Housing Market Intro and Summary

In “Marching Under the Shadow of Recession Fears – Housing Market Review” I spent some time discussing the impact of the Fed’s move to normalize monetary policy. That impact continues to ripple through the housing data. Yet, individual home builders are not yet reporting much impact from rising rates. They appear to be “hanging in there”. For example, see “KB Home: A Tempting Off-Cycle Buy At A Recession Valuation” or my Seeking Alpha post “Taylor Morrison Home: An Underperforming And Underappreciated Builder.”

These claims remind me of the confident commentary ahead of the 2018 housing slowdown. At that time, the Fed was also trying to normalize policy. The Fed had to quickly reverse course after the housing market slowed down significantly and a parallel sell-off in the stock market appeared to push financial markets close to instability. However, this time could be different if the labor market remains strong, and the stock market manages to avoid the worst of the possible tantrums.

Regardless, this time is one of heightened economic sensitivities. Inflation and dysfunctional supply chains have thrown large challenges at home builders. However, on the other side of these challenges will be builders with incredibly efficient operations honed first through the crucible of the pandemic and now through the necessities of cost control and logistics excellence. These dynamics should turn the stocks of home builders into choice investments in the middle of whatever sell-offs lay ahead.

Housing Stocks

Home builders managed to out-perform the S&P 500 (SPY) in April. Although the iShares US Home Construction ETF (ITB) already trades below its March, 2022 lows, ITB is hanging in there with a stabilization through most of April. The major indices of the stock market ended April sliding past March lows with deep plunges for the month overall.

Still, I remain “on watch” for a potential reversal of all of ITB’s pandemic era gains. Such a test will get me reconsidering my reluctance to launch fresh trades and investments in home builders ahead of the start of the seasonally strong period for these stocks (October or November). Two months ago, I declared an end to the last seasonal pattern.

Housing Data

New Residential Construction (Single-Family Housing Starts) – March, 2022

In the previous Housing Market Review, I claimed that “starts are not likely to go higher for a while given supply constraints and the prospects for lower sales in the future.” March’s small decline leaves the impression of some kind of plateau.

Starts decreased 0.7% from February to 1,200,000. February’s starts were revised slightly upward to 1,221,000. Starts were 4.4% below last year’s March starts. While starts are likely at a plateau, they still compare favorably to the 1,200,000 level that preceded the 2001 recession.

![Housing starts Source: US. Bureau of the Census, Privately Owned Housing Starts: 1-Unit Structures [HOUST1F], first retrieved from FRED, Federal Reserve Bank of St. Louis, April 28, 2022.](https://fred.stlouisfed.org/graph/fredgraph.png?g=OExC)

The West returned to being the only region with a year-over-year increase in single-family starts. The Northeast and Midwest experienced significant declines. Housing starts in the Northeast, Midwest, South, and West each changed -32.6%, -22.6%, -0.6%, and +10.9% respectively year-over-year.

Existing Home Sales – March, 2021

For the first time since perhaps the beginning of the pandemic, the National Association of Realtors (NAR) used “slower demand” to describe the market for existing homes. The rare increase in inventory along with month-over-month and year-over-year declines in sales revealed the issue: “The housing market is starting to feel the impact of sharply rising mortgage rates and higher inflation taking a hit on purchasing power.”

Existing home sales surged in January only to plunge in February and now decline in March. The seasonally adjusted annualized sales in March of 5.77M decreased 2.7% month-over-month from the downwardly revised 5.93M in existing sales for February. Year-over-year sales decreased 4.5%.

Recall for January sales, the NAR pointed to the prospects of higher mortgage rates as a driver of demand. Now, the likely resulting pull-forward of demand left a bit of an air pocket in the current market.

(For historical data from 1999 to 2014, click here. For historical data from 2014 to 2018, click here) Source for chart: National Association of Realtors, Existing Home Sales© [EXHOSLUSM495S], retrieved from FRED, Federal Reserve Bank of St. Louis, April 20, 2022.

