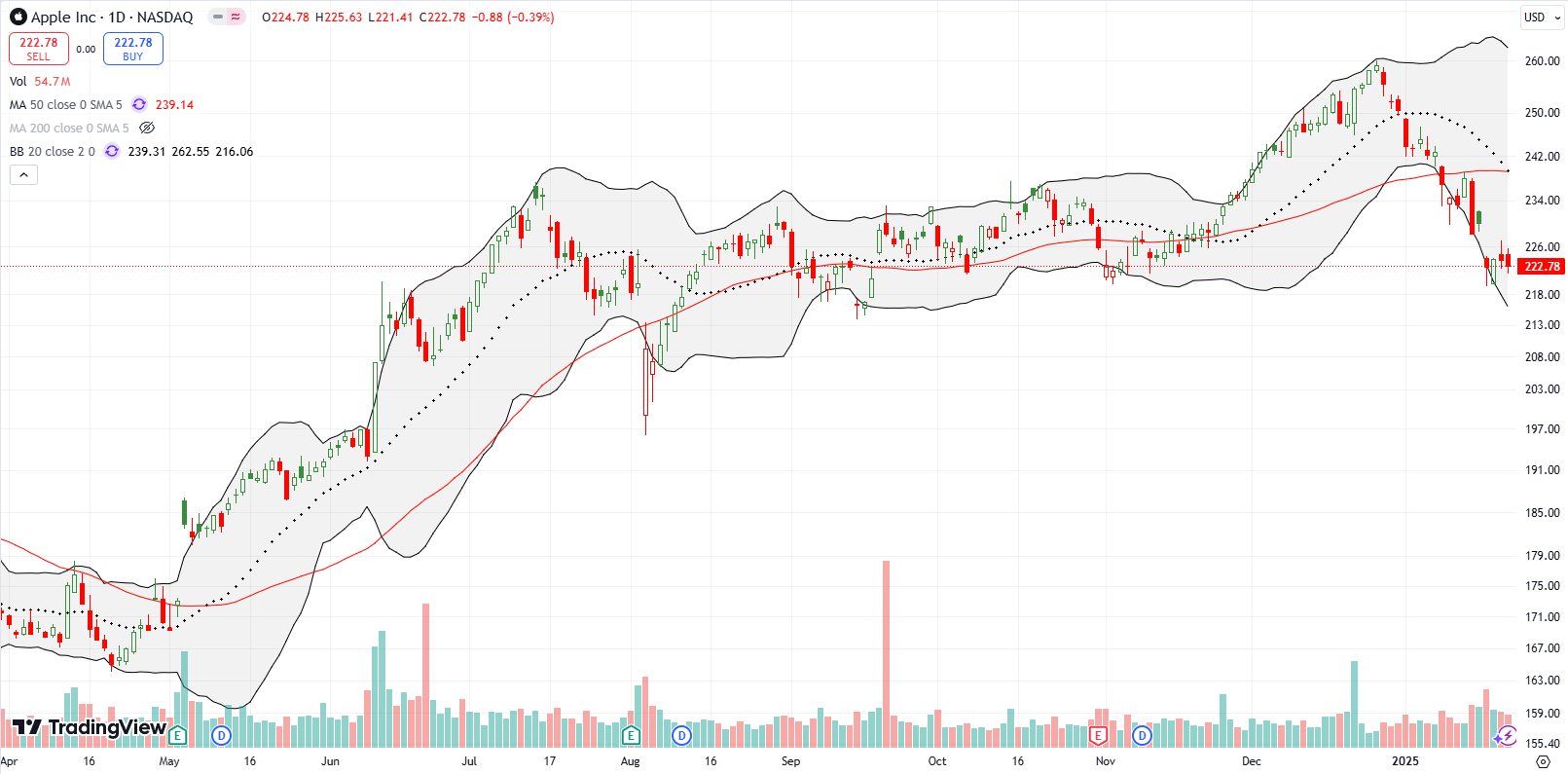

Apple Inc (AAPL) started last week with a 3.2% gap down. Buyers lifted the stock from its lows and formed a hammer pattern. I kept AAPL on my watchlist for a confirmation of the classic bottoming pattern. I thought the confirmation came on Thursday as AAPL rose to a new high for the week. The “green shoots” failed to last and sellers quickly faded the move. I am now sitting on a call spread that I dared to buy despite earnings coming this week. DeepSeek should not impact AAPL since its Apple Intelligence roll-out has already been met with muted enthusiasm by the stock market.

I officially surrender to my poor execution on Twilio Inc (TWLO). I have done too much talking and no buying on TWLO. In early November, I lamented missing out on a large post-earnings move. I hoped for a pullback that never came. Now I get to lament being on the sidelines after TWLO surged 20.0% following an investor day conference.

Fabless semiconductor company Himax Technologies, Inc (HIMX) first got on my radar in 2016 or 2017 when a relative brought it to my attention. However, the technicals looked tenuous and I never jumped in. HIMX actually topped out in this period. The stock came alive again during the pandemic’s high tech mania. In telling fashion, HIMX failed at resistance from its all-time high.

My alerts were screaming last week as HIMX surged. I was tempted to jump in at the beginning of the week, but I stopped short. HIMX is benefiting from news of a deal with Taiwan Semiconductor (TSMC). The hype was strong enough to send the stock hurtling along its upper Bollinger Band (BB) for a 45% gain in the week. Wow! Looking back I should have been willing to buy HIMX after it cooled from December’s 44.9% ONE-day gain. Now I can only hope for a fresh pullback. Clearly, the momentum is in HIMX’s favor again.

Alternative energy plays like First Solar (FSLR) have understandably failed to participate in the post-election euphoria. After falling 10.1% post-election, FSLR has actually done well to churn in a trading range. Unfortunately, last week’s trip to the bottom of the trading range may have broken the camel’s back. FSLR closed at a 9-month low with high trading volume all week. At some point, I plan to start nibbling on FSLR shares as the ultimate contrarian play for the coming years.

Be careful out there!

Footnotes

Subscribe for free to get email notifications of future posts!

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #283 over 20%, Day #4 over 30% (overperiod), Day #16 under 40%, Day #16 under 50%, Day #20 under 60%, Day #121 under 70%

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long SPY put spread, long IWM, long AAPL call spread

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, BlueSky, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.

“look for a wide swath of pick and shovel AI plays to take deep dives”

That would be MU. 🙁

Thanks for the reminder! MU goes to the top of the list.