If the housing market remains strong through 2021, Meritage Homes (MTH) may be one of the best catch-up trades in the cohort of major home builders. MTH hit an all-time high 4 months ago in October. Since September, MTH’s valuation has dropped from 2.0 (expensive!) price/book to 1.4, 1.1 price/sales to 0.7, 12.8 to 8.1 12-month trailing P/E, and 9.4 to 7.2 forward P/E. The stock trades around its 50 and 200-day moving averages (DMAs). Moreover, MTH is struggling to recover from a 7.8% post-earnings loss last month. This price action compares unfavorably to ITB which broke out last week and trades a fraction of a percent off its all-time high.

From reading the Seeking Alpha transcript of the Meritage Homes earnings conference call, I concluded that analysts were dissatisfied with the amount of demand the company pulled forward into Q4 from Q1 2021. Meritage projected back-end loaded community count which implies a potential miss for the important Spring selling season. Moreover, the company’s 2021 guidance presented the prospect of negative year-over-year comparables (comps). MTH emphatically insisted that it sees nothing wrong with housing demand and its target of 300 communities in 2022 is not in jeopardy. Taking these reassurances at face value, I think the negative reaction created a buying opportunity per the seasonal model for trading home builders.

Shifting Demand

Management explained the pull-forward of closings into the fourth quarter:

“…the way that we think about it is a lot of the closings that were forecasted probably in the analyst models for 2021, we got a big chunk of those into Q4. We pulled them up because our cycle times were shorter and we were able to get those closings into 2020. So if you kind of take the combination of the 2020, 2021 and you do a five rolling quarter, we’re probably right on top of where you guys thought we would be just that came in Q4 of 2020 instead of Q1 of 2021.”

The explanation makes sense but clearly failed to mollify analysts. The company is also demonstrating some “lumpiness” in cycle times in its sales/supply chain. Somehow, the company shortened cycle times below expectations to pull Q1 closings into Q4. Yet, at the same time, the company is unable to pull forward its community count. Sure, these events are in different parts of the supply chain, but the inconsistency is one more thing to unsettle analysts.

Community Count: An Issue of Supply

Meritage’s guidance on community count broke out as follows:

- First half of 2021 at 200 communities give or take a few. Meritage ended 2020 with 199 “active” communities compared to 244 at the end of 2019.

- End 2021 with approximately 235-245 communities

- Target 300 communities for June, 2022

Management explained the contours of the heavy back-end loading on the community count.

“We wanted to give the community count guidance with that mid point in the script as well to help with the guidance and the models to make sure that everyone understands that it’s not a demand or a labor issue that – that’s a governor on our guidance that if those were listed that we were able to get to a higher number, it’s just how quickly can we get [lots] in the ground…We have the labor to get to those community count targets, but there’s not a way to accelerate that. So that the governor is really the availability of lots in communities not elongated cycle times or concerns about demand.”

Meritage explained what is NOT problem, but I am not 100% clear on the actual problem. Perhaps the original June, 2022 target for 300 community count locked the company into a process that cannot move faster. In that case, I am fine accepting that Meritage’s supply issue will miss some short-term opportunity while still leveraging the longer-term opportunity. In a market with strong demand, the company may also have the opportunity to increase price or shift some entry-level homes to move-up homes. Meritage explained it increased prices in Q4 consistent with “strong local market demand.” Entry-level homes were 70% of Q4 orders and 67% of average active communities, up from 55% and 45% respectively in the year prior.

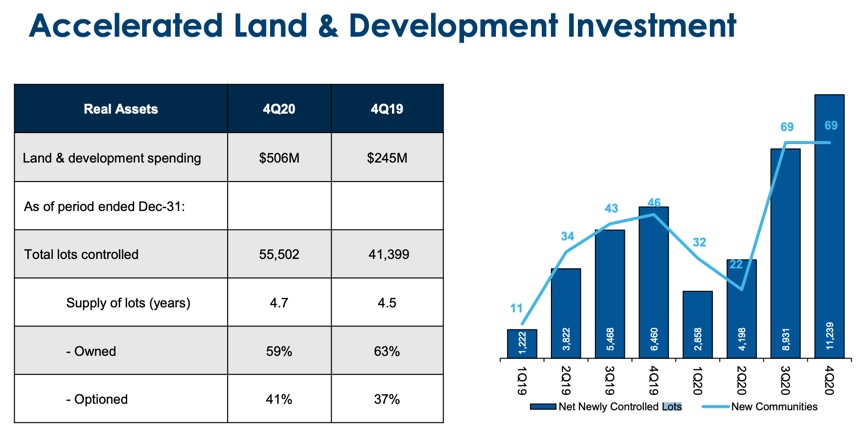

Lot count and land development is a caveat to the community count guidance. Meritage Homes accelerated both in the fourth quarter. Clearly, the company is very bullish about the future. So all else considered, MTH stands to benefit greatly if housing demand remains robust after this year. (Kudos to a Seeking Alpha article for reminding me to take lot count into consideration).

Guidance: A Dip On the Negative Side

Meritage’s guidance range includes the potential for negative year-over-year comps. I added year-over-year percentage changes using the Q4 2020 report and the Q1 2020 report. The 2019 to 2020 percentage changes are in parentheses. First, the full-year:

- 11,500-12,500 home closings: -3.0% to +5.6% (2019 to 2020: +28%)

- $4.2-4.6 billion home closing revenue: -5.9% to +4.5% (2019 to 2020: +24%)

- Home closing gross margin 22.0-23.0%: 0 to +100bps (2019 to 2020: 310bps)

- Diluted EPS $10.50-$11.50: -4.5% to +4.5% (2019 to 2020: 71%).

Next, Q1 of 2021:

- 2,600-2,900 home closings: +12% to +25% (2019 to 2020: +31%)

- $950.0 million to $1.05 billion home closing revenue: +6.7% to +17.9% (2019 to 2020: +27%)

- Home closing gross margin ~22.5%: ~+250bps (2019 to 2020: +330bps)

- Diluted EPS $2.25-$2.50: +23.0% to +36.6% (2019 to 2020: +182%)

The guidance shows a dramatic dichotomy between Q1 and full-year guidance comparables. The profile looks like decelerating growth. No wonder analysts rushed to downgrade and sellers unloaded MTH stock. I am actually surprised that MTH did not suffer a worse sell-off. Any negative growth prospects at this point in the economic cycle could be considered a red flag.

The Trade

I have written favorably about MTH in the past. For example, Meritage led home builders in the V-shaped recovery off last year’s trough. As a result, I am definitely biased to interpret the company’s results more optimistically with a dash of benefit of the doubt. If the stock resumes the downtrend from the all-time high, I will be forced to reconsider this analysis. The next earnings report should be very telling in terms of whether the company decides to deliver upside guidance. In the meantime, I have already accumulated the shares I want to hold for the seasonal trade. The stock also should have some support from an extra $100M approved in November for buying back stock.

Be careful out there!

Full disclosure: long MTH