After presenting my conditions for bottoming across the collection of ARK funds, the funds suffered a serious setback in the bottoming process. Some funds hit new lows and others cracked critical support levels. The stock market’s rebound from oversold conditions helped turn the tide and sentiment on the ARK funds. Interestingly, performance relative to key technical levels is subtly diverging. These variations imply that successful bottom-fishing requires a selective lens despite the strong positive correlations across these speculative ETFs. In this post, I update the technical outlook and reset the conditions for making trades.

While Wood’s macro-economic and micro-economic commentaries are interesting reference points, I continue to observe that these academic studies and forecasts are nearly irrelevant to performance. Sentiment looks like the key driver. When the market is risk-on, ARK funds soar. When the market is risk-off, ARK funds sell-off. In the current worst case scenarios, they collapse. For today’s market, these risk attitudes closely follow the words and monetary policies of the U.S. Federal Reserve. This cycle of monetary tightening takes money out the market that might otherwise chase speculative stocks. Higher interest rates force investors to care about valuations and profitability; valuations for speculative stocks run exceptionally high in risk-on environments and few care about (current) profitability. Fears of a looming recession scare off all but the most speculative investors and traders.

No Capitulation Coming

Note well that traditional measures of capitulation used for measuring bottoming processes do not apply to the ARK funds. Cathie Wood and team clearly will remain committed to their portfolios and philosophies no matter what happens on the ground. Their rolling 5-year investment horizons facilitate an unending and nearly boundless optimism about the future. By extension, fans and acolytes of ARK keep buying the funds all the way down just as the portfolio managers continue accumulating their battered and bruised stocks. For example, Markets Insider reports that investors poured a net $1.3B into ARK Innovation ETF (ARKK) through May 10th despite losing 58% from the beginning of the year. Earlier this month, VettaFi reported that ARKK enjoyed a net cash infusion of $568M with year-to-that-date net inflows of $1.5B. ARK managed $28.1B in assets at its peak last year. However, now those assets are only worth $9.1B. In other words, bottom-fishing in ARK will not likely pivot around capitulation. Instead, other technicals and risk attitudes loom largest.