March’s absolute inventory level of 950K homes increased 11.8% from February, marking a rare second straight monthly increase. Still, inventory dropped 9.5% year-over-year (compare to February’s 15.5%, January’s 16.5%, December’s 14.2%, November’s 13.3%, October’s 12.0%, September’s 13.0%, August’s 13.4%, July’s 12.0%, June’s 18.8%, and May’s 20.6% year-over-year declines, unrevised). “Unsold inventory sits at a 2.0-month supply at the present sales pace, up from 1.7 months in February and down from 2.1 months in March 2021.” The on-going year-over-year decline in inventory is on a 34-month streak.

The increase in absolute inventories did not impact the urge to buy what did sell. The average 17 days it took to sell a home in March dropped by a day from February which in turn was a day lower than the previous two months. Market demand among those who can still afford a home remains strong. As the NAR observed, “homes are selling rapidly.”

The increase in inventory did not slow down prices. The median price of an existing home increased 4.5% from February at $375,300 and up 15.0% year-over-year. Prices have increased year-over-year for 121 straight months, which is a fresh all-time record streak. The downtrend from June’s $362,900 all-time high ended with March hitting an all-time price high.

While affordability issues should hit first-time home buyers hardest, they increased their share of sales a second month in a row. First-time home buyers increased to a 30% share of sales in March, up from 29% in February and 27% in January. However, the share is down 32% year-over-year. The NAR speculated that first-timers are still scrambling to lock in existing rates before they increase further. The NAR’s 2017 Profile of Home Buyers and Sellers reported an average of 34% for 2017, 33% for 2018, 33% for 2019, 31% for 2020, and 34% for 2021. Investors retreated again with their share of sales dropping from 19% to 18%. Their share was 15% a year ago.

All regions declined in sales year-over-year. The regional year-over-year changes were: Northeast -11.8%, Midwest -3.1%, South -3.0%, West -4.7%.

For the sixth month in a row, the South’s median price soared year-over-year. The combination of on-going price gains and (previous) sales gains speaks volumes for the on-going popularity of the South for existing homes. Inflation could continue the divergence of the South from other regions; the South has outpaced the other three regions 7 months in a row. The regional year-over-year price gains were as follows: Northeast +6.8%, Midwest +10.4%, South +21.2%, West +5.4%.

Single-family home sales decreased 2.7% from February and declined on a yearly basis by 3.8%. The median price of $382,000 was up 15.2% year-over-year.

California Existing Home Sales – March, 2022

California achieved more pricing milestones even as the inventory picture finally improved for the first time in a long time.

March’s median home price surged 10.1% month-over-month, the largest monthly jump in 9 years. The year-over-year increase of 11.9% sent the median price to a new all-time record. The price per square foot also rose above $400 for the first time ever. Half of California’s counties set new price records. The sales-price-to-list-price ratio rose to 103.9% from 102.2% a year ago. The California Association of Realtors (C.A.R.) explained these price moves came “…primarily due to a surge in sales of higher-priced homes” as buyers rushed ahead of mortgage rate increases. Specifically:

“The share of million-dollar home sales increased for the second consecutive month, surging to 32.9 percent in March, the highest level on record. Additionally, strong month-to-month sales growth in the San Francisco Bay Area contributed to the jump in sales of million-dollar homes statewide, as 70 percent of the region’s sales were priced above $1 million, and sales in the region increased 70.5 percent from February.”

These price gains occurred alongside an increase in inventory. For the first time in 2 years, the Unsold Inventory Index (UII) did not decline year-over-year. The number of months of inventory remained at 1.7. Active listings in March reached a 5-month high with the first year-over-year increase since June 2019. Newly added listings reached a 7-month high. Per the C.A.R. “the month-to-month increase of 37.7 percent in newly added listings was also the highest since May 2020.” The C.A.R. is hopeful the tight inventory situation is finally turning the corner.

California’s existing homes sales decreased 0.5% month-over-month. For March, the C.A.R. reported 426,970 in existing single-family home sales. Sales decreased 4.4% year-over-year. C.A.R. expects the sales pace to moderate further as rising mortgage rates dampen some of the market’s enthusiasm. However, if higher-income households continue driving sales, I think the median price should remain elevated.

