Stock Market Commentary

The current administration’s policy of long-term growth through short-term pain in the form of austerity came into clear focus last week. I earlier introduced this concept in “Growth Scare or Overreaction – An Oversold Market or Something Worse?“. Last week, U.S. Treasury Secretary Scott Bessent laid out the strategy in detailed economic and political terms in an interview with the Economic Club of New York. In various remarks, the President has also tentatively tried to prepare the country for short-term economic pain. The financial market’s growing awareness of this plan has come in the form of selling pressure and increased volatility in the last two weeks.

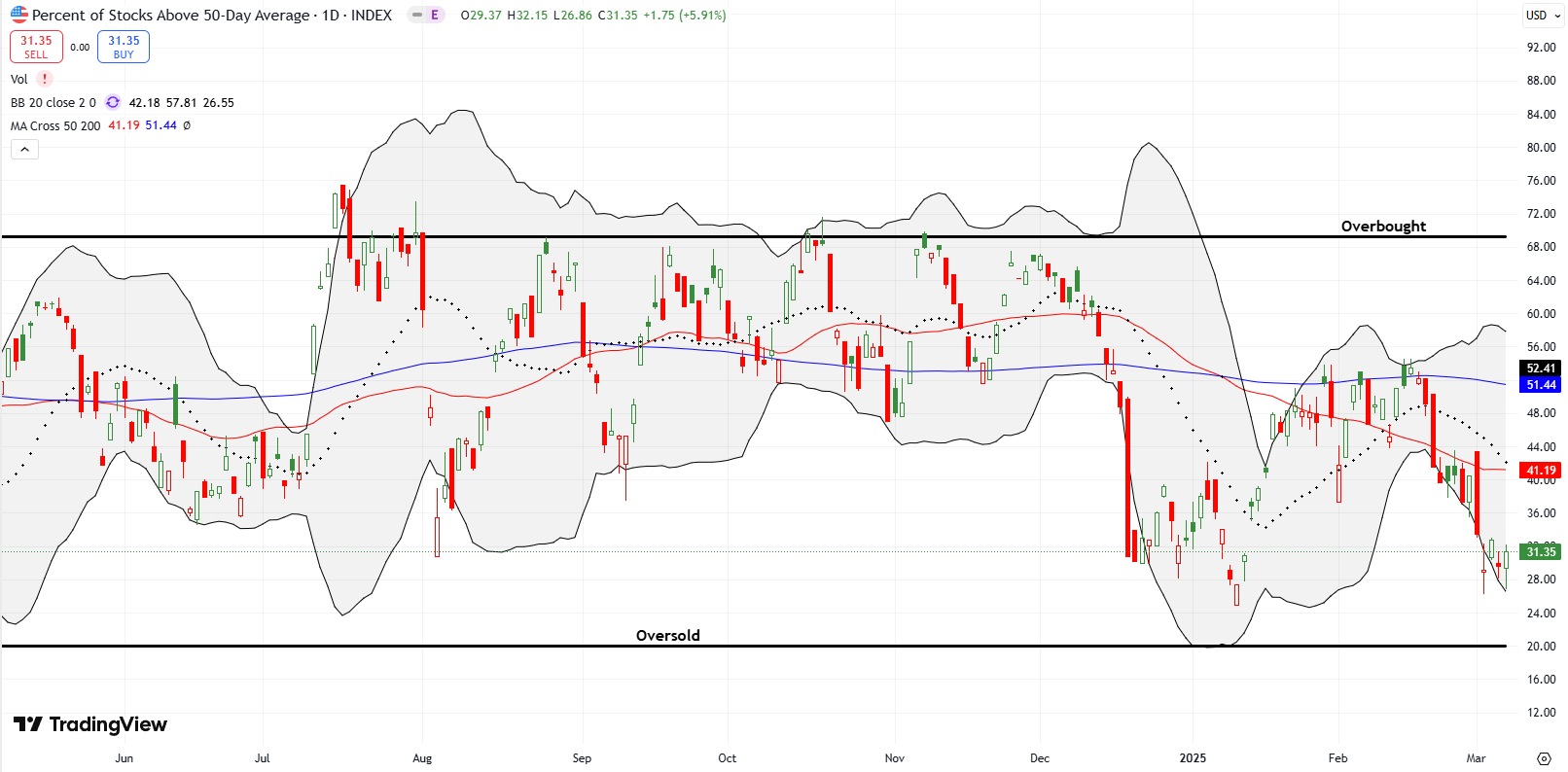

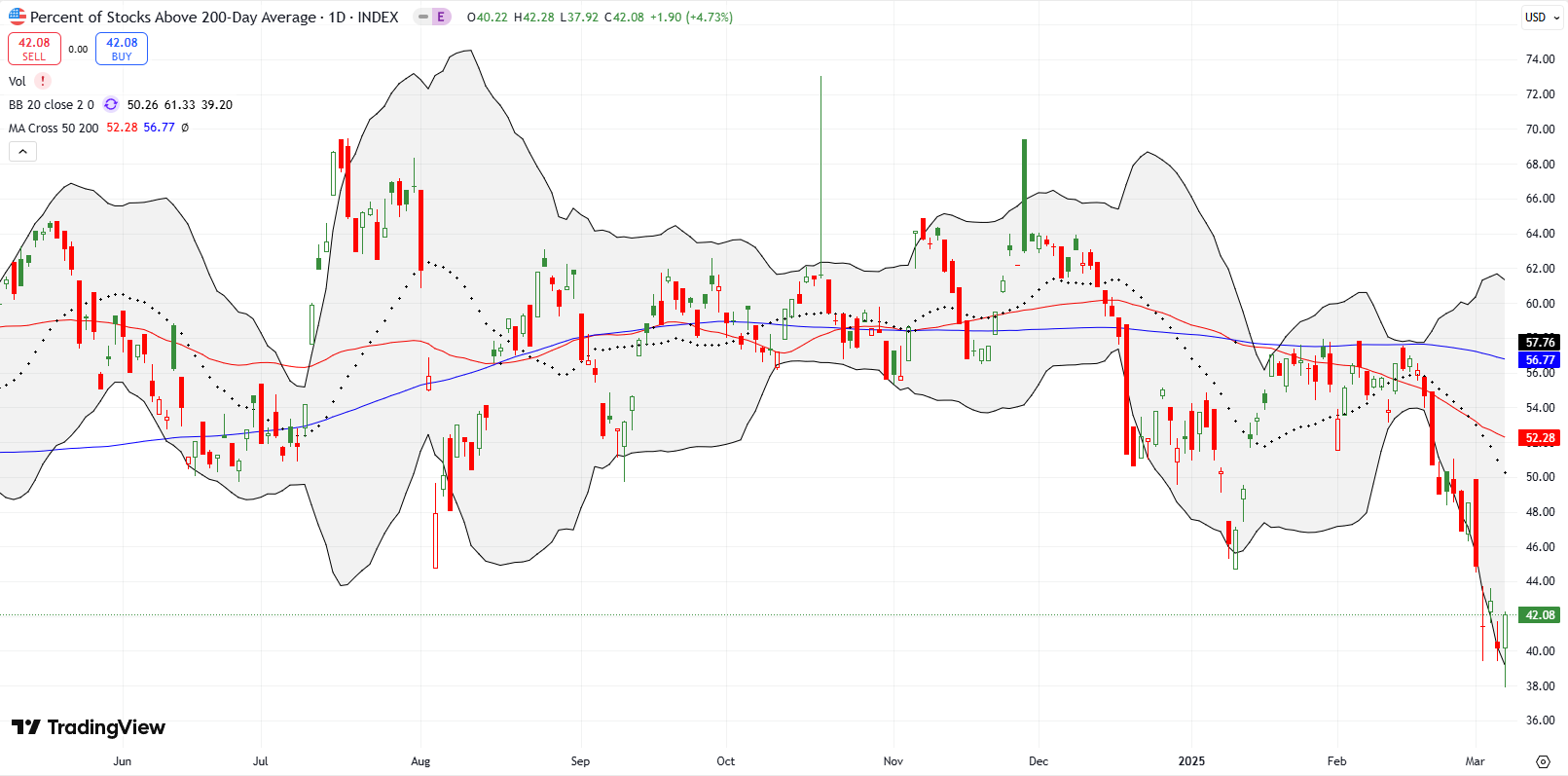

Market breadth is finally expressing this pain through a return to its lows from the last stock market pullback. Thus, I see a stock market that looks like it is “oversold enough.” Still, until the market has fully priced in and accepted the coming potential pain, I also recognize that there remain significant downside risks in the form of a potential bear market.

