Housing Market Intro and Summary

In my last Housing Market Review, I discussed the prospects for the impact of higher interest rates. I concluded there could be little impact on prices. Those dynamics could soon be overshadowed by the impacts of a global economic war and the declining sentiment that comes from watching the misery of an invaded nation of millions.

Since the housing market surprised to the upside during the pandemic, the market could once again surprise as having a home in troubled times could look more appealing than ever. However, even if demand normalizes just to pre-pandemic levels, tight inventories could keep prices elevated. The further compromise of supply chains could leave inventories of new homes low. High prices could leave existing home owners even more reluctant to move. Given the heightened uncertainty, I decided this is as good a time as any to officially bring an end to the seasonal trade in home builders.

Housing Stocks

The iShares Dow Jones US Home Construction Index Fund (ITB) out-performed the S&P 500 (SPY) in 2021 with a 49% gain versus 27%. Fortunes continue to diverge this year. ITB is in bear market territory with a 20.0% year-to-date loss despite a sharp rebound from oversold trading conditions. I am holding ITB shares and a call spread as my last positions for the seasonal trade. Once sold (or expired for the options), I have no current plans to refresh the trade until the season starts again in October/November.

My sale of a position in Meritage Homes Corporation (MTH) signaled to me the need to end the seasonal trade. I sold a put option at a healthy premium ahead of January earnings. The put converted into shares (assignment) in February. I felt fortunate to re-achieve a net gain at the end of last week’s rally and took profits there.

Housing Data

New Residential Construction (Single-Family Housing Starts) – January, 2021

Single-family home starts decreased for a second month to 1,116,000 which was 5.6% below December’s starts (revised upward from 1,172,000 to 1,182,000). Starts were 2.4% below last year’s January starts. Housing starts look like they have normalized into a range just above 1,000,000 units.

![Housing starts Source: US. Bureau of the Census, Privately Owned Housing Starts: 1-Unit Structures [HOUST1F], first retrieved from FRED, Federal Reserve Bank of St. Louis, January 29, 2022.](https://fred.stlouisfed.org/graph/fredgraph.png?g=Mr9G)

The West was the only region to increase year-over-year. This gain broke a streak of three straight double-digit declines. Housing starts in the Northeast, Midwest, South, and West each changed -38.0%, -11.7%, -2.2%, and +13.9% respectively year-over-year. The direction of sequential changes matched the year-over-year changes.

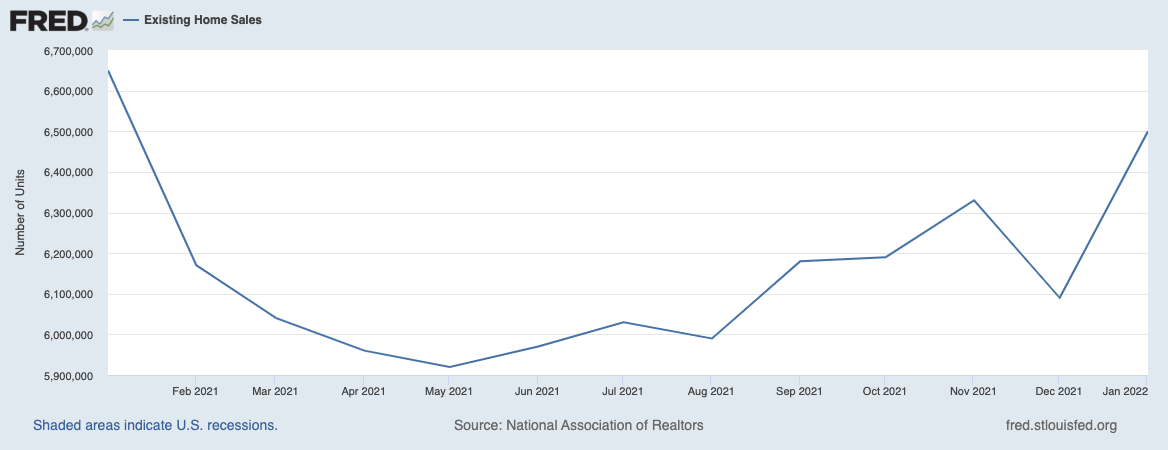

Existing Home Sales – January, 2021

Existing home sales surged in September, jumped in November, and surged in January. As a result, the seasonally adjusted annualized sales in January of 6.5M increased 6.7% month-over-month from the downwardly revised 6.09M in existing sales for December. Year-over-year sales decreased 2.3%. Normalization is gliding to an end with the year-over-year comparables becoming less challenging.

The National Association of Realtors (NAR) pointed to the prospects of higher mortgage rates as a driver of demand: “Buyers were likely anticipating further rate increases and locking-in at the low rates, and investors added to overall demand with all-cash offers…Consequently, housing prices continue to move solidly higher.”

(For historical data from 1999 to 2014, click here. For historical data from 2014 to 2018, click here) Source for chart: National Association of Realtors, Existing Home Sales© [EXHOSLUSM495S], retrieved from FRED, Federal Reserve Bank of St. Louis, March 5, 2022.

