Redfin Corporation (RDFN) joined a slowly growing list of companies announcing layoffs. In a heartfelt blog post, CEO Glenn Kelman explained “I’m sorry we can’t keep our commitment to you. With May demand 17% below expectations, we don’t have enough work for our agents and support staff, and fewer sales leaves us with less money for headquarters projects”. This plunge in demand represents a sharp swing in fortunes from the stimulus-driven housing mania that erupted after the pandemic began. At the time, Redfin had to scramble to keep up with demand. Again from Kelman: “When we were turning away tens of thousands of customers in 2020 and 2021, we had to hire a thousand employees a month to catch up, requiring berserk levels of recruiting, training and licensing”. This whipsaw in the business correlates directly with a sharp swing in interest rates.

When the Fed rushed emergency monetary measures into the economy, interest rates plunged and mortgage rates plunged along with it. Now, the Fed’s push to normalize monetary policy has forced the market to quickly price in a large jump in future interest rates. The chart below overlays iShares 20+ Year Treasury Bond ETF (TLT) with RDFN to show the close relationship. TLT is the dark purple line. TLT increases when interest rates decrease. The RDFN price chart is the red and green candlestick chart. The moving average lines apply to RDFN.

The Interest Rate Whipsaw

So far, as a stock, RDFN has proven heavily tied to easy monetary policies. For example, until the Fed moved to make a “mid-cycle” adjustment in monetary policy in August, 2019, RDFN’s stock was trading in a downward sloping price range. RDFN, along with the housing market and the stock market in general, took off starting the next month. RDFN even went parabolic just weeks ahead of the pandemic. The rush back into RDFN started after the stock market collapse. This whipsaw was the prelude to the mania that Kelman described as making operating conditions tough to the upside. RDFN peaked as TLT experienced its first major pandemic era correction. RDFN’s path downward has accompanied TLT all year in 2022.

Now RDFN must figure out how to turn things around during an entrenched housing downturn. Kelman predicts that “we could be facing years, not months, of fewer home sales”. With the stock at all-time lows, one would hope the worst outcomes are already priced into the stock. Unfortunately, there are no near-term catalysts to fuel a turn-around. If such hope existed, Kelman would not have felt compelled to break its commitment to employees “twice now in three years”.

The Trade

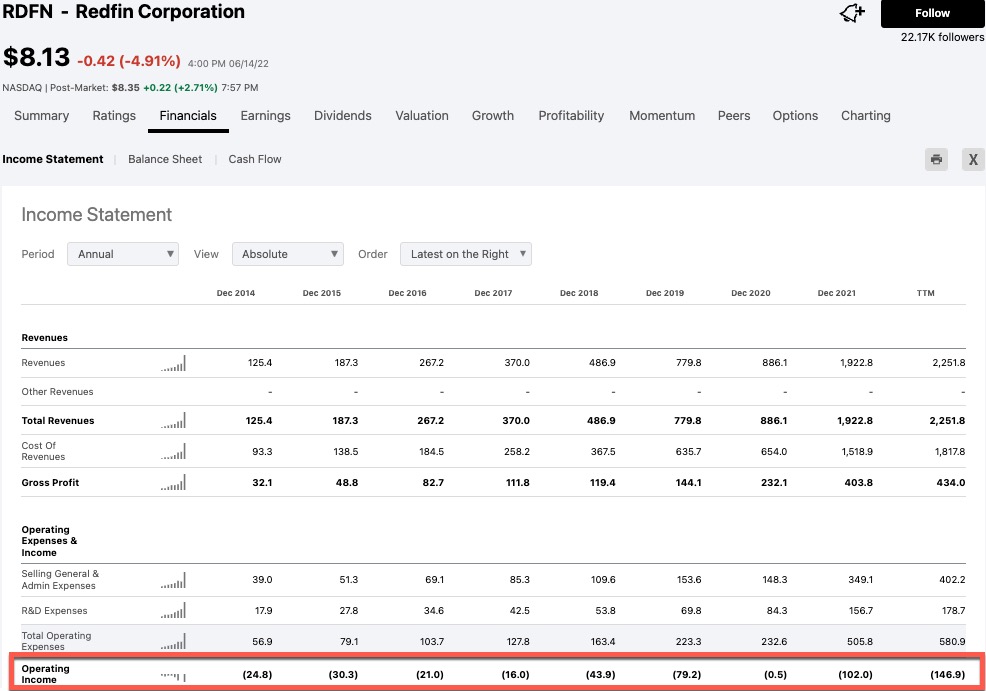

Interest rates must at least stabilize to help RDFN bottom. The rebuilding will take a more favorable interest rate environment. As long as rates continue rising (TLT declining), investors will expect a worsening future for RDFN. Until the trend ends, there is little point in contemplating buying this stock that has become incredibly cheap at 0.5 times sales. Another potential turning point could come when the company finally figures out how to run a profitable business; Redfin’s annual operating income has been negative since 2014.

Kelman called out the need to achieve profitability: “our culture has been making an important shift toward performance and profits”. Fortunately, the fundamental, generational story of housing remains intact. I am looking for Redfin to bounce back whenever the outlook for inflation and thus interest rates improves. I will next check in on the story when going over my plans for the next seasonal trade on home builders.

Be careful out there!

Full disclosure: no positions