(This is an excerpt from an article I originally published on Seeking Alpha on April 7, 2013. Click here to read the entire piece.)

{snip}

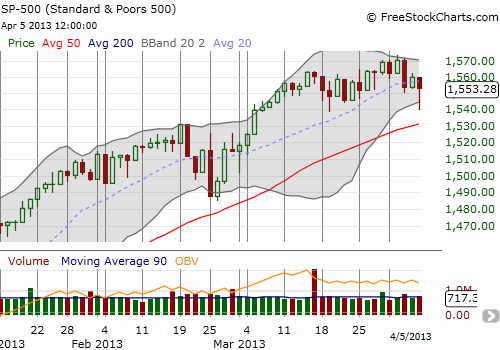

The market seemed to convulse on the notion that the Fed could actually end asset purchases but seemed to ignore the conditional of a much improved labor market and improving economy. Moreover, Williams did not express certainty, he expressed hope. In fact, Williams went to great pains to remain consistent with standing policy and highlighted that the Federal Reserve will remain in a very accomodative stance for quite some time. {snip}

{snip}

{snip}

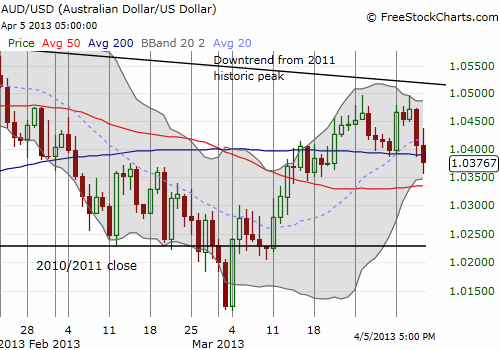

Australian dollar

I covered the latest decision on monetary policy several days ago (see “The Reserve Bank Of Australia Marginally Concedes To A Brighter Outlook“). At the time, I stubbornly decided to hold onto my short Aussie bias with my short AUD/USD position given my expectation that resistance at the long-standing downtrend line would hold. I was rewarded but in a very unexpected way.

{snip}

{snip}

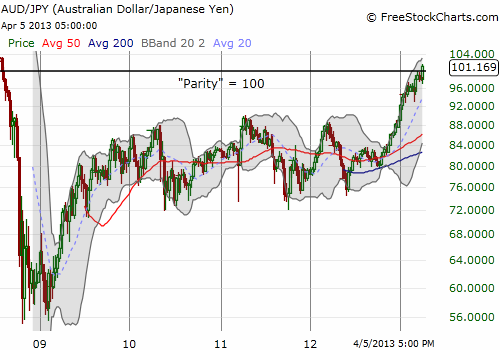

Japanese yen

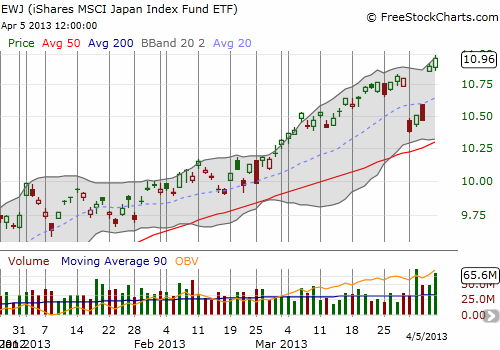

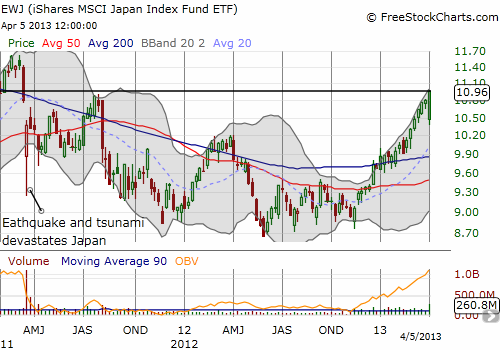

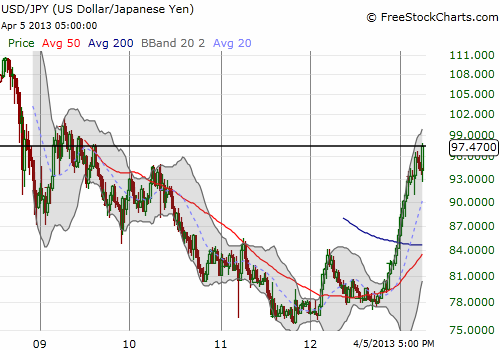

No superlative is enough for the rapid weakening in the Japanese yen in the wake of the BoJ move. When I wrote about how the Nikkei was finally selling off just on the heels of a 3-week strengthening of the yen, I claimed that it had opened a rare buying opportunity for iShares MSCI Japan Index (EWJ) and a good spot to open fresh shorts on the yen. However, I did not anticipate this instant surge to fresh 2+ year highs for EWJ.

