A Flashback

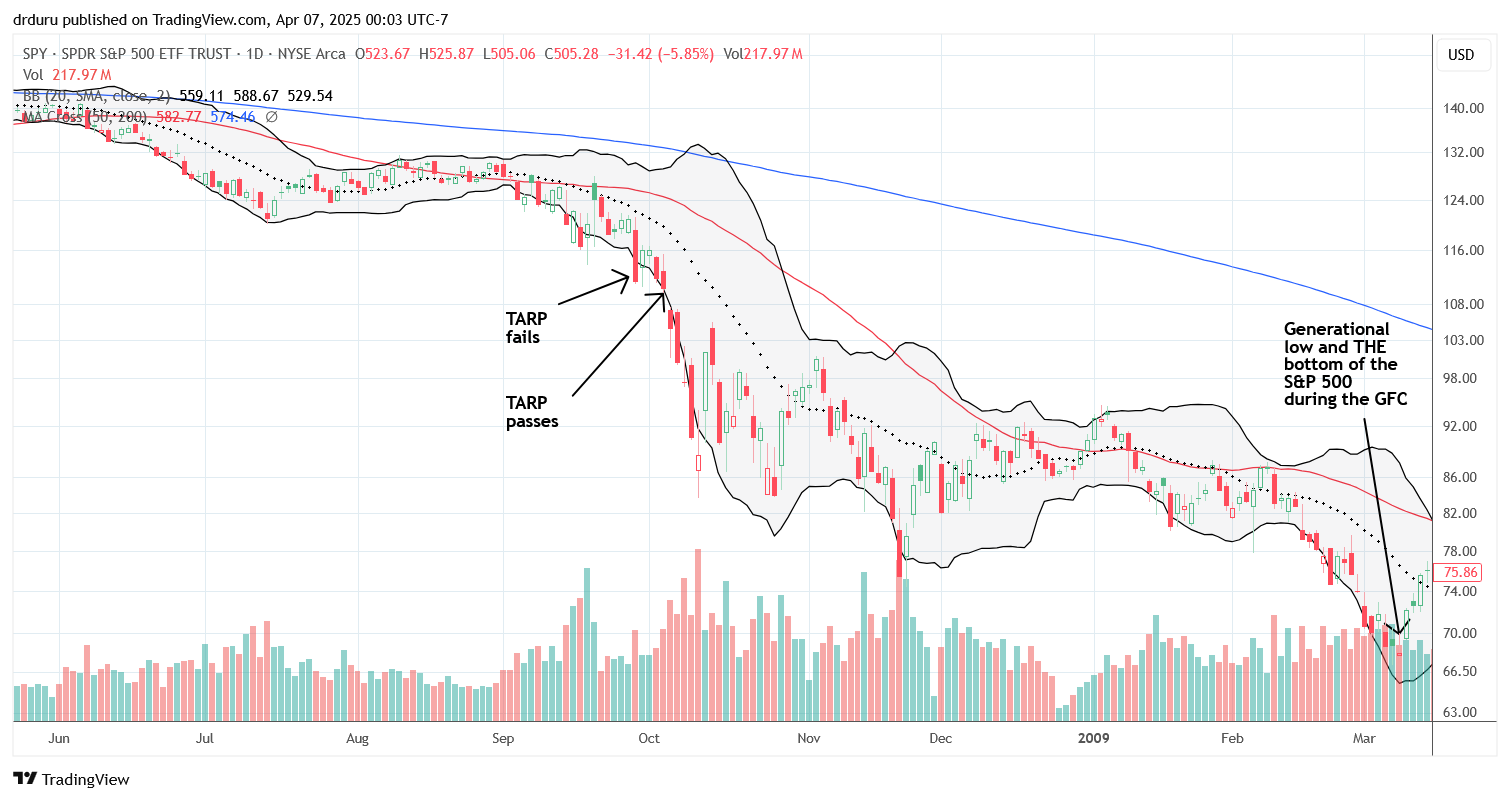

On September 29, 2008, a nervous and weak stock market anxiously awaited the outcome of a Congressional vote on a $700B Wall Street bailout package known as TARP (the Troubled Asset Relief Program) as part of the Emergency Economic Stabilization Act of 2008. According to briefing.com, the S&P 500 (SPY) was down about 3.5% ahead of a vote from the House of Representatives. At 1:45pm Eastern, the House rejected the bill and the S&P 500 immediately fell to a total 7.0% loss on the day. By the time the dust settled on the carnage, the S&P 500 lost 8.8% and closed at a 4-year low.

With outright panic breaking out in financial markets, the machinery of government scrambled to try to pass a revised version of TARP. Hope spread through the markets with the S&P 500 jumping 4.1% the next day and holding steady the next. However, the wait proved too much to bear. By the time Congress passed a new version of TARP and President Bush signed the bill into law on October 3, 2008, the S&P 500 faded from initial gains that day to a close at a fresh 4-year low. The market suffered another 5 months of a rolling crash before the S&P 500 achieved its final bottom of the Great Financial Crisis (GFC).

This entire episode remains seared in my memory. I will never forget where I was when Congress failed to pass TARP. I was on a business trip at the University of Rochester in New York. An overhead TV screen streaming the news in an open area allowed me to sneak a peek at the calamity while I walked with my colleagues. I groaned after seeing the news of the failed TARP and the resulting extended crash in the stock market. I recount this episode as a reminder of the typical dynamics that connect financial markets to government action. First, the market tries to force the hands of government into action by selling off and creating financial calamity. Second, authorities get the message and eventually act to stem the worsening panic. So far in this current economic chaos, we have the first but none of the second.

