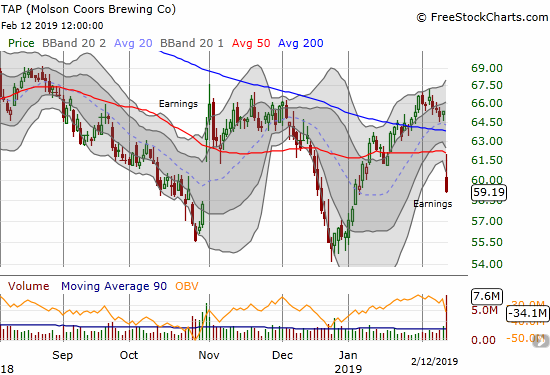

I guess all that corn syrup is weighing down Molson Coors (TAP).

I did not have a chance to follow-up on my positive technical outlook on TAP because a poor earnings response took the stock down today by a whopping 9.4%. The stock gapped down below support at both its 50 and 200-day moving averages (DMAs). The response was a near mirror image of the post-earnings gap up at the end of October. Now TAP looks ready to close that gap one more time.

Source: FreeStockCharts.com

The earnings report was peppered with some poor results even as the company spun a relatively positive outlook, for example promising to re-establish a dividend payout-ratio in the range of 20-25% of annual trailing underlying EBITDA sometime later in 2019…

- Q4 worldwide brand volume decreased 1.5%

- FY Net Income of $1.1 Billion ($5.15 Per Share) decreased 28.7%

Perhaps most damaging was an announced restatement:

As previously disclosed in our Current Report on Form 8-K filed on February 12, 2019, we will be restating our previously issued financial statements as of and for the years ended December 31, 2017 and 2016 in our 2018 Annual Report on Form 10-K and will be reporting ineffective internal control over financial reporting as of December 31, 2018, due to the existence of a material weakness associated with such restatement. Specifically, in connection with preparing our 2018 financial statements, MCBC identified an error in our 2016 income tax accounting for inside and outside basis differences related to our partnership in MillerCoors which resulted in an understatement of our deferred tax liability and income tax expense, and overstatement of net income by $399.1 million as of and for the year ended December 31, 2016. This deferred tax liability required revaluation in 2017 due to the impacts of the Tax Cuts and Jobs Act which, along with other insignificant errors in the 2017 calculations related to the previously held equity interest in MillerCoors, resulted in an overstatement of our income tax expense and understatement of net income of $151.4 million for the year ended

December 31, 2017, and a net cumulative understatement of our deferred tax liability of $247.7 million as of December 31, 2017.

TAP reassured investors that this restatement had “no impact to underlying results.” TAP’s complete earnings report is long and complicated, so I honestly find it difficult to unwind exactly what spooked investors. No matter what it was, needless to say the stock is no longer a buy until the technical situation improves: a recovery above 50/200DMA resistance and/or a successful retest of the December lows.

Be careful out there!

Full disclosure: no positions