I used the Google Trends Momentum Check (GTMC) for gold as a relatively reliable indicator for trading sentiment on the precious metal until around 2016. After that year, Google trends for the term “gold” essentially flatlined. When gold went parabolic to start 2022, the GTMC for “gold” failed to trigger. The extremes in search interest stopped materializing along with extremes in price. When gold went parabolic in the first few months of the massive injection of liquidity into the COVID-19 economy, Google search yawns greeted the inevitable peak (August, 2020). However, it turns out I needed to shift my gaze about 90 degrees. Thanks to a closing note from Marketplace’s April 24th broadcast, I learned that the GTMC for gold may have shifted to a new search term: “how to buy gold.”

“How to Buy Gold” As An Indicator of Gold Sentiment

As a reminder, the GTMC works inversely to price action at the extremes. When search interest reaches an extreme in parallel with an extreme in price action, then sentiment in the direction of the price action is also at an extreme. Whether the extreme is high or low, I anticipate some kind of reversal. In the most extreme cases, this reversal marks the end of the price direction, a lasting top or a bottom.

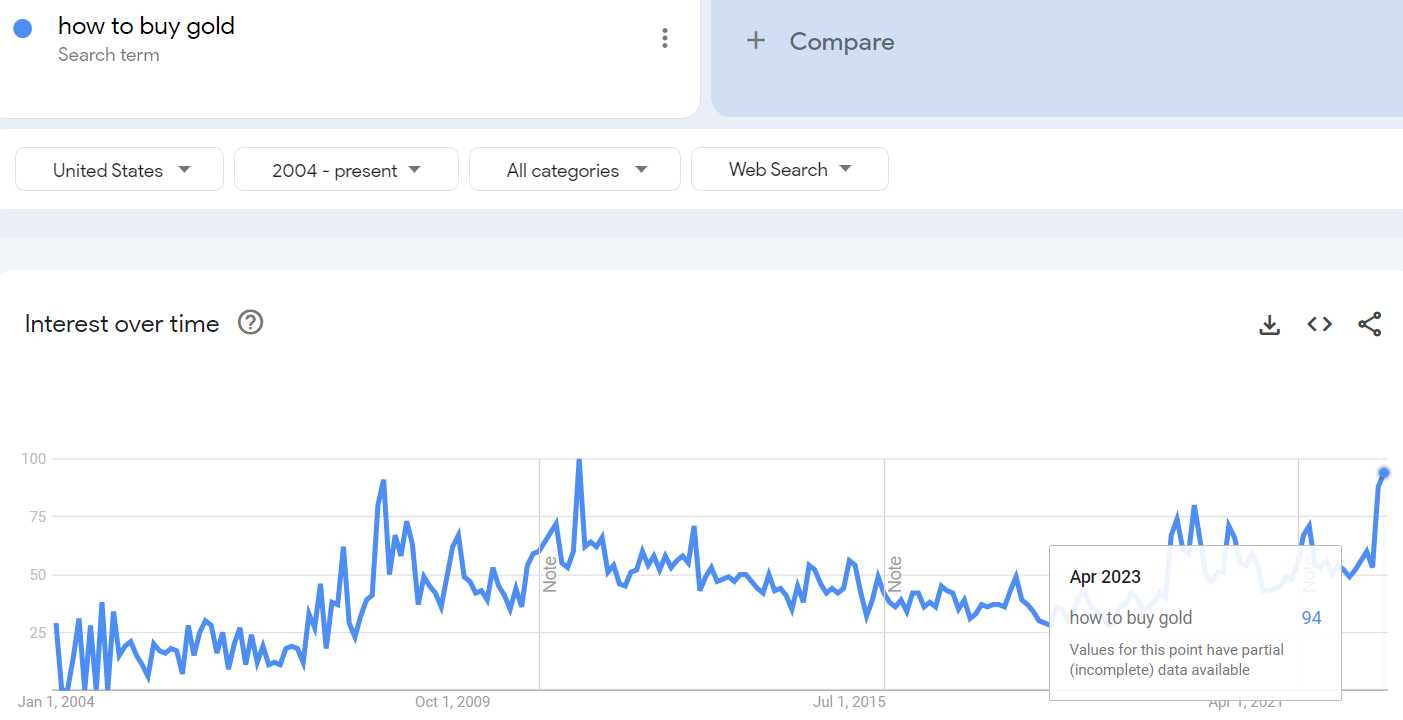

U.S. google searches on the term “how to buy gold” index higher, so far, than any other month on record except for August, 2011. At that time, gold soared to a high that, you guessed it, gold did not surpass until the 2020 peak. The surge in gold during the financial crisis created the 3rd highest peak in Google search interest.

