Trees do not grow to the sky – even cryptocurrency trees with Bitcoin leaves.

The old adage describes a core rule of the physics of price momentum. Whether buying or selling, traders and investors eventually exhaust themselves – whether existing resources are too low to maintain buying pressure or motivated sellers finally run out of inventory to dump on the market.

In the case of Bitcoin’s current run-up, exhaustion happened right at the $12K level. More specifically, as soon as Bitcoin (BTC/USD) broke above and then dipped below that psychologically important level, a wave of sellers jumped in likely afraid the run came to a sudden end on a false $12K breakout. I imagine the price action triggered stops below the $12K level.

Source: TradingView.com

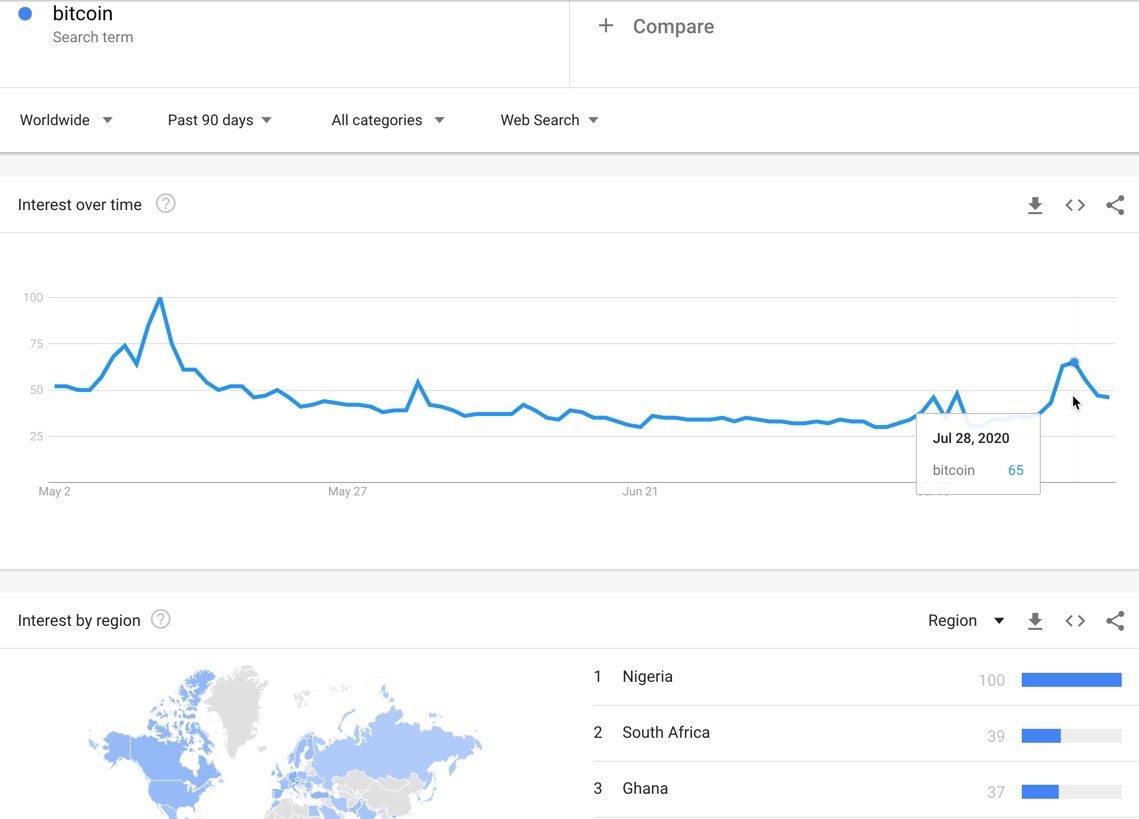

The Google Trend Momentum Check (GTMC) suggests that the Bitcoin breakout is not yet over even in the short-term (I am getting more and more comfortable using GTMC as a trading signal). Neither the $10K breakout nor the subsequent run-up attracted a significant spike in search interest in “Bitcoin.” The jump in interest on July 27th and 28th paled in comparison even to the jump on May 11th when Bitcoin experienced a sharp and brief pull back.

Source: Google Trends

So for now, I am sticking with the trading strategy I discussed in my last Bitcoin post equating Bitcoin to an anti-dollar trade. I am chasing momentum higher so I am buying pullbacks in the middle of the run-up (note this strategy is exactly opposite the strategy I followed when Bitcoin crashed along with financial markets in March). Even though the current pause looks like a refresher before the next leg higher, I did not buy the current pullback: prices are right around levels of the last pullback where I added to my position.

I am also eyeing the U.S. dollar index (DXY) which looks set up for a relief rally. The U.S. dollar suffered tremendous and persistent selling pressure through most of July. A small rebound similar to the one in the second half of June is very possible.

Source: TradingView.com

I am not expecting Bitcoin to pull back much in the face of a relief rally for the U.S. dollar index. Bitcoin slowly drifted downward during June’s dollar rebound. Even if a sharp pullback happens, I will remain patient through the move. The downward trend in the dollar is just beginning given the massive amount of devaluation happening between the Federal Reserve and the U.S. government’s largesse in response to the economic emergencies driven by the coronavirus (COVID-19) pandemic.

Be careful out there!

Full disclosure: long BTC/USD, long and short various U.S. dollar currency pairs