Grin and Bear It

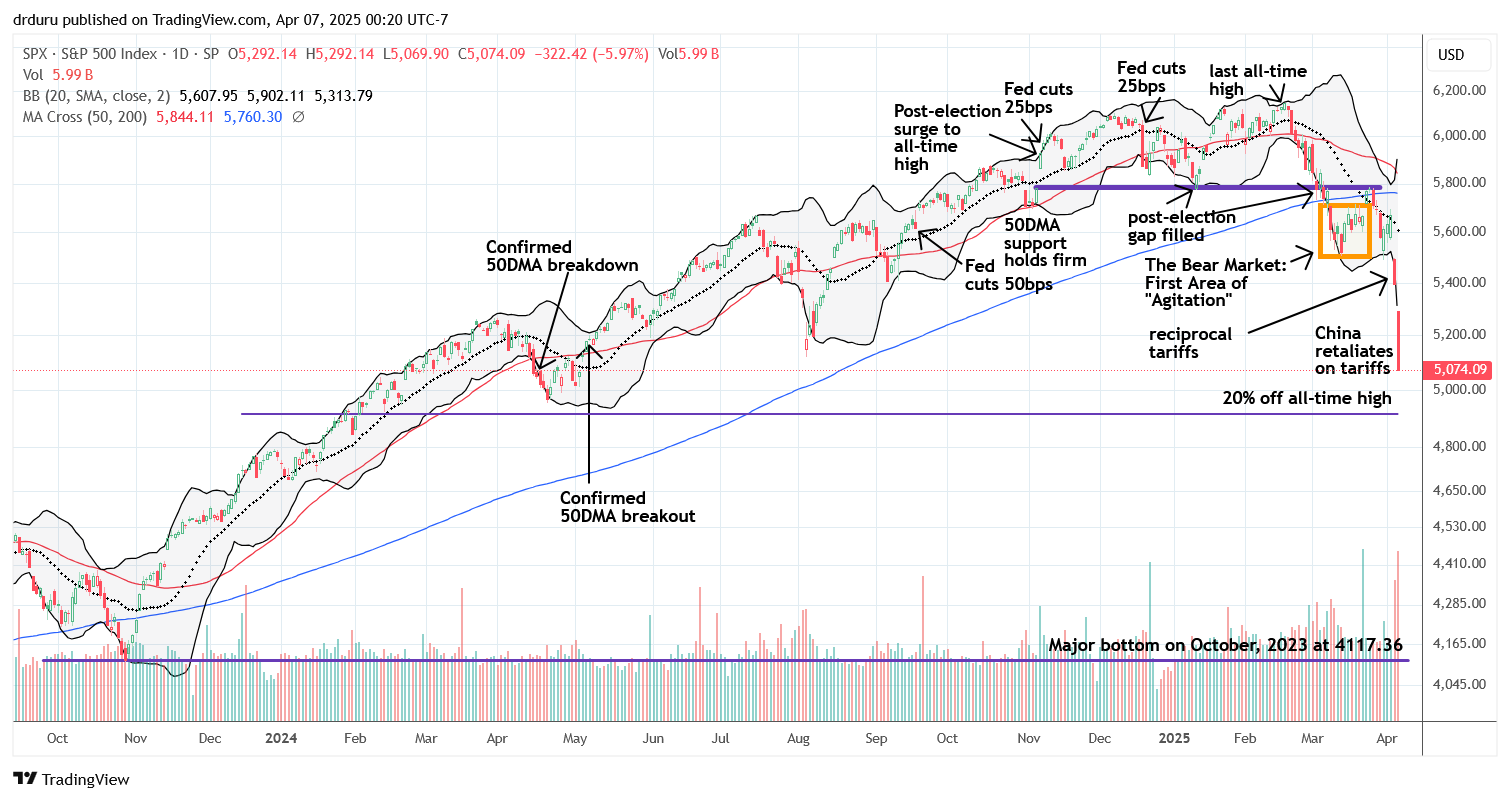

Today we have a rolling crash in the stock market with financial markets panicking. As I type on a Sunday night, S&P 500 futures are down another 4%. The panic about President Trump’s aggressive plan on tariffs and the resulting extension of economic warfare has so far found unsympathetic witnesses in Washington D.C. Various members of the cabinet went on the airwaves to both defend Trump’s tariff policy and to downplay the resulting market chaos and carnage, essentially telling the American public to grin and bear it. An interview with President Trump (on an airplane?) was quite instructive. Here is a key clip from a YouTube video from PBS Newshour on April 6, 2025:

Question from Bloomberg reporter: “Is there a Trump put? Is there pain in the market at some point where you’re unwilling to tolerate this idea of a Trump put? Is there a threshold?”

President Trump’s response: “I think your question is so stupid…I don’t want anything to go down. But sometimes you have take medicine to fix something…We have been treated so badly by other countries because we had stupid leadership that allowed this to happen. They took our businesses. They took our money. They took our jobs. They moved it to Mexico. They moved it to Canada. They moved a lot of it to China. And it’s not sustainable…now we have hundreds of millions of dollars are pouring into our country on a monthly basis. It’s already started, because I put tariffs on. And eventually it’s going to straighten out. And our country will be solid and strong again.” – from “President Trump addresses tariff policy as market futures crash”, PBS Newshour, April 6, 2025, YouTube.

Trump’s response clarifies that whining from the stock market will fall on deaf ears. Trump has prescribed the medicine, and he is willing to let the treatment take its course. Instead of market panic translating into panic by the government, the market will have to console itself. Thus, the typical technicals of oversold and rebounds are more precarious than ever. Traders and investors must think and act very soberly and take seriously worse case scenarios. For example, could the S&P 500 eventually fall to 4000 as Jim Cramer warns? Well, there is a valuation argument that I have shown informally. There is a policy argument based on the government staying on its current course no matter what. And then there is the technical argument. Around 4000, the S&P 500 simply reverses all the giddy gains from the major bottom of 2023 after the market started to look forward to rate cuts that did not come for another 11 months.