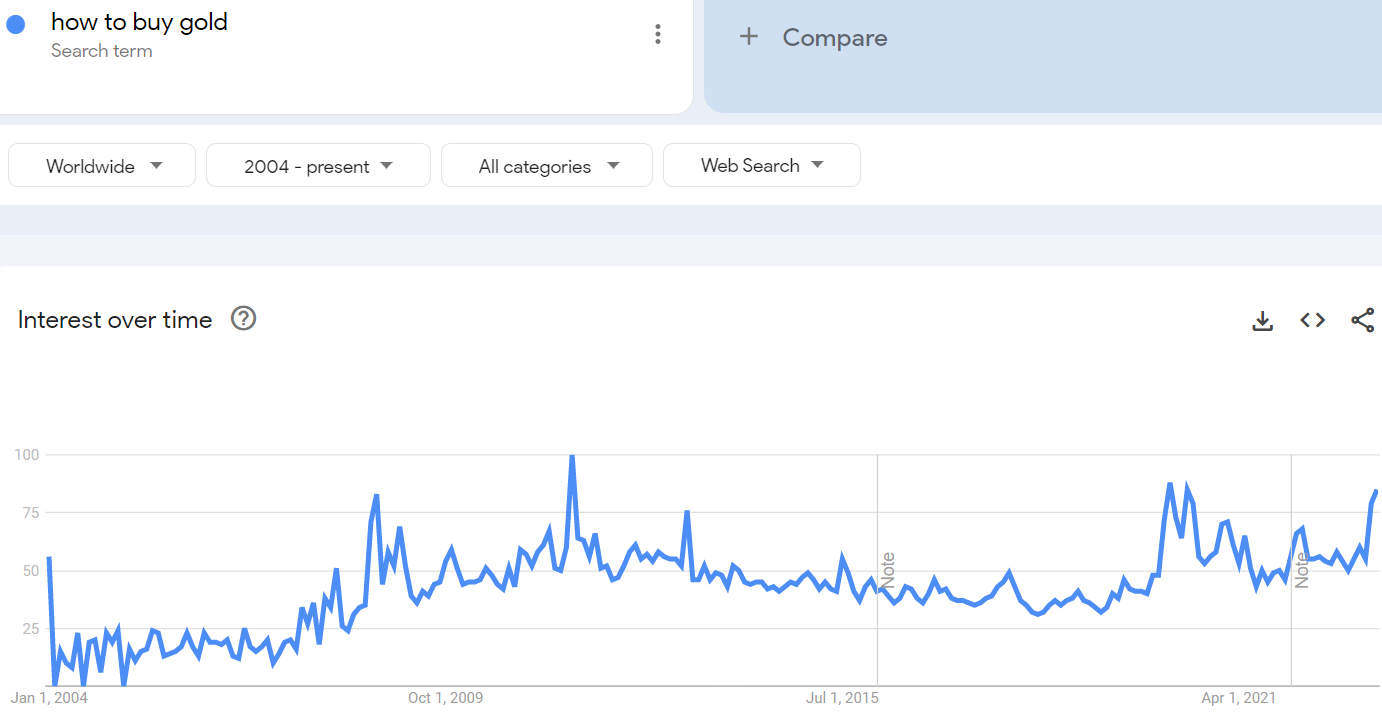

Interestingly, the peak for worldwide searches has not yet surpassed the pandemic era peak. Still, the surge is extreme and indicates an abrupt magnification of bullish sentiment on gold.

Whether the U.S. or worldwide, the GTMC for “how to buy gold” showed enough of a spike in January to flag an imminent top for gold’s parabolic move at that time.

While I am encouraged by this revival of GTMC for the gold trade, I am slightly wary of the large difference in the indices for the two Google search phrases. The amount of searches on “how to buy gold” are significantly smaller than “gold”. On an overlay of the two indices, “how to buy gold” does not even appear. Fortunately, “how to buy gold” is more meaningful and more directly related to the trade in gold. In fact, the related topics and related queries for “how to buy gold” are more gold-related than the search on “gold”.

The Trade

The exact peak in US search interest for “how to buy gold” occurred on April 2nd. The daily view shows that peak. That day was a Sunday. Two trading days later, the SPDR Gold Shares (GLD) surged 1.9%. Six more trading days later, GLD gapped up with a 1.4% gain that transformed into an abandoned baby top. According to the GMTC, this proximity is enough to signal some kind of top for GLD.

While GLD likely printed a top, I doubt we have seen THE top for gold. I sold half of my GLD call spreads into the gap up, but I held the other half. Going forward, I will of course keep a close eye on the new indicator of gold sentiment for further trading clues when prices next reach an extreme.

Be careful out there!

Full disclosure: long GLD, long GLD call spread

Interesting conceptual difference. I agree “how to buy” is a more precise measure of relevant interest than “gold”. Also maybe good: “how to trade”.

You might ask “Bard” the best way to use Google Trends to find peaks in interest in gold trading…

You’re talking my language! All sorts of possibilities with generative AI to help find the best search trends…