I still can hardly believe my eyes, but it seems that a V-shaped recovery is truly underway in the housing market. In my last Housing Market Review, I wrote about housing-related stocks printing V-shaped recoveries ahead of data suggesting that such a recovery was underway. Last week’s sales activity report from home builder TRI Pointe Group (TPH) provided convincing data that home buyers (and sellers) are indeed ramping up their activity back to normal seasonal patterns.

V-Shaped Housing Recovery

TRI Pointe Group reported net new home orders in May were just 5% down from May, 2019 levels. April’s orders plunged 54%. Cancellations peaked the week of March 30th and declined from 36% in April to 23% in May. Cancellations ran at 16% in the second quarter of 2019 and were 4% of backlog in Q1 2020. TRI Pointe highlighted a 7% year-over-year increase in orders in California. Last quarter, California made up 35% of TRI Pointe’s home deliveries, compared to 40% in Q1 2019. The Californian orders surely helped the company close the gap on May.

For additional context, TRI Pointe’s January net new home orders were up 71% year-over-year – the biggest January in the company’s history. Net new home orders were up 53% year-over-year in February which generated the highest monthly order volume ever for the company.

In other words a V-shaped recovery for TRI Pointe will translate into exceptionally strong results for Q2 and beyond. Not only did TRI Pointe’s business rebound sharply from April to May, but also the company’s business in the highly valuable California market underline the potential for an upside surprise. These promising prospects motivated me to review my notes from the company’s Q1 2020 earnings report from April 24th and record them here.

Overall Assessment

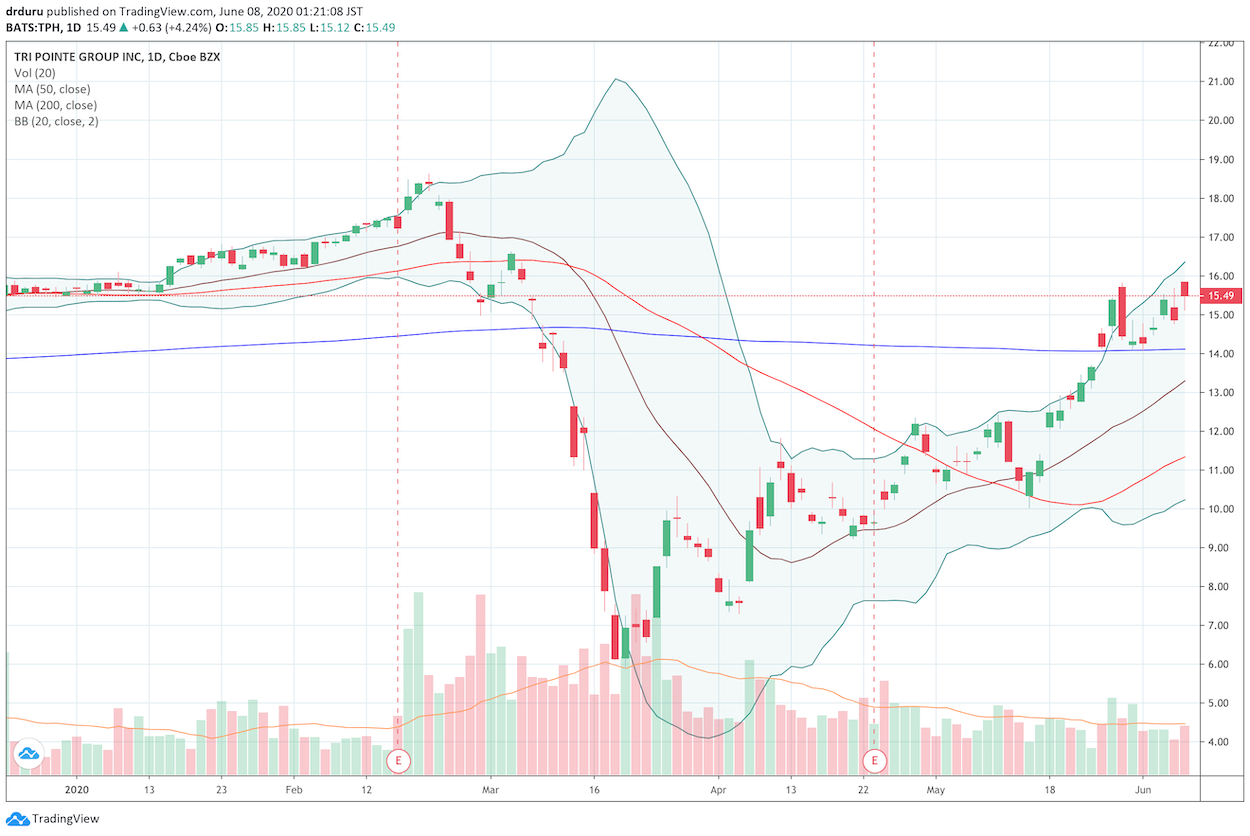

I am bullish on TRI Pointe Group (TPH) given a combination of the strong technicals on the stock and the apparent imminent return to strong financial performance. TPH broke out above its 200-day moving average (DMA) on May 26th and successfully tested the 200DMA as support on May 29 and June 1. I plan to buy back into TPH in the coming days and weeks ahead of the next earnings report as long as the stock stays above its 200DMA. These purchases will go against my rules regarding the seasonality of investing/trading in housing-related stocks. These are exceptional times.