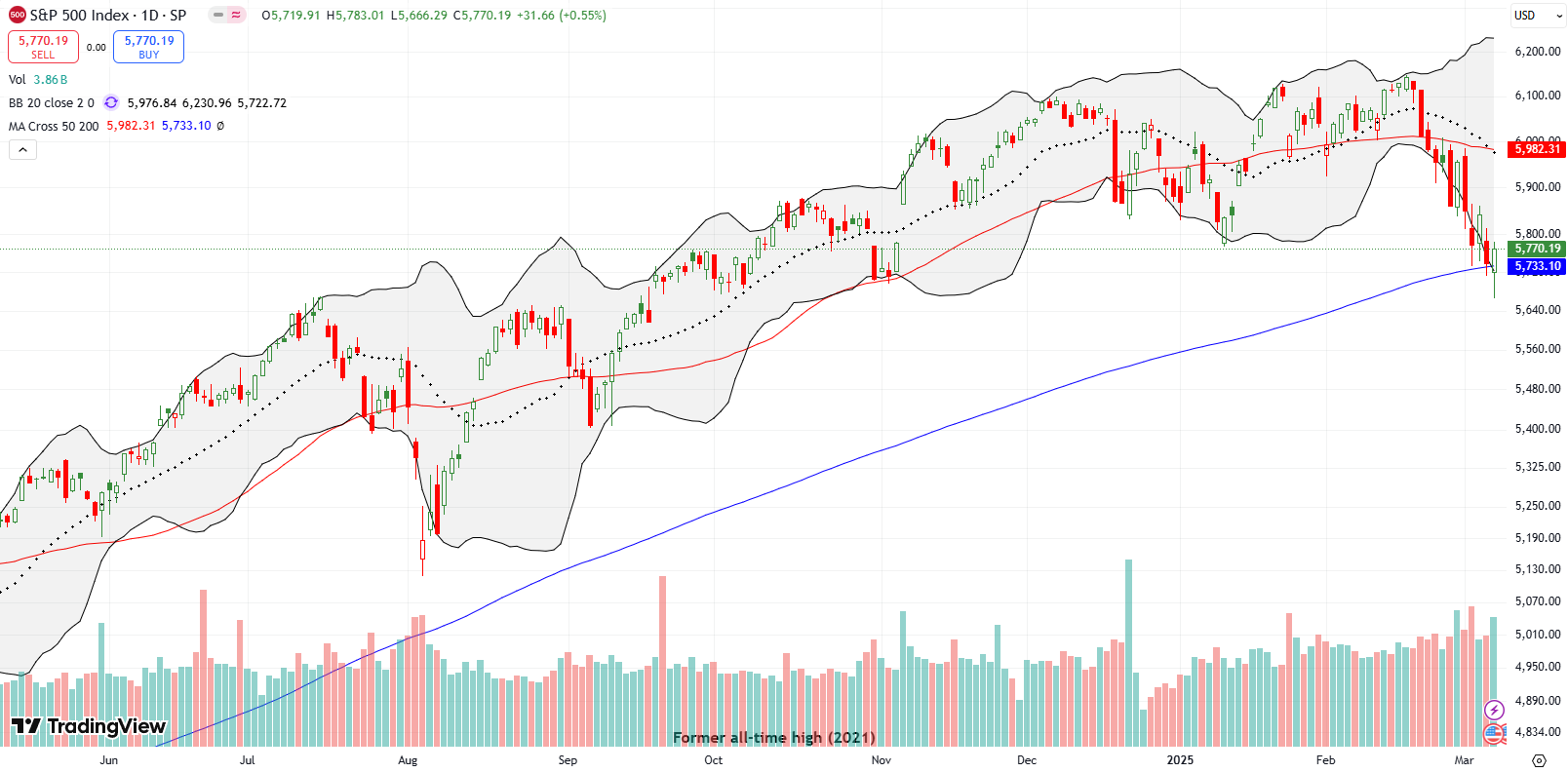

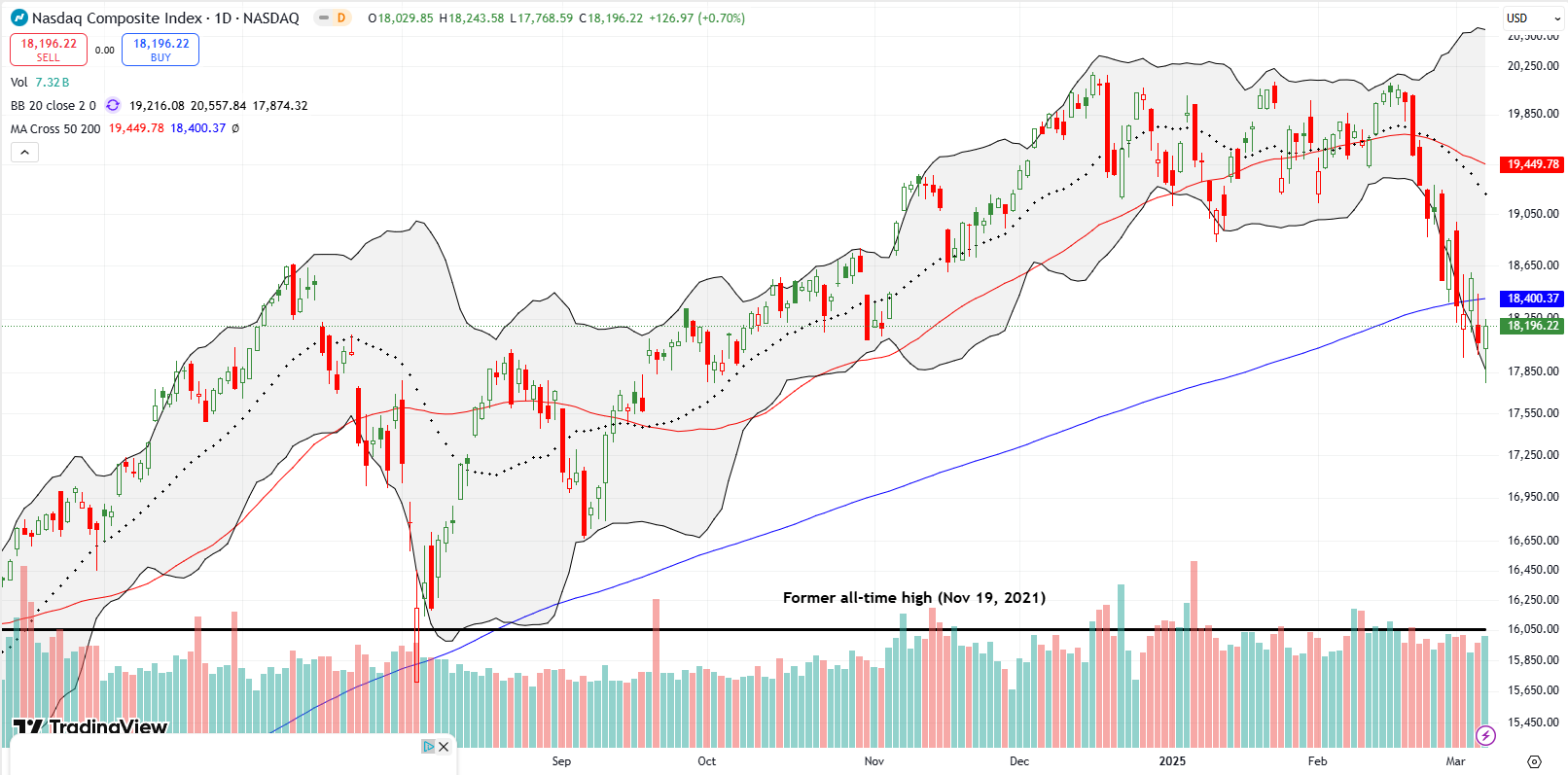

The Stock Market Indices

The S&P 500 (SPY) barely avoided bear market pain by rebounding from a breakdown below support at its 200-day moving average (DMA) (the blue line). Still, buyers have a lot left to prove as the index has fallen nearly straight down since hitting a marginal new all-time high last month. The S&P 500 last closed below its 200DMA in late October and early November. Perhaps more importantly, the index reversed all its post-election gains for the second time…a weakness that flashes bearish overtones after the 50DMA breakdown confirmed a double-top across January and February. Given the S&P 500 is only down 1.9% for the year, a real sell-off would mean the pain is just getting started. I am still holding my SPY March put spread as one of my last hedges, but I will likely take profits this week.

The NASDAQ (COMPQX) twice stopped short of reversing its post-election gains, once last November and again in January. This third dip was not a charm. The tech-laden index sliced through 50DMA support last month on its way to a confirmed 200DMA breakdown last week. The NASDAQ is now in bearish territory just days after reversing all its post-election gains. The index is down 5.8% for the year.