New Residential Sales (Single-Family) – March, 2022

New home sales of 763,000 were down 8.6% from February’s 835,000 (significantly revised upward from 772,000). Sales were down 12.6% year-over-year. New home sales have moved from tough comparables to slightly below trend performance.

![new home sales Source: US. Bureau of the Census, New One Family Houses Sold: United States [HSN1F], first retrieved from FRED, Federal Reserve Bank of St. Louis, April 28, 2022.](https://fred.stlouisfed.org/graph/fredgraph.png?g=OExG)

At $436,700 the median home price rebounded from February’s small drop to $421,600. Once again, a shift in mix helped to drive the median price. Most notable was a return to earlier highs in share for the top two price tiers. This shift took the median home price to a new all-time high. The persistent upward push in prices despite a softness in sales matches the dynamics in the existing home market. I earlier assumed affordability issues would favor a shift in sales mix toward the lower tiers.

![new home median sales price Source: U.S. Census Bureau and U.S. Department of Housing and Urban Development, Median Sales Price for New Houses Sold in the United States [MSPNHSUS], retrieved from FRED, Federal Reserve Bank of St. Louis; April 28, 2022.](https://fred.stlouisfed.org/graph/fredgraph.png?g=OExI)

The monthly inventory of new homes for sale increased a third straight month, this time from 6.3 to 6.4. I continue to think inventory will continue higher given the on-going robustness in housing starts. The absolute inventory level of 407,000 ended seven straight months of gains. The marketplace for new homes remains balanced – unlike the extreme scarcity in the existing home market.

A large divergence reemerged for year-over-year changes in regional sales. The Northeast and the West were the two big winners at 12.8% and 21.0% respectively. The Midwest plunged 13.8%, the sixth straight month with a significant decline. The South returned to large double digit losses with a drop of 24.7%, making 4 of the last 5 months suffer steep year-over-year declines. The graph below shows the significance of the South and the relative insignificance of the Northeast and the Midwest for new home sales. Shortly after the pandemic, the South looked like it could soon challenge the highs from the Great Housing Bubble!

![Regional new one family home sales Source: U.S. Census Bureau and U.S. Department of Housing and Urban Development, New One Family Houses Sold in South Census Region [HSN1FS], Midwest Census Region [HSN1FMW], Northeast Census Region [HSN1FNE], West Census Region [HSN1FW], retrieved from FRED, Federal Reserve Bank of St. Louis, May 1, 2022.](https://fred.stlouisfed.org/graph/fredgraph.png?g=OLst)

Home Builder Confidence: The Housing Market Index – April, 2022

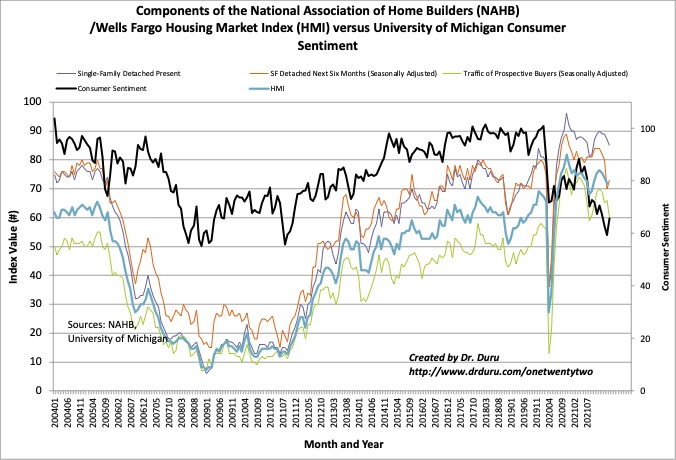

The NAHB/Wells Fargo Housing Market Index (HMI) dropped another 2 points in April from 79 to 77. The HMI has fallen each month this year as unbridled optimism normalizes under the pressure of rising interest rates. The National Association of Home Builders (NAHB) also blamed the familiar drivers of rising construction costs and lower affordability. While the overall declines are significant, the components were not unified in pessimism. The expectation for future sales, “SF Detached Next Six Months (Seasonally Adjusted)”, actually jumped 3 points even as the traffic of prospective buyers plunged 6 points to its lowest level since August, 2021. The HMI is at its lowest point since last September although housing demand appears to be hanging in there.