{snip}

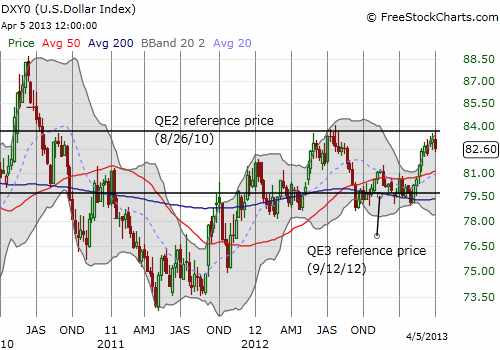

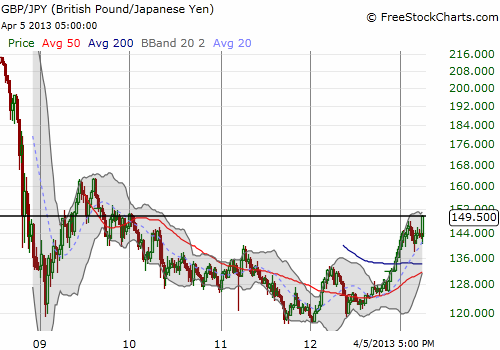

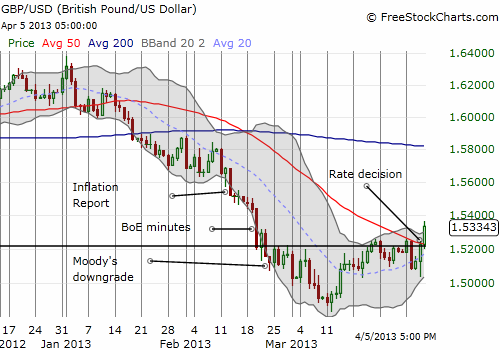

I mention the British pound (FXB) as potentially an even better play than the U.S. dollar because it seems to have bottomed for now.

British pound

The Bank of England (BoE) delivered no surprises in keeping rates and QE steady. However, with economic conditions weakening, the lack of action seems to imply that stubbornly elevated inflation levels are causing hesitation. {snip}

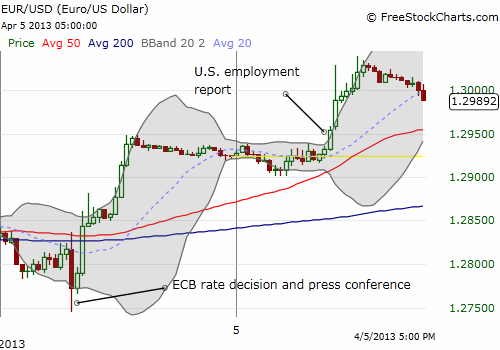

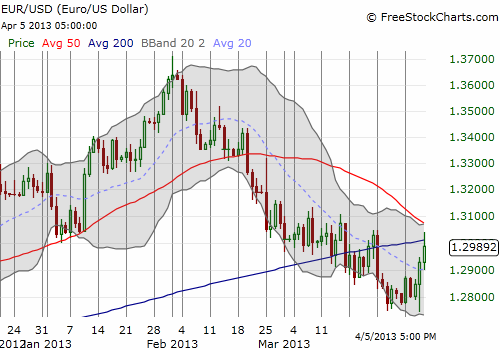

The euro

{snip}

{snip}

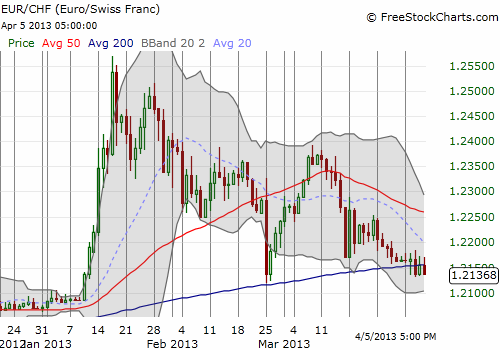

Swiss franc

One factor working against the euro is the creeping recovery of the Swiss franc (FXF) from weakness earlier in the year. {snip}

Source of charts: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 7, 2013. Click here to read the entire piece.)

Full disclosure: long SSO calls, short GBP/USD, net long Australian dollar, long EUR/CHF, long USD/JPY