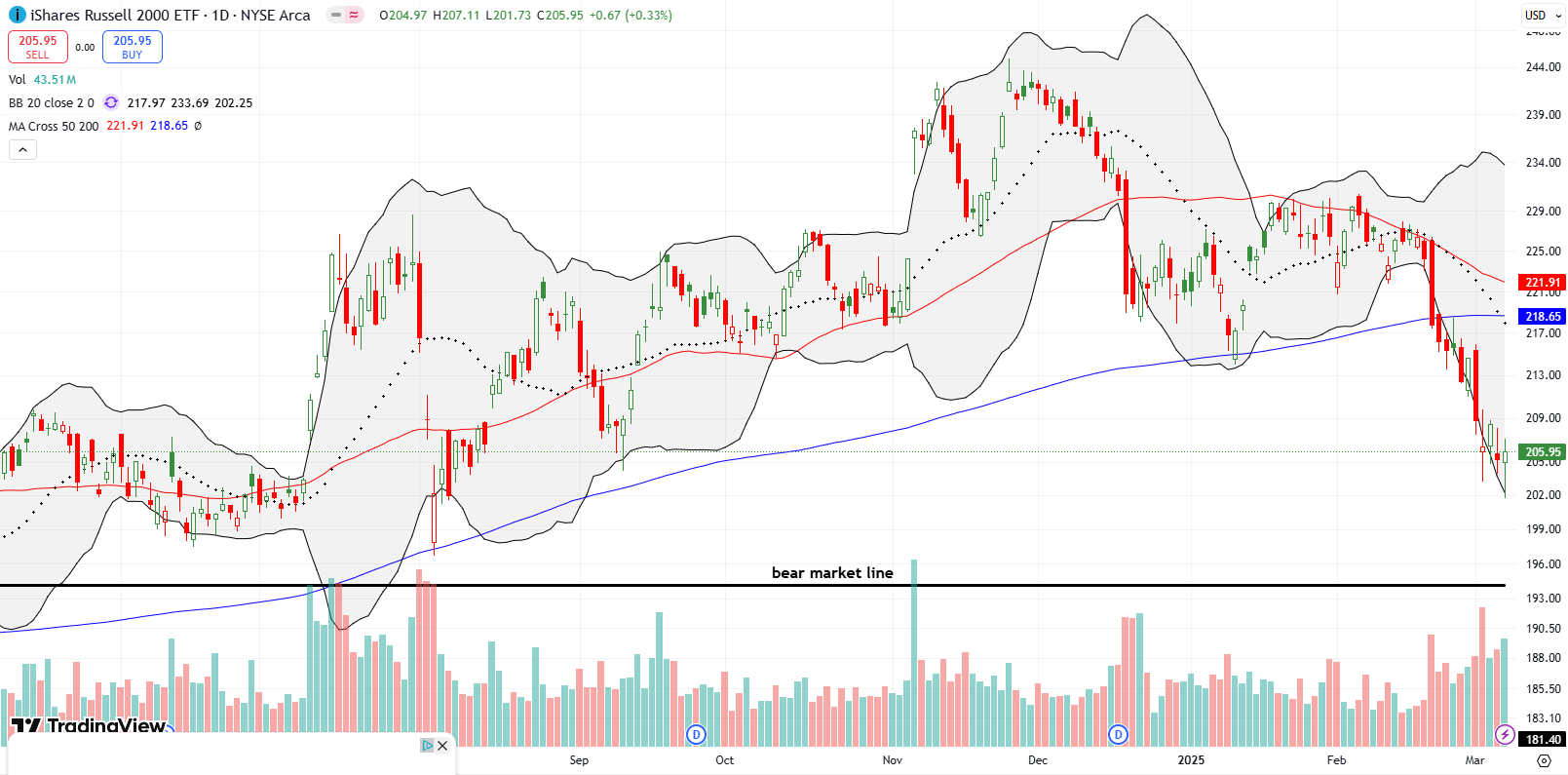

The iShares Russell 2000 ETF (IWM) has been slicing through bearish territory since mid-February. After Monday’s 2.7% decline, IWM gapped down again and stabilized around 7-month closing lows. I once thought the bear market line was forever in the rearview mirror. Now IWM is within another sell-off of a fresh bear market.

The Short-Term Trading Call With the Pain

- AT50 (MMFI) = 31.4% of stocks are trading above their respective 50-day moving averages

- AT200 (MMTH) = 42.1% of stocks are trading above their respective 200-day moving averages

- Short-term Trading Call: cautiously bullish

AT50 (MMFI), the percentage of stocks trading above their respective 50DMAs, closed the week at 31.4%. The oversold threshold sits close by at 20%. However, as I have mentioned in the past, during a bull market, I have learned that the low 30s is often “close enough” to oversold to warrant getting short-term bullish ahead of the trigger in the official trading rules. I made the case for oversold enough last week in a YouTube video. Now, the tricky part is how to execute through on-going volatility and the on-going risk for a lot more downside pain given the growing market headwinds. The charts below represent a small sample of how I am thinking through difficult choices.