Interestingly, consumer confidence experienced a significant rebound. The drag of consumer confidence made me anticipate an eventual slide in home builder confidence. A rebound in consumer confidence could augur for at least a stabilization in HMI.

As a reminder, the thick blue/turquoise line represents the overall HMI in the chart below.

Source for data: NAHB

The regions were quite divergent for a fourth straight month. The Northeast bounced from the depths of pessimism to two points short of the high for the year. After increasing by 3 points in March, the Midwest plunged 7 points to 64. The Midwest is at its lowest point since the first few months of the pandemic. The South managed to increase by a point off its low of the year by 2 points. The West suffered a setback to levels last seen in September. While the Northeast drove the HMI’s decline in March, the Midwest and the West drove the declines in April.

Home closing thoughts

Spotlight on Mortgage Rates

Given the spotlight on the Federal Reserve’s attempt to normalize policy, I am tracking mortgage rates more regularly. Over the past week, mortgage rates finally slowed their ascent. If rates actually stabilized here, the housing market could continue hanging in there with a gradual journey to normalization. If the rate pace picks up again after this week’s Federal Reserve meeting, I fully expect subsequent and notable declines in housing activity. The chart below includes long-term Treasury yields for context.

![Sources include: Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 30-Year Constant Maturity [DGS30], retrieved from FRED, Federal Reserve Bank of St. Louis and Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis, May 1, 2022](https://drduru.com/onetwentytwo/wp-content/uploads/2022/05/220501_Mortgage-Rates-and-Treasury-Yields.png)

A Sober Perspective On Cooling Down the Housing Market

The media is seeking out stories of the impact of rising rates. Unlike the builders who continue to report no impacts, the media can of course find the industry insiders who confirm the worst fears. Last week, Marketplace broadcast an interview with just such an insider whose alarming quote made its way into the title: “The mortgage business has ‘come to a screeching halt’“. Vivian Gueler, the CFO of Pacific Trust Group in Los Angeles, California, explained that business significantly slowed as soon as mortgage rates starting rising in late January. Interestingly, Gueler had a very sober perspective which aligns with Fed-published research describing an over-heated housing market:

“The low rates drove up too much business, too much demand — and the prices, ultimately. So that had to be reeled in. And of course, increasing interest rates is one way of doing that. So ultimately, I think it’ll be a good thing. But we’re just going to have to ride it out, you know, at least, I would say through this year at least.”

I fully agree with Gueler: a sizzling hot housing market is not healthy. The activity is unsustainable so the fallout can be tough particularly on buyers late in the cycle. However, this time around, I still suspect that prices will not come down as much as we might expect with rising rates. The dynamics driving low inventory will persist. Absent a fresh foreclosure crisis, the people still shopping for homes could still face high demand for limited inventory.

Mysterious Spike In the Homeownership Rate

I read some pieces on Seeking Alpha juxtaposing low population growth in the U.S. versus soaring housing starts over the past two years or so. These authors conclude that the contrast is part of a bubble narrative: starts are feeding investor demand. While I have not yet sought out a counter-explanation (for example, the release of pent-up demand does not require population growth), I did take a look at the homeownership rate as one check. The chart below deepened the mystery.

The homeownership rate (he blue line) jumped sharply to 67.9% in the second quarter of 2020. That surge coincided with the full recovery for existing home sales and, more importantly, the extreme surge in new home sales to 13-year highs. Assuming those people remained in their homes, the subsequent drop and eventual return to pre-pandemic levels of homeownership. Perhaps the number of households suddenly jumped faster than the purchase of (new) homes. Unfortunately, the data on total households is annual and only available through 2020.

I asked FRED for an explanation of the spike. FRED has no explanation. The response included a link to an article covering racial and regional differences in homeownership rates as the only recent work FRED has on the homewonership rate. The article observed the spike but offered no explanation.

I overlayed the total household count as a reminder that over the 12 years the home ownership rate fell, total households continued higher and higher. That divergence represents some of the pent-up demand that got unleashed from 2020 to 2021.

Be careful out there!

Full disclosure: long ITB shares, long SPY calendar put spread