Source: TradingView.com

TRI Pointe decided to cease building spec inventory. I expected this decision from all builders, but TRI Pointe is one of the few that brought specs to a complete halt. This is an ironic decision given the company’s strong sales performance. I will consider a restart of specs as a final confirmation that the company is seeing a return to normal for its business.

Amazingly, the company reported that only 4% of its backlog has a home to sell. The implication is that almost everyone who has an order with TRI Pointe is ready to close the deal when the time comes. This readiness reduces the prospect for future cancellations and makes the backlog robust. TRI Pointe noted that it has a specific strategy to minimize orders from people who are still conditioned on selling a home. This 4% is even more amazing given that move-up buyers are the majority of net new orders. TRI Pointe’s buyer segments have changed little in terms of net order activity: 26% entry level, 54% move-up, 17% luxury, and 3% active adult. TRI Pointe also keeps entry-level a low segment to maintain strong credit profiles of its buyers.

Finally, TRI Pointe is also attractive from a valuation perspective. In particular, the price/book ratio is still below 1.0, the threshold considered to be recession-level pricing.

My lingering concern about TRI Pointe and other builders is that they are almost all selling to the same or overlapping financially sound households. A recession naturally puts a tight cap on that population of buyers. A lack of economic growth will quickly deplete this population of buyers. So if GDP fails to normalize, say by Q1 or so of 2021, I expect the performance of home builders to level off by Q4 of this year.

Stock Performance

- One day after reporting Q1 2020 earnings: +6.2%

- Since the close after reporting Q1 2020 earnings: +46%

- Since the close after Q4 2019 earnings: -15%

- Since the close after Q1 2019 earnings: +17%

- For the year until the close before earnings: -38%; compare to -30% for the iShares Dow Jones US Home Construction ETF (ITB)

Valuation (from Yahoo Finance)

- 12-month trailing P/E: 9.0

- 12-month forward P/E: 10.7

- Price/book: 0.95

- Price/sales: 0.7

- Short % of float: 11.2%

Year-Over-Year Performance (3 months ended March 31, 2020 and quarter-ending values)

- Home sales revenue: +21%

- New homes delivered: +18%

- Net new home orders: +26%

- Average selling price: -2.6%

- Net income: +44,806% (from $71K to $31,883K)

- Adjusted gross margin: from 18.4% to 23.4%

- Gross margin: from +14.4% to 20.5%

- Net income per diluted share: from 0 to $0.24

- Ending backlog value: +31%

- Cash and cash equivalents: +89.7%

- Ratio of net debt to capital: from 30% to 35%

Guidance and targets

- Withdrew previous 2020 guidance given the uncertainties of the coronavirus pandemic

Highlights from the Earnings Call

Market Conditions and Characteristics of Demand

- Buyers are in strong financial health: Home buyers using TRI Pointe’s financing arm (“Connect”) have an average loan-to-value (LTV) ratio of 75%, 83% of buyers have a FICO above 700.

- “…continue to see a little bit of flight from density to a more suburban environment, but still close to employment centers.”

Balance Sheet

- Creating a “net around the company’s liquidity” by deferring land acquisitions and minimizing capital expenditures.

Regional characteristics

- Highest net sales in Southern California, second in Washington, and third Las Vegas for April month-to-date.

Margins and Costs

- Despite the new rules about social distancing, TRI Pointe has figured out how to prevent a material increase in cycle times for building homes. The company referenced labor “hungry for work.”

- Seeing no delays in the supply chain.

- Lumber prices are falling.

- Have not yet reduced any fixed costs.

Pricing Power

- “We haven’t seen any major price reaction so far since the shelter-in-place rules.”

- Increased use of small incentives like broker co-op and a financing buy down program.

Share buyback

- After buying early in Q1, the company ceased buyback activity due to a lack of market clarity. From the earnings report: “Repurchased 6,558,323 shares of common stock at a weighted average price per share of $15.55 for an aggregate dollar amount of $102.0 million in the three months ended March 31, 2020.” The stock is finally trading back to that average level.

- No plans for returning to the market until clarity returns.

Digital readiness

- “Adapted and accelerated” the digital sales process, including self-scheduling, virtual tours, remote design studio, and a close process that limits in-person interactions.

Earnings data sources

- 2020 1st quarter results: April 24, 2020

- 2019 4th quarter results: February 18, 2019

- 2019 1st quarter results: April 25, 2019

- Seeking Alpha Transcripts: TRI Pointe Group, Inc. (TPH) CEO Doug Bauer on Q1 2020 Results – Earnings Call Transcript

Be careful out there!

Full disclosure: long ITB