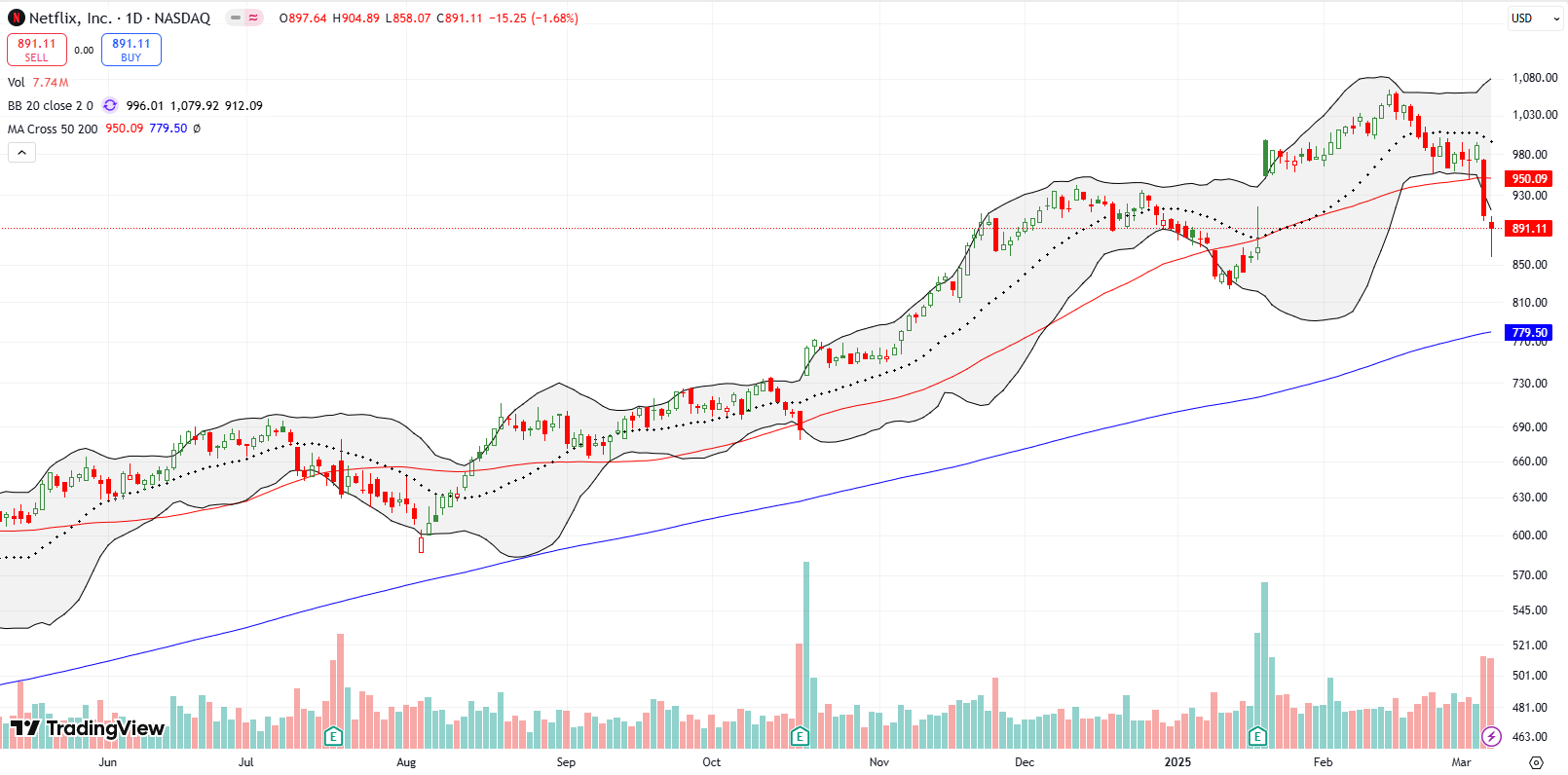

Netflix (NFLX) was a relatively safe place to hide until it wasn’t. On Thursday, NFLX plunged 8.5% on no news. Thus, I figured NFLX could be the proverbial last general to get shot before a bottom finally occurs. In other words, traders and investors try to hold their winners as long as they can before giving in to selling pains in the market. When a general like NFLX falls, it can signal the last wave of selling that leads to selling exhaustion. Unfortunately, I got a little too cute trading this idea by buying a call option that expired the very next day.

Instead of sharply rebounding, NFLX fell as much as 5.4% on Friday before rebounding to a 1.7% loss. At the lows of the day, NFLX finished reversing all its post-earnings gains (reference the gap up in January). With NFLX also overstretched well below its lower Bollinger Band (BB) (the curved black line), the stock remains on my buy list for a rebound at least to overhead 50DMA resistance. My next trade will wait for a move above Friday’s intraday high.

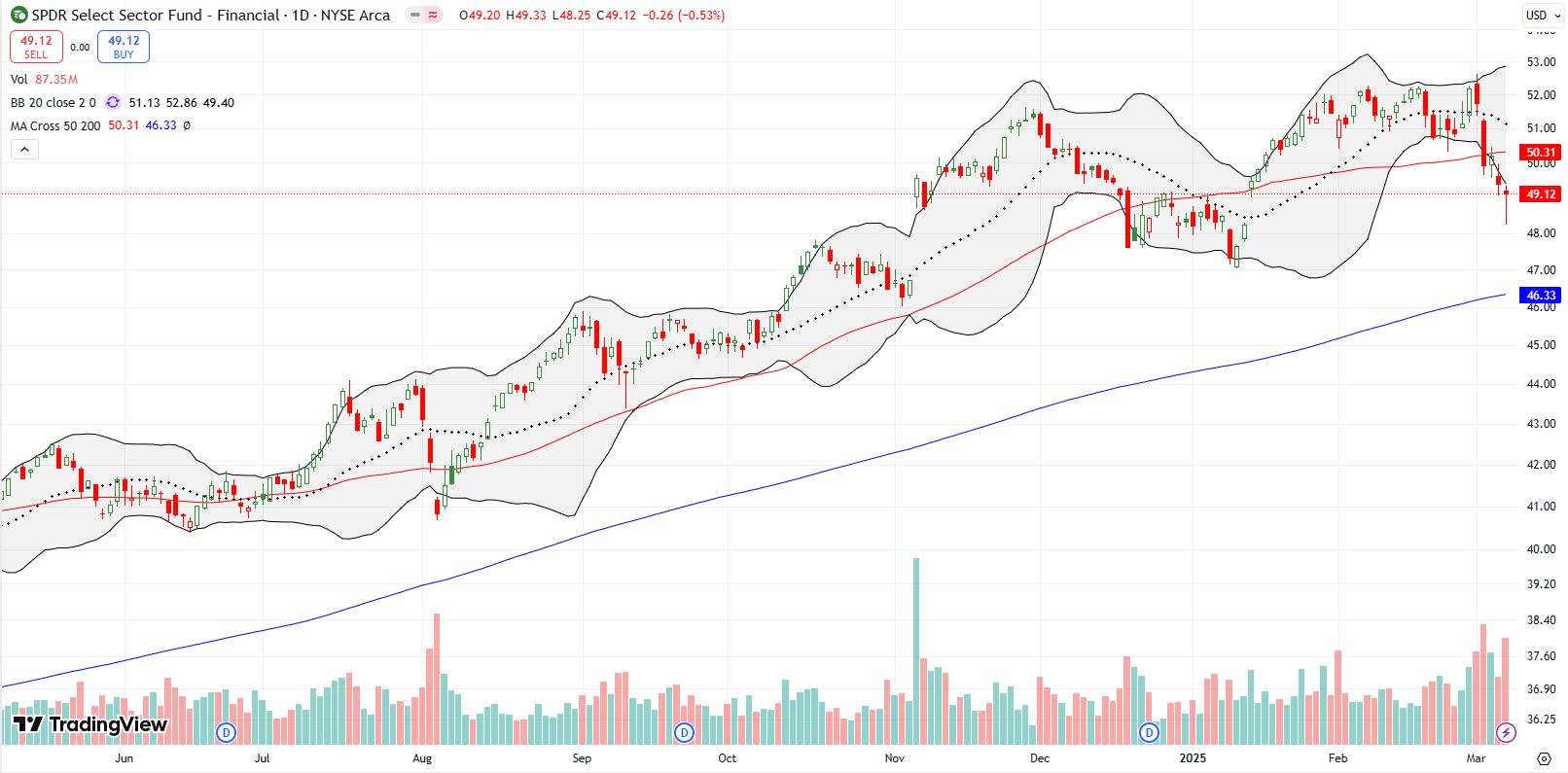

Financials are also latecomers to pain. The SPDR Select Sector Fund – Financial (XLF) fell 4 days out of 5 last week, coming off a challenge of all-time highs. The selling includes a confirmed 50DMA breakdown. Given XLF remains above its last low, the ETF of financials retains a solid uptrend, now supported by its 200DMA.