The Levels

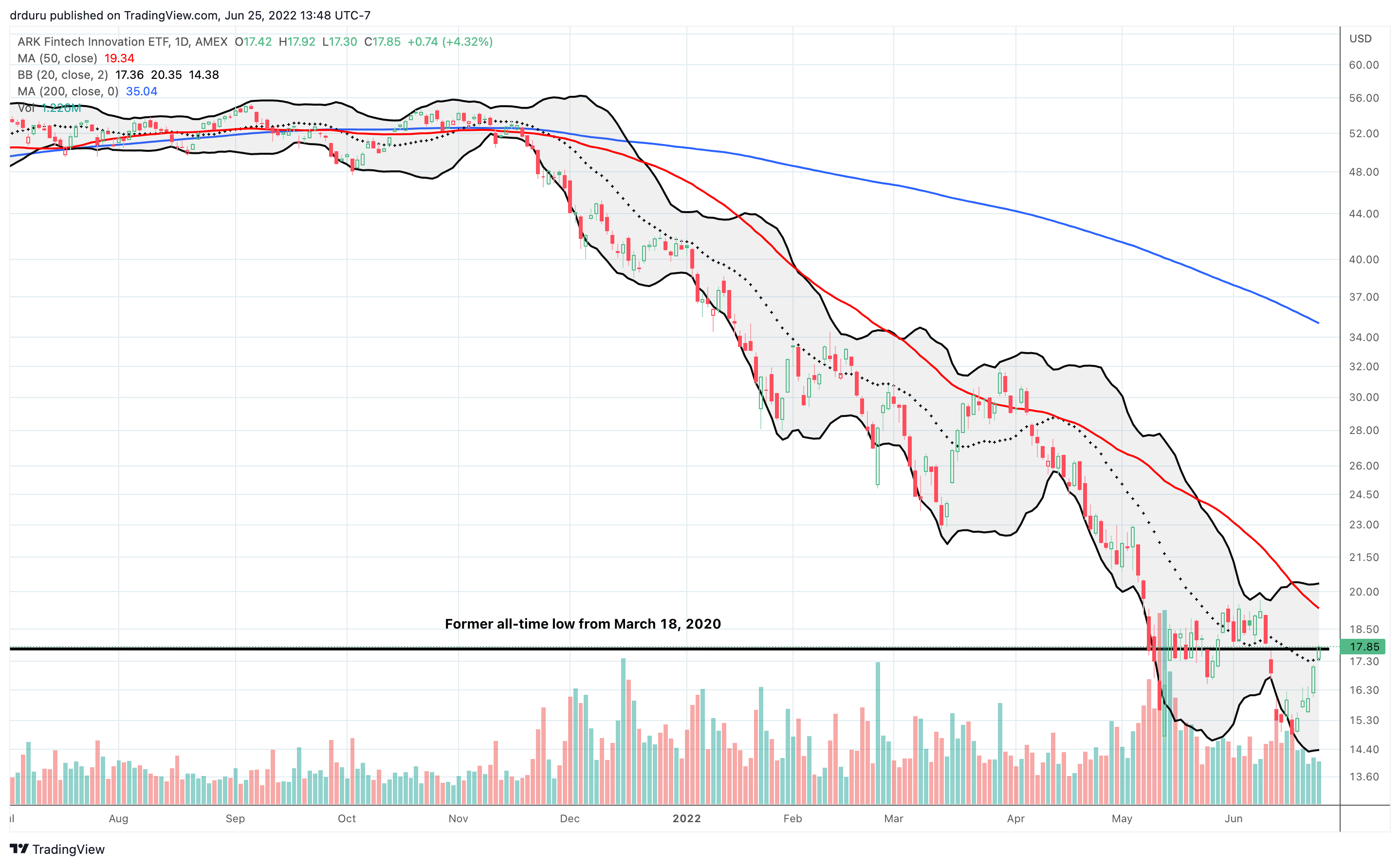

ARK Fintech Innovation ETF (ARKF)

ARKF hit all-time lows in June and removed itself from my signals for the bottoming process. Still, I loaded up on ARKF call options into the sell-off for one more round. I took profits as ARKF rallied into its 20-day moving average (DMA) (the dotted line below). I will now leave ARKF alone until/unless it breaks out above the June highs and then the declining 50DMA (the red line below). A fresh sell-off could spell trouble for ARKF with a heightened risk of fresh all-time lows. ARKF is now a no-touch until a breakout confirms a bottoming process.

ARK Genomic Revolution ETF (ARKG)

ARKG is in better shape than ARKF and has become a higher priority focus of my attention. While ARKG did not quite test its pandemic low in May or June, I will give ARKG a pass for a bottoming process if it breaks out above the pre-pandemic high. Currently, ARKG made its first bullish move with a new high for June and a 50DMA breakout. I am now waiting on ARKG to extend this bullish sentiment.

ARK Innovation ETF (ARKK)

Cathie Wood was fond of pointing out ARK’s strong performance relative to the pandemic lows. She rightfully takes pride in steering her funds through the period with enduring optimism. The Fed’s rush of liquidity into the financial system sealed the deal. However, those bragging rights are long gone after ARK bounced off its pandemic low on an intraday basis in May. In June, ARK bounced with the market without printing a retest of the pandemic low. Still, I consider the close encounter to be “good enough” for a double-bottom pattern. Now I wait to see whether ARK can push beyond its June high and declining 50DMA for a confirmation. From there, ARK provides a LOT of potential upside for a test of the pre-pandemic high. My hedge of ARK July puts are naturally dwindling in value, but I look forward to chasing a bullish breakout.

ARK Autonomous Technology & Robotics ETF (ARKQ)

The ARK Autonomous Technology & Robotics ETF (ARKQ) delivered an impressive double bottom at its May, 2022 closing low. If not for the poor risk environment along with lingering overhead resistance, I would flip bullish on ARKQ here. Instead, I remain short shares (as a hedge). I look forward to flipping bullish on a breakout above the 50DMA and the June high. ARKQ has tremendous upside from there to its 200DMA resistance. In other words, I am in no rush to chase ARKQ here. I am looking for more technical clarity.

ARK Next Generation Internet ETF (ARKW)

The ARK Next Generation Internet ETF (ARKW) diverged subtly from the technicals for ARKK. ARKW never tested its pandemic low and remains below both the June high and declining 50DMA. ARKW is off the focus list for now in favor of ARKK.

ARK Space Exploration & Innovation ETF (ARKX)

The ARK Space Exploration & Innovation ETF (ARKX) is still a no-touch. ARKX printed an all-time low earlier this month. Unfortunately, this negative milestone means no bottoming pattern is in play. Moreover, ARKX is still far away from its declining 50DMA which defines the downtrends for most ARK funds.

The Trade

In summary, I am now bullish on ARKG and ARKK although I await further technical confirmations of the fresh risk-on sentiment. I have no interest in ARKX. I am awaiting further technical developments in ARKQ and ARKW before making a judgement (at least I am no longer bearish). The Federal Reserve’s monetary policy looms large over all these funds. Financial markets are finally taking the Fed’s aggressive monetary tightening seriously. Accordingly, if the Fed remains as hawkish as ever in the July policy meeting, I fully expect all the ARK funds to sell-off sharply. Recall that Cathie Wood’s key short-term outlook relies on the Fed crying uncle next month on recession risks and lower inflationary pressures. Wood expects and NEEDS the Fed to back down on its hawkishness. Right now, the market is showing hints of anticipating this risk-on scenario. Accordingly, a July Fed disappointment could create big losses for the ARK collection.

Finally, here is why the 50DMA and pre-pandemic highs carry such large technical weight for ARK. All the ARK funds have declining 50DMAs, so they define months long downtrends. A confirmed breakout above these trend lines defines an end to those downtrends and a freshly bullish phase in trading. The pre-pandemic highs retain importance as key signals of renewed investor interest in the underlying stocks of these funds. Hurtling that line of resistance will define the end of the deepest of negative sentiment that took ARK down to or near the pandemic lows this year. Alternatively, price failures at these lines of resistance send the risks of fresh downside soaring. Keep an eye on market breadth for clues on the unfolding technical context.

Be careful out there!

Full disclosure: short ARKQ, long ARKK puts