December’s absolute inventory level of 860K homes dropped 5.5% from December, a sixth consecutive month-over-month decline. Inventory dropped 16.5% year-over-year (compare to December’s 14.2%, November’s 13.3%, October’s 12.0%, September’s 13.0%, August’s 13.4%, July’s 12.0%, June’s 18.8%, May’s 20.6%, April’s 20.5%, and March’s 28.2% year-over-year declines, unrevised). “Unsold inventory sits at a 1.6-month supply at the current sales pace, down from 1.7 months in December and from 1.9 months in January 2021.” The on-going year-over-year decline in inventory is on a 32-month streak and dragged absolute inventory levels to a fresh all-time low. The NAR noted that the inventory scarcity is worst below the $500K price level which in turn will increase the mix of buyers to the high end.

The average 19 days it took to sell a home in January was the same as in December.

The median price of an existing home decreased 1.2% from December at $350,300. Prices have increased year-over-year for 119 straight months which is a fresh all-time record streak. However, prices have trended downward since June’s $362,900 all-time high. Unless the mix of high-end buyers increases substantially, this record streak of price gains could finally end this June. January’s price hike was a 15.4% year-over-year gain.

First-time home buyers dropped to a 27% share of sales in January, down from 30% in December and 33% in January, 2021. The NAR’s 2017 Profile of Home Buyers and Sellers reported an average of 34% for 2017, 33% for 2018, 33% for 2019, 31% for 2020, and 34% for 2021. The gap between the current share and the prevailing annual average is the largest I can remember from recent data. This milestone could be the first confirmation of a worsening inventory imbalance at the lower-end of the market. Investors stepped into the gap by increasing their share of sales from 17% to 22%. Their share was only 15% a year ago.

The regions were directionally split with the largest changes on the downside. The regional year-over-year changes were: Northeast -8.2%, Midwest 0%, South +0.3%, West -6.6%.

For the fourth month in a row, the South’s median price soared year-over-year. The NAR reflected on this strength: “The migration to the Southern states is clearly getting reflected in higher home sales and fast rising home prices compared to other regions”. The regional year-over-year price gains were as follows: Northeast +6.0%, Midwest +7.8%, South +18.7%, West +8.8%. The South had provided stretched homebuyers an oasis of affordability, but that source of relief may soon dry up at the current pace.

Single-family home sales increased 6.5% from December and declined on a yearly basis by 2.4%. The median price of $357,100 was up 15.9% year-over-year.

California Existing Home Sales – January, 2022

For the third month in a row, the California Association of Realtors (C.A.R.) described competitiveness as “less heated” but “still elevated.” At 101.2, the statewide median sales-price-to-list-price ratio maintained its lowest level since February. The median time to sell a house is still a mere 12 days – just 1 day longer than a year ago.

California’s existing homes sales increased 3.4% month-over-month. For January, the C.A.R. reported 444,540 in existing single-family home sales. Sales decreased 8.3% year-over-year as tough comps start to ease. Three out of four of California’s counties experienced year-over-year sales declines with the largest drops in the most expensive markets. This dynamic contrasts sharply with the national sales segmentation described by the NAR.

At $765,580 the median price returned to monthly declines by decreasing 3.9% from December. The median was still up 9.4% year-over-year. The $372 price per square foot dropped from December’s $382 and is up 12.3% year-over-year. Home prices increased year-over-year in all 5 of California’s regions and 45 out of 50 counties.

Inventory finally increased although it still sits near rock bottom levels. The Unsold Inventory Index (UII) increased from 1.2 to 1.8 months of sales. The UII was 1.4 a year ago. Active listings soared 37.2% from December (no annual change provided).

New Residential Sales (Single-Family) – January, 2022

After surging back to the current uptrend line, new home sales dipped slightly. New home sales of 801,000 were down 4.5% from December’s 839,000 (significantly revised up from 811,000 – ending three straight large downward revisions). Sales were down 19.3% year-over-year. Note that January, 2021 was a major peak in sales that marked the end of the pandemic-era buying frenzy. That peak was a 14-year high and represents a very tough comparable!

![new home sales Source: US. Bureau of the Census, New One Family Houses Sold: United States [HSN1F], first retrieved from FRED, Federal Reserve Bank of St. Louis, February 3, 2022.](https://fred.stlouisfed.org/graph/fredgraph.png?g=MBC1)

At $423,300 the median home price rebounded sharply from December’s mix-driven plunge. The all-time high was set in October, 2021 at $427,300. The rebound was driven by a sharp swing in share of sales back to the top half of the distribution. Whereas I postulated December’s shift happened from affordability forces, January’s readjustment makes the move look like a random (temporary) decline.

![new home median sales price Source: U.S. Census Bureau and U.S. Department of Housing and Urban Development, Median Sales Price for New Houses Sold in the United States [MSPNHSUS], retrieved from FRED, Federal Reserve Bank of St. Louis; February 3, 2022.](https://fred.stlouisfed.org/graph/fredgraph.png?g=MFMc)

The monthly inventory of new homes for sale increased from 6.0 to 6.1. The absolute inventory level of 406,000 delivered a sixth month of gains. On the whole, the marketplace for new homes is balanced despite the headline descriptions of a tightly constrained market.