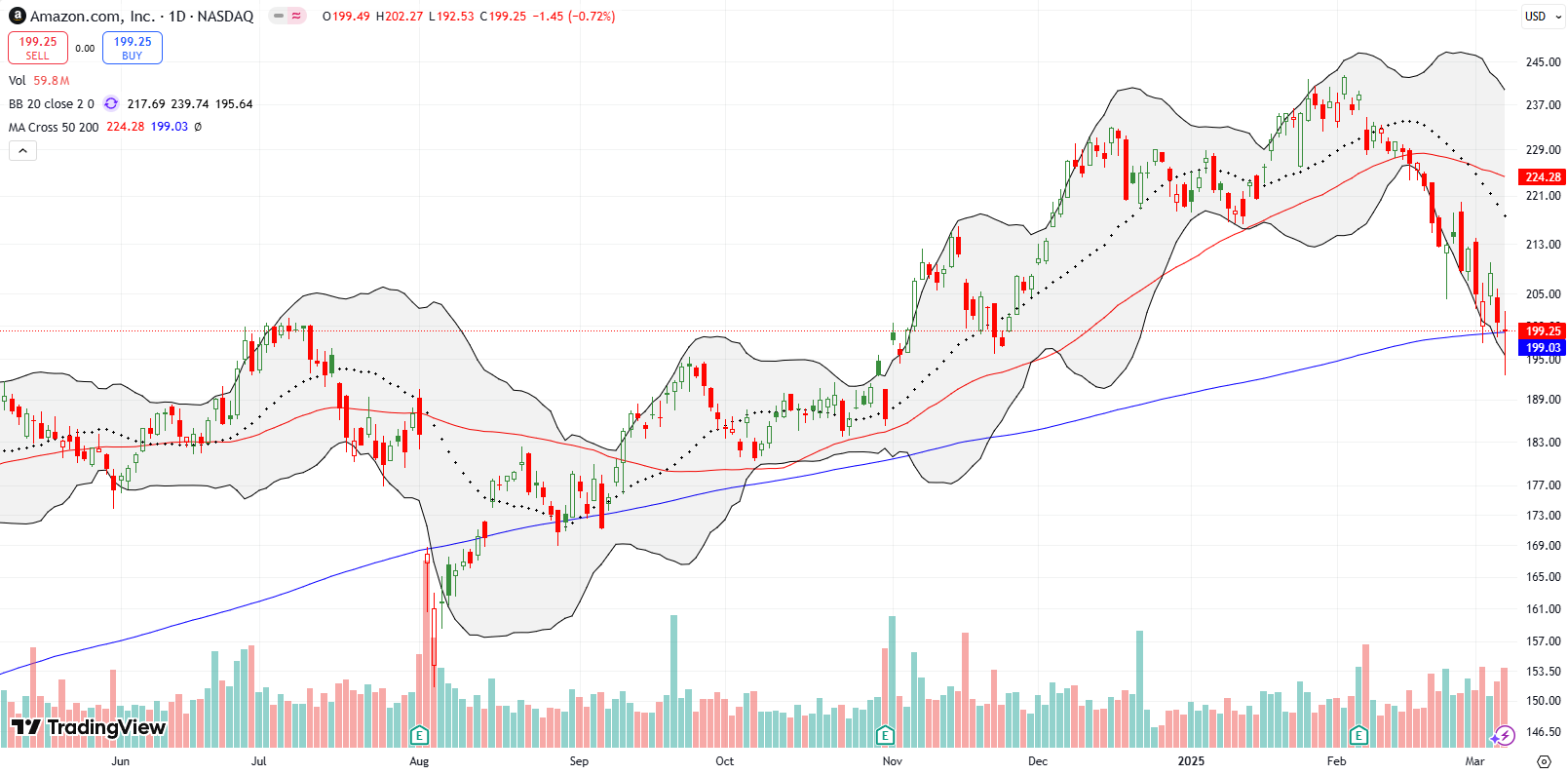

My trade on Amazon.com (AMZN) failed miserably after the stock’s 50DMA provided no support. I dared to try again as AMZN clings to 200DMA support. I bought a weekly $205/$215 call spread as a play on a rebound. Needless to say, if AMZN confirms a 200DMA breakdown (with two lower closes), then the stock stumbles its way into bearish territory. Note that AMZN is already down 17.7% from its all-time high, so it is definitely teetering on a stock-specific bear market.

Cybersecurity software company Okta, Inc (OKTA) was my rare big winner of the week. I took a chance on OKTA as it pulled back from its December post-earnings pop. I did not wait for a test of 50DMA support or a 200DMA breakout, and I lucked out with both events. Ahead of earnings, I even dared to hang on to my remaining profits as OKTA battled with 50DMA support ahead of earnings. I quickly took profits in the after hours at $101. Given I felt fortunate after taking so many risks, I did not feel a single tinge of regret as OKTA soared in regular trading to $108.31 and then $116.31 the next day (full disclosure: my daughter still holds the stock in her paper trading account for a contest in her economics class – she failed to sell it on Friday as instructed!).

