Stock Market Commentary:

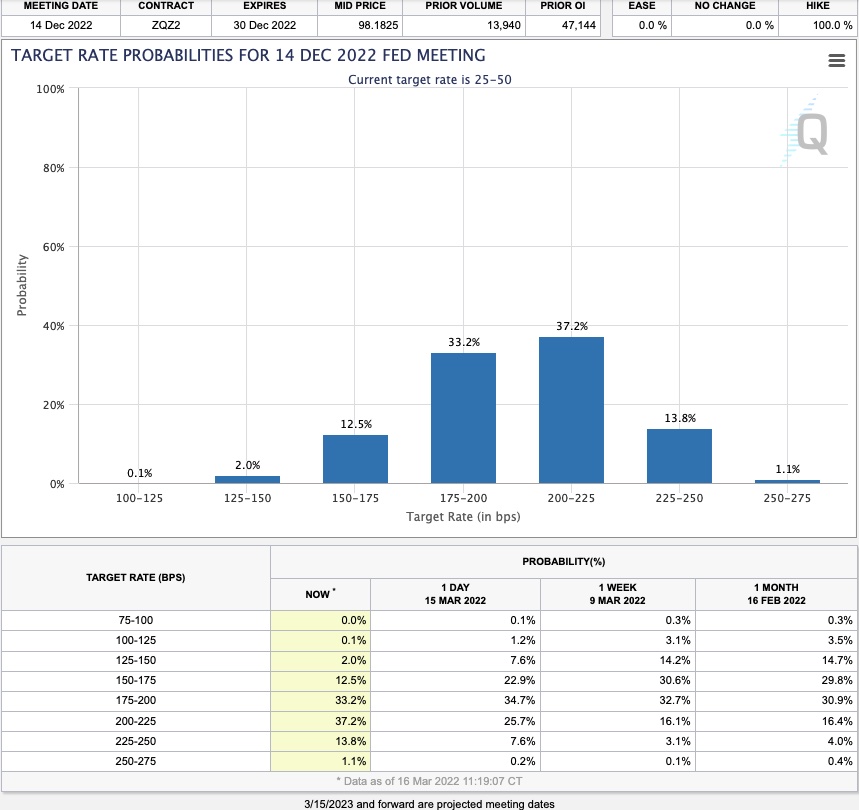

I will not attempt to back my way into an explanation for today’s impressive rally in the stock market. Maybe the surge is another classic bear market relief rally. Maybe the relief fuel symbolizes a market finally ready to leave a bottom behind. Time will tell. What IS clear is that the stock market looked past an incrementally more hawkish Fed to buy up anything not already nailed down. Meanwhile, Fed fund futures took note and increased the odds of much higher rates by December. Specifically, the futures punched above the critical 50% probability for rates to get as high as 2.0% to 2.25% at the end of the year.

From the Fed’s statement:

“With appropriate firming in the stance of monetary policy, the Committee expects inflation to return to its 2 percent objective and the labor market to remain strong. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 1/4 to 1/2 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee expects to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting…

Voting against this action was James Bullard, who preferred at this meeting to raise the target range for the federal funds rate by 0.5 percentage point to 1/2 to 3/4 percent.”

I was looking for the Fed to get hyper-creative to thread the needle between aggressively fighting against today’s inflationary pressures and the risks of sending the economy into a recession. Instead, the Fed chose to keep it plain and simple: claim future success. From Chair Jerome Powell’s introductory statement: “We are attentive to the risks of potential further upward pressure on inflation and inflation expectations. The Committee is determined to take the measures necessary to restore price stability. The American economy is very strong and well positioned to handle tighter monetary policy.”

The Fed’s claim is good enough for the stock market for now.

The Stock Market Indices

The S&P 500 (SPY) pulled off what is now a rare stunt in 2022. The index closed above its 20-day moving average (DMA) (the dotted line below) for only the 9th time this year. The current 2-day win streak is only the 6th of its kind this year. The longest streak so far was 3 days almost 2 months ago. This milestone was a good time to take profits on my SPY call spread expiring on Friday. Now I watch to see whether buyers can actually maintain this momentum. Note well that converged resistance from the 50 and 200DMAs (red and blue lines below) loom directly overhead.

The NASDAQ (COMPQX) entered bear market territory last week. Conditions worsened further with a 2.0% loss that took the tech-laden index right to support from the 2022 intraday low. Buyers turned the battleship right around the next day with a complete reversal of that loss. That buying power set the stage for today’s Fed-day celebration. The NASDAQ closed above its 20DMA with a 3.8% gain. The NASDAQ has yet to challenge downtrending 50DMA resistance all year. Accordingly, the index is already sitting at a critical test. I held my QQQ call positions with an eye to likely resistance from the last test of 20DMA resistance. Soon after Thursday’s open, I will most likely sell the spread expiring on Friday. The second spread expires next Friday.

The iShares Russell 2000 ETF (IWM) still looks comfortable in its churn. IWM gained 3.2% and looks ready to test its 50DMA support. However, a 50DMA breakout means little in the context of a developing trading range. IWM need to surpass the February highs to earn a definitive change in tone. My IWM call spread expires in mid-April, so I was content to keep holding.

Stock Market Volatility

The volatility index (VIX) came tumbling down under the weight of the market’s celebration. The primary uptrend in place all year finally gave way. Now I am eyeing the secondary uptrend defined by the read line below.

The Short-Term Trading Call While Running Low On Fuel

- AT50 (MMFI) = 41.5% of stocks are trading above their respective 50-day moving averages

- AT200 (MMTH) = 35.6% of stocks are trading above their respective 200-day moving averages

- Short-term Trading Call: cautiously bullish

AT50 (MMFI), the percentage of stocks trading above their respective 50DMAs, surged to 41.5%. Suddenly, my favorite technical indicator is right back to the top of the presumed range. AT50 is also just below the presumed trendline of descent. This test is the most important market event to me. A breakout would represent a major change in tone for the stock market. An immediate reversal would deliver more of the same. Either way, the buying window just got very narrow on the major indices. Now buyers and bulls need to thread the needle. My trading call stays put.

With the incrementally more bullish tone in the stock market, I did not feel the need to add to my few remaining hedges. However, for good measure, I used ARKK’s impressive 10.4% gain to add “cheap” $50 strike puts expiring next week…just in case.

Be careful out there!

Footnotes

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #482 over 20%, Day #7 over 30%, Day #1 over 40% (overperiod ending 16 days under 40%), Day #49 under 50%, Day #82 under 60%, Day #262 under 70%

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long QQQ call spreads, long IWM call spread, long ARKK puts and put calendar spread

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, Twitter, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.