Regional sales numbers were mixed with a third straight month of exceptionally large year-over-year swings. The Northeast suffered a second month with a steep drop with a loss of 46.8% for January. The Midwest plunged 37.1%, a fourth straight month with a significant decline. The South declined double digits for a third straight time, this time a drop of 23.8%. The West was the only region with a gain; it was up 5.3% with a second straight month of gains. The relative lagging by the West a year ago generated easier comps than other regions experienced.

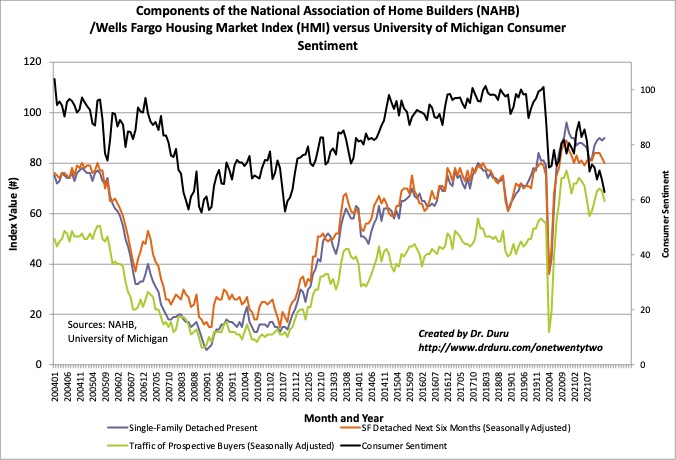

Home Builder Confidence: The Housing Market Index – February, 2022

The NAHB/Wells Fargo Housing Market Index (HMI) dropped just a point from 83 to 82. Under the covers, the components and regional breakdowns tell a more interesting story. The Single-Family Detached Present increased a point thanks to a one-point downward revision for January. The HMI pressure came from the forward-looking components, especially from a five point fall in the Traffic of Prospective Buyers (Seasonally Adjusted). While this component spent a few months last year at lower levels, I now see a potential downtrend brewing. If so, this declining forward-looking sentiment could indicate lowering levels (yet still historically high) for HMI this year.

Source for data: NAHB

Home builder sentiment has been incredibly resilient despite all sorts of pressures in the housing market. Current housing demand amid tight inventories seems to be the key support helping builders look through worsening supply chain issues and increasing costs. The NAHB complained: “Production disruptions are so severe that many builders are waiting months to receive cabinets, garage doors, countertops and appliances…These delivery delays are raising construction costs and pricing prospective buyers out of the market.” The NAHB is also worried about rising rates further hurting housing affordability.

The regions were very divergent for a second straight month. The Northeast surged from 69 to 80 in December, dropped to 71 in January, and surged again to 78 in February. The Midwest fell just a point like the aggregate HMI. The South declined from 86 to 84. The West gained a second straight month; the region increased from 89 to 91. In other words, the key South and West regions remain very high, and the South was the main driver of the small drop in the HMI. The South clearly has an outsized influence on HMI.

Home closing thoughts

Mortgage Applications

A 13.1% week-over-week drop in mortgage applications last month made big headlines for housing market news. This decline took mortgage applications back to levels last seen December, 2019. The Mortgage Bankers Association (MBA) explained:

“Purchase applications, already constrained by elevated sales prices and tight inventory, have also been impacted by these higher rates and declined for the third straight week. While the average loan size did not increase this week, it remained close to the survey’s record high.”

The drop makes sense and is not alarming given the hyper-activity brought on by the easy money dynamics of the pandemic. Moreover, the record high loan size means that applications are mainly hurting at the lower price points where affordability is most challenging with higher rates.

Regardless, dropping to December, 2019 levels means coming down from the clouds and resting on the highest peak in the mountain range. December, 2019 was quite a strong time for the housing market. While the stock market was wobbling in response to potential trouble ahead from the nascent news about the coronavirus, the Housing Market Index (HMI) was at a 20-year high. Existing home sales were still bouncing around in a range but new home sales were near post financial crisis highs. In other words, mortgage applications need to drop a lot more and on a sustained basis before signaling new troubles for the housing market. (Moreover, recall the share of sales to investors soared in January for existing homes – investors do not fill out mortgage applications).

Contract Buying for Homes In Chicago

I ran into this story from three years ago. It describes how Black families in Chicago were denied conventional mortgages and forced into buying expensive contracts to live in homes. Ironically, realtors writing these contracts increased their profits by scaring White families out of neighborhoods with increasing diversity. They encouraged these fearful families to abandon their homes on the cheap which in turn got sold at large mark-ups to Black families eager to find a place where they were allowed to live. This episode of American history provides one more example of many describing the broad, national harm of racial discrimination. From the NPR article:

“Black families in Chicago lost between $3 billion and $4 billion in wealth because of predatory housing contracts during the 1950s and 1960s…

- Between 75 percent and 95 percent of homes sold to black families during the 1950s and 1960s were sold on contract.

- The price markup on homes sold on contract was 84%.”

Be careful out there!

Full disclosure: long ITB shares and call spread