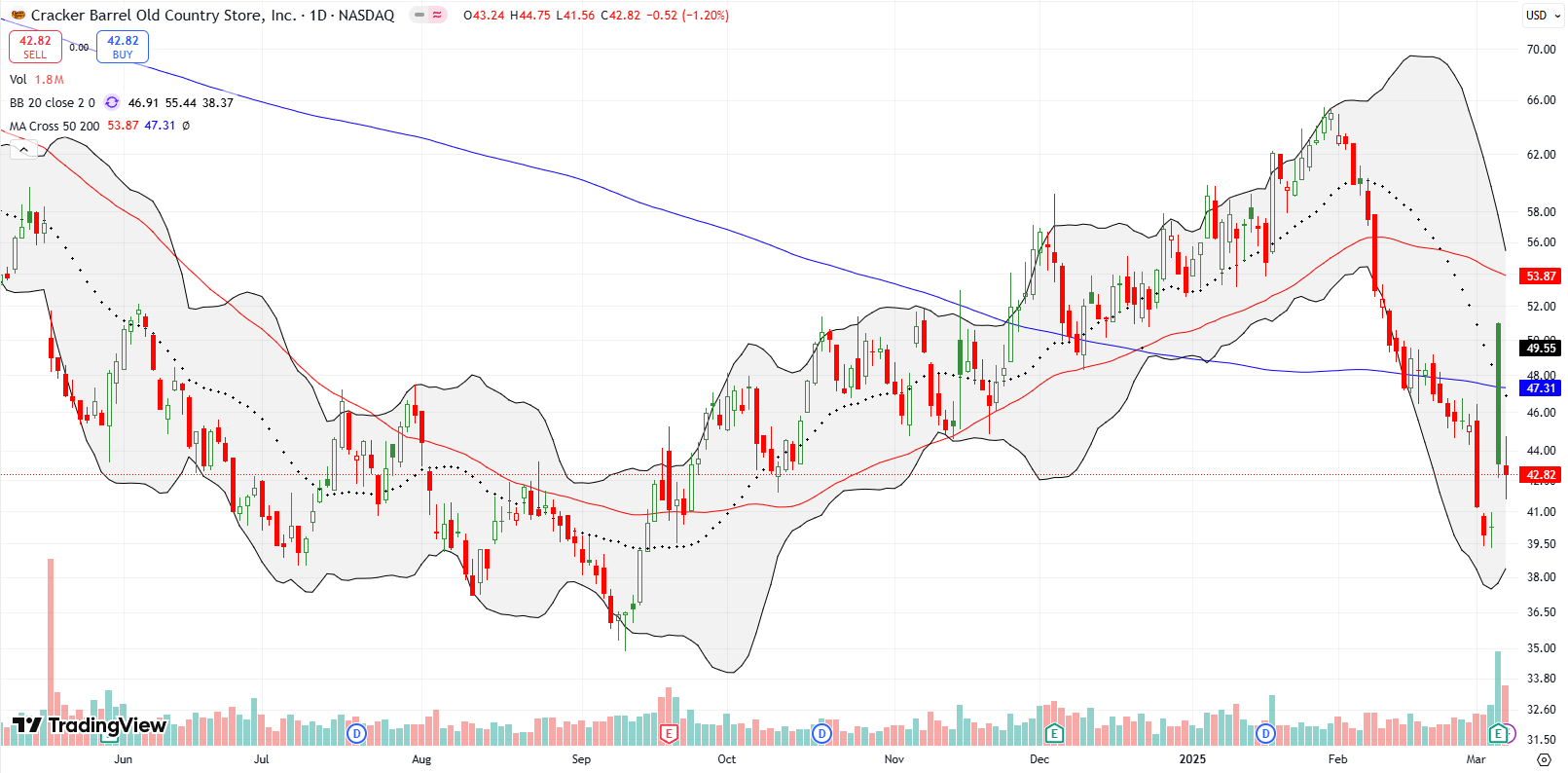

Cracker Barrel Old Country Store, Inc (CBRL) is another post-earnings winner where I felt fortunate to extract profits. In December, I celebrated a timely reentry into CBRL as a turn-around stock. I felt like a genius for two more months. A steep slide through 50DMA support did not deter me, but a 200DMA breakdown definitely should have taken me out of CBRL. Not too differently from OKTA, I lucked out post-earnings with CBRL as the stock gapped above its 200DMA. I immediately took profits. In due time, sellers returned CBRL to a 200DMA breakdown. Consumer discretionary stocks are taking large hits, especially stocks reliant on leisure expenditures. With the market starting to anticipate significant pain for consumers, I am unlikely to return to CBRL for a while.

