Stock Market Commentary

The stock market quickly moved away from its close call with overbought conditions to pulling off a refresher for extended overbought conditions. The acquiescence of President Trump in signing a heavily negotiated, highly contentious pandemic relief bill seemed to provide the spark for the buying in the major indices.

The Stock Market Indices

The S&P 500 (SPY) did its part in contributing to the refresher for extended overbought conditions. The index gapped up at the open and finished with a 0.9% gain and an all-time high. Support at the 20-day moving average (DMA) held firm.

The NASDAQ (COMPQX) also made its contribution to the refresher for extended overbought conditions. The tech-laden index gapped at the open and finished with a 0.7% gain and an all-time high.

Stock Market Volatility

The volatility index (VIX) stubbornly held support despite the buying in the major indices. The 20 level still looks like solid support. The longer the VIX remains elevated above that support, the more likely a fresh surge becomes. This prospect is the main dynamic to watch even as bullish trading conditions linger in this near-historic extended overbought period.

The Short-Term Trading Call: A Refresher for Extended Overbought Conditions

- AT40 = 76.1% of stocks are trading above their respective 40-day moving averages (Day #30 overbought)

- AT200 = 86.4% of stocks are trading above their respective 200-day moving averages TradingView’s calculation).

- Short-term Trading Call: neutral

Last week, AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, had a close call with the 70% overbought threshold. That brush with bearishness is already a distant memory with AT40 closing today at 76.1% on the heels of gap openings for the S&P 500 and the NASDAQ.

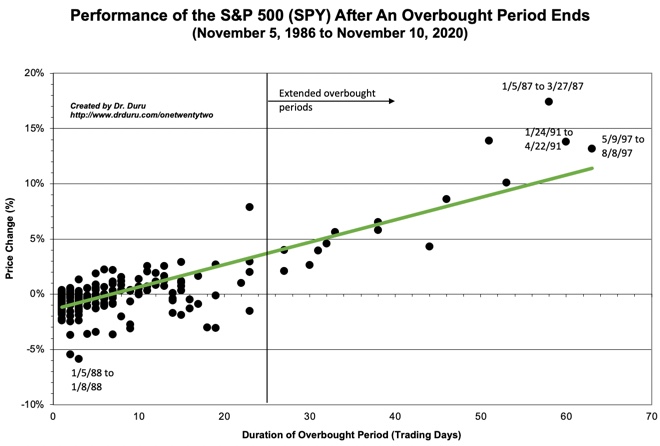

The stock market is on day #30 of overbought conditions. The S&P 500 has 4.2% in gains since overbought trading resumed on November 13th. The index was stuck in a near 3-week range of 2-3% overbought gains. In my previous Above the 40 post, I claimed the underperformance in the index suggested the stock market has one more rally left in it before the overbought period ended. That rally got going today with a refresher for the overbought period. The chart below indicates that the S&P 500 is still slightly underperforming given an overbought period ending at 30 days should deliver nearly 5% in gains for the period.

Also note that only 12 other overbought periods have lasted longer than the current one (since 1986).

Stock Chart Reviews – Below the 50DMA

AMC Entertainment Holdings (AMC)

The prospects of 2021 bringing more normalcy to our lives is not helping AMC Entertainment Holdings (AMC). The trading alone suggests that investors believe the clock will run out on the company before the broad reopenings.

Meritage Homes (MTH)

The clock may also be ticking on the home builders. Many remain stuck in months-long trading ranges with little signs of imminent breakouts. Instead, stocks like Meritage Homes (MTH) are slowly but surely languishing.

Beyond Meat (BYND)

Last week I noted my surprise that Beyond Meat (BYND) did not benefit from this month’s bevy of parabolic moves and highly speculative trades. With a 7.4% loss and a 200DMA breakdown, the stock is looking even more exhausted. A breakdown to a new post-earnings low would confirm a new bearish trend in BYND.

Whirlpool (WHR)

Just as the housing trade is languishing a bit, so too is the trade in Whirlpool (WHR). The maker of major household appliances suffered a serious bout of underperformance although it remains within a months-long trading range. To-date, WHR has barely avoided closing lower than the big 10.4% loss in November. A break of that support will confirm a new bearish turn in the stock.

Stock Chart Reviews – Above the 50DMA

Amazon.com (AMZN)

Amazon.com (AMZN) helped lead the way for big cap tech on the day. AMZN is stuck in a 6-month trading range, but today’s 3.5% made the stock look freshly alive. I have AMZN on the list for a calendar call spread: I do not want to wait until a clean breakout to new all-time highs.

Booking Holdings (BKNG)

The prospect of more normalcy in 2021 is keeping Booking Holdings (BKNG) aloft. The travel-related services company jumped to a new 2 1/2 year high on today’s 2.4% gain. The stock looks ready to definitively clear the recent post-earnings consoldiation.

The Walt Disney Company (DIS)

The reopening optimism gave The Walt Disney Company (DIS) a fresh tailwind of optimism. DIS gapped higher, closed with a 3.0% gain, and notched a fresh all-time high. Enthusiasm from the company’s Investor Day earlier this month sent the stock surging 13.6%. Disney finally looks like a winner in the age of streaming entertainment.

Redfin (RDFN)

An incredible run-up in Redfin (RDFN) took the real estate services company far ahead of home builders and other housing-related stocks. RDFN is finally cooling off a bit now. The stock is a buy on dips down to the last breakout point above the former all-time high at $56. I am waiting patiently for a test of uptrending 20DMA support.

Be careful out there!

Footnotes

“Above the 40” (AT40) uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to measure breadth in he stock market. Breadth indicates the distribution of participation in a rally or sell-off. As a result, AT40 can identify extremes in market sentiment that are likely to reverse. Above the 40 is my alternative name for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #53 over 20%, Day #37 above 30%, Day #36 over 40%, Day #35 over 50%, Day #34 over 60%, Day #30 over 70%

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%). Source: FreestockCharts

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long UVXY, long DIS, long BKNG

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, Twitter, and even Instagram!

*Charting notes: FreeStockCharts stock prices are not adjusted for dividends. TradingView.com charts for currencies use Tokyo time as the start of the forex trading day.