Note well, 4000 is FAR away from my base case of market damage to the S&P 500. I am just soberly keeping this possibility in my mind as a part of the distribution of potential outcomes from the current economic chaos, especially given how seemingly big institutional money got out the market in large chunks in March while retail stayed the course and bought. Market makers may next turn their attention to shaking out retail from the market.

Bessent’s Pushback

Also instructive was U.S. Secretary Treasury Scott Bessent dismissal of the market correction. Here are choice quotes from his interview on NBC News on April 6:

“You never know what the reaction’s going to be. One thing that I can tell you is..what I’ve been very impressed with is the market infrastructure. We had record volume on Friday, and everything is working very smoothly. So the American people can take great comfort in that.

In terms of the market reaction—look, we get these short-term market reactions from time to time. The market consistently underestimates Donald Trump. I remember in 2016, the night President Trump won, the market crashed. The market crashed, and it turned out he was going to be the most pro-business president in over a century—maybe in the history of the country.”

Nevermind that the crash at Trump’s first election happened without the market having information on what a Trump president would really do. Now the market has plenty of information and yet increased uncertainty. Moreover, the crash is on-going and happening in regular market hours. Back in 2016, futures, which are heavily manipulated, crashed and by the time the S&P 500 opened the next morning, the overnight fuss was all but gone.

The interviewer went on to press Bessent about Trump’s exhortation to the country to “hang tough.” She asked specifically “How difficult is it going to be, and how long are Americans going to have to hang tough?” Bessent protested in response: “Well, again, I reject that assumption. There doesn’t have to be a recession. Who knows how the market is going to react in a day or a week? What we will have are the long-term fundamentals to prosperity. I think the previous administration had put us on a course toward financial calamity.”

There are several clues to note from this response. First of all, the interviewer never mentioned recession. Bessent jumped to that association based on an assumption that people might interpret Trump’s “hang tough” as an acknowledgement of economic weakness. I think the administration is genuinely worried about a recession and is trying to jawbone the nation’s pysche out of the bunker mentality that can lead to a recession. Bessent’s reference to long-term fundamentals suggests a willingness to overlook whatever the market is doing in the here and now. Short-term panic is irrelevant to the conviction around long-term success. Finally, the reference to a failed economic trajectory going into this administration further reinforces the notion that “turning back” is not an option.

In other words, we should all brace for an administration that is determined to plow ahead and to largely ignore the market’s press to force action. The market will find itself out of sorts with this kind of dynamic. This abnormality is symbolic of what I have called out as the potential change in the global economic order that suggests past economy+stock patterns could be poor lessons to apply for future expectations.

The interviewer continued to press Bessent for more answers and clarity: “How long will this period of uncertainty be? Are we talking about weeks? Are we talking about months? Are we talking about years?” Bessent fired back with a historical analogy that reinforced the notion that the administration is full steam ahead: “Again, this is an adjustment process. What we saw with President Reagan, when he brought down the great inflation and we got past the Carter malaise, was that there was some choppiness at that time. But he held the course, and we’re going to hold the course. This has been years in the building – years in the making. This unsustainable system.”

Of course President Reagan did not bring down inflation. It was the great Federal Reserve Chair Paul Volker who bravely took on vicious criticism as he sent rates soaring to choke off inflation. President Carter appointed Volker specifically for this job despite the political risks to his presidency (and he indeed paid the price). Reagan granted Volker a second term. Misapplied history aside, the message from Bessent is clear: get used to the “choppiness” until the President’s medicine takes its course.

Can the World Grin and Bear It?

In the meantime, the world shakes and shivers and struggles to just grin and bear it. The Prime Minister of Singapore has become one of the most viral prophets of how the world feels about the current economic chaos. The video is just over 5 minutes. I recommend readers watch the entire thing if you are seeking deeper understanding of what is happening beyond the U.S. perspective. I cannot do this speech justice by picking out choice quotes.

Be careful out there!

Full disclosure: long SPY shares

excellent summary of events. very informative. always like to read/heard your analysis.

Richard

Thanks!