Credo Technology Group Holding Ltd (CRDO) provides various high-speed connectivity solutions for optical and electrical Ethernet applications (per Seeking Alpha). In December, CRDO soared an amazing 47.9% post-earnings only to lose much of those gains in a 30.9% plunge and 50DMA breakdown on DeepSeek fears. A swift rebound reversed those losses only to have sellers subsequently do even more damage. A the end of last week, CRDO suffered a 200DMA breakdown and closed at a near 4-month low. As with most stocks at this oversold enough juncture, I am looking to buy CRDO on a close above the 200DMA for a rebound at least to 50DMA resistance.

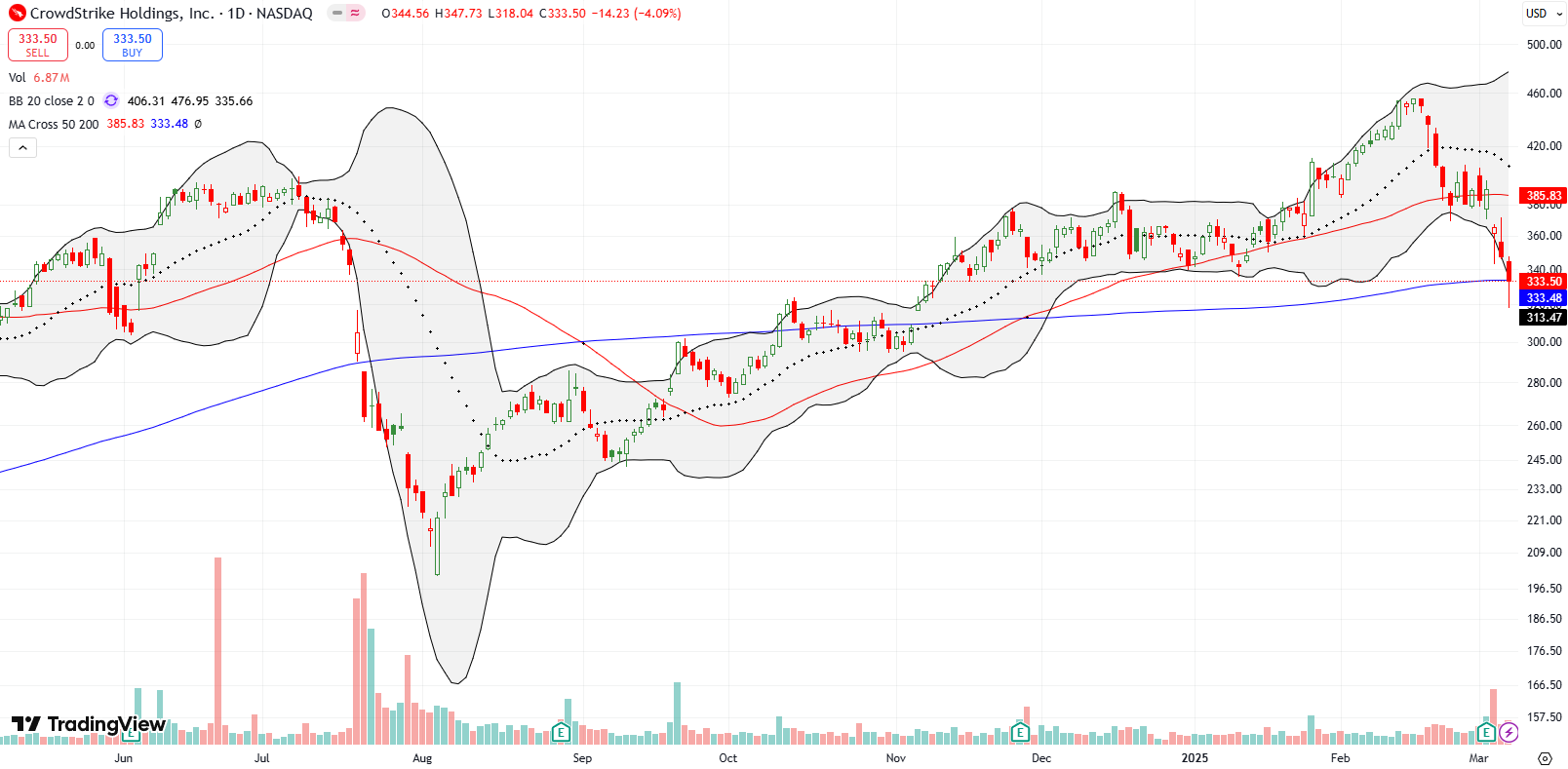

The amazing recovery in Crowdstrike Holdings, Inc (CRWD) came to an end last month. Support at its 50DMA held for 7 trading days until earnings drove a 6.3% loss. Sellers followed through from there to test and barely hold 200DMA support. Suddenly, CRWD is down 26.7% from its all-time high set last month.

