AT40 = 43.8% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 52.6% of stocks are trading above their respective 200DMAs

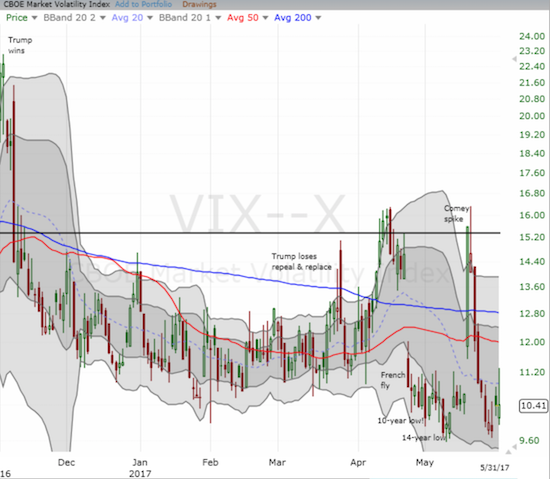

VIX = 10.4 (volatility index)

Short-term Trading Call: cautiously bullish

Commentary

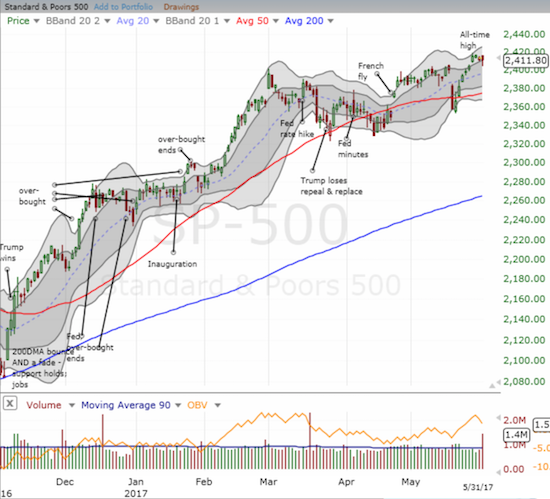

And just like that, the stock market made it even harder for me to keep a bullish bias on my short-term trading call.

Financials suffered a major blow when J.P. Morgan (JPM) revealed that revenue is down 15% in the quarter (excluding June). Bank of America piled on by indicating trading revenue would be down year-over-year on tough comparisons. Traders acted swiftly and created serious and bearish technical damage.

The Financial Select Sector SPDR Fund (XLF) is the only thing preventing me from jumping all over shorts on JPM and GS…and implicitly becoming even less bullish on the stock market. XLF has yet to follow-through on a head and shoulders (H&S) top. I am watching this important indicator of market and economic health ever more closely.

Financials weakened the S&P 500 (SPY). Yet, after sellers failed to make fresh intraday lows from the first hour of trading, buyers closed out the final 90 minutes in a strong rush to scoop up “bargains.” It was yet another signature close for the S&P 500 that put the weakness of sellers on full display even as carnage raged in an important sector of the market.

As a result of another implosion of selling interest, the volatility index, the VIX, flipped from an intraday 8.9% gain to a near flat close. The VIX thus stayed firmly entrenched at an extremely low level.

Through it all, AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, jumped off its intraday low of 39% to close at 43.8%, a very slight gain over the previous day. Albeit small, this gain was important for indicating that weakness in financials failed to further weaken important underlying technicals of the stock market. Moreover, any bounce for AT40 from the 30% range gets my attention as a potential bottoming move.

AT200 (T2107), the percentage of stocks trading above their respective 200DMAs, was not so fortunate and failed to support an optimistic interpretation of the day’s events. AT200 bounced from 51% but still ended the day with a loss and its third lowest close since the November U.S. Presidential election.

This trading action brings the market into summer trading on a very mixed note. Two key economic reports – the May jobs report and the monetary policy report from the U.S. Federal Reserve – could have extra influence on what happens. At least the fate of the U.S. dollar index (DXY0) hangs in the balance…

Amazon.com (AMZN) will also be on everyone’s radar as the stock flirts with a historic $1000 trading level. AMZN crossed the $1000 threshold over the last two trading days but failed to close there. Today, the stock made an impressive recovery from its intraday low as it traversed the entire upward trending upper-Bollinger Bands (BBs). Something tells me the most willing sellers were already flushed out in this move…

Be careful out there!

— – —

FOLLOW Dr. Duru’s commentary on financial markets via email, StockTwits, Twitter, and even Instagram!

“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #321 over 20%, Day #141 over 30%, Day #8 over 40% (overperiod), Day #11 under 50%, Day #23 under 60%, Day #93 under 70%

Daily AT40 (T2108)

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Weekly AT40 (T2108)

*All charts created using freestockcharts.com unless otherwise stated

The charts above are my LATEST updates independent of the date of this given AT40 post. For my latest AT40 post click here.

Related links:

The T2108 Resource Page

You can follow real-time T2108 commentary on twitter using the #T2108 or #AT40 hashtags. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag.

Be careful out there!

Full disclosure: net short the U.S. dollar, long UVXY call options

*Note QQQ is used as a proxy for a NASDAQ-related ETF

S&P continues to defy logic and reality but hey that can continue for a long time, until it doesn’t ! I am stil trading around a CAD long position waiting for the shorts to get cleaned out but it doesn’t seem they have budged this week. However, with oil back to the bottom of the range, it will be interesting to see where price goes next week. Wish I had stuck with the euro long. Hindsight is 20:20. Do you reckon the bottom is in on cocoa ?

Euro is just getting started! 🙂

CAD is surprising resilient. It could/should soar once oil bounces back.

I think the bottom is indeed here on cocoa. Finally. Here is a related Bloomberg article: “Bearish Cocoa? Here Are Five Reasons Why the Worst May Be Over”

https://www.bloomberg.com/news/articles/2017-05-31/bearish-cocoa-here-are-five-reasons-why-the-worst-may-be-over