CRWD’s test of 200DMA support is doubly important. Note how the stock also sits right at the bottom of the consolidation period that set up the final run to a breakout and all-time high. If this support fails, CRWD will confirm a bear period and could continue selling off for quite some time. Otherwise, like other tests of 200DMA support, a higher close will have me expect a rebound at least to 50DMA resistance.

Vistra Corp (VST) is a highly charged utility that has planted itself in the middle of the AI data center frenzy. That positioning is why the DeepSeek scare took down VST by 28.3%. A 12.3% post-earnings loss confirmed the end of momentum for VST. Last week, sellers followed through with a marginal confirmation of a 200DMA breakdown. The stock looks topped out for now. However, of course, if VST manages to recover 200DMA support, the stock will be an interesting prospect to play for a rebound to 50DMA resistance.

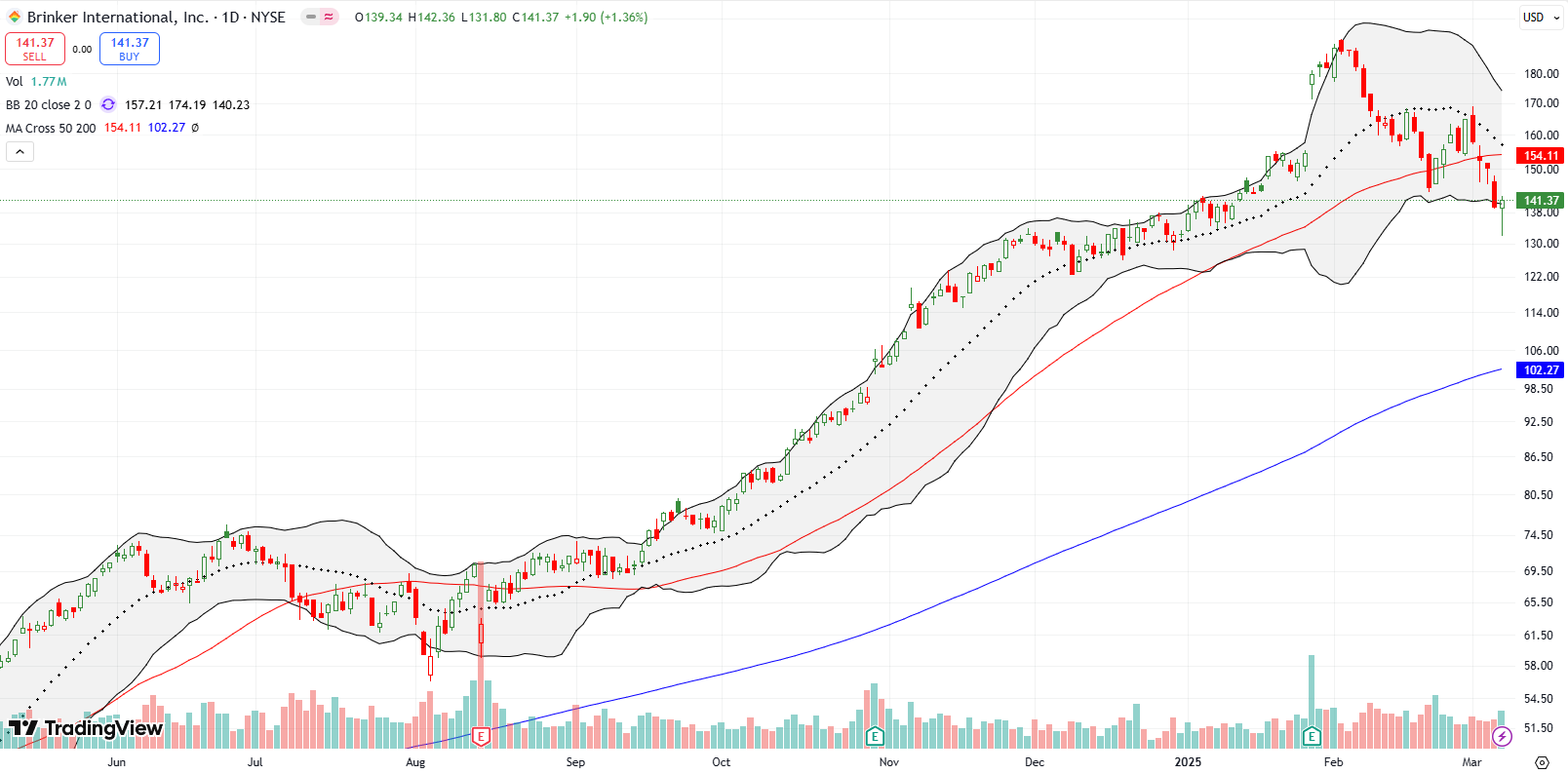

Late last month I made the case for a $135/$120 put spread on Brinker International, Inc (EAT). EAT promptly rebounded from its 50DMA breakdown but ran into a brick wall at declining 20DMA resistance (the dotted line). As EAT extended well below its lower BB on Friday, I took profits as part of my reduction in bearish bets in this oversold enough period. I still think EAT is in trouble as a high-flyer in a troubled sector that is falling out of favor in the current environment of economic uncertainty, chaos, and pain.

Be careful out there!

Footnotes

Subscribe for free to get email notifications of future posts!

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #307 over 20%, Day #28 over 30% (overperiod), Day #5 under 40% (underperiod), Day #17 under 50%, Day #44 under 60%, Day #145 under 70%

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long SPY put spread, long IWM calls, long AMZN call spread

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, BlueSky, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.