Florida Atlantic University and Florida International University co-create a “buy versus rent” scoring system called the Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index. Last month, this index crossed a critical threshold for the first time since 2010: U.S. households are once again better off renting than buying. This cross-over provides further confirmation of the worsening affordability issues I have recently chronicled in my monthly Housing Market Reviews.

From the August, 2018 summary post:

“It is clear that we are at a point where markets will begin to see downward pricing pressure, implying in some markets annual pricing increases will begin to slow…U.S. housing markets are clearly heading toward the peak of the current cycle.”

The good news is that the transition from peak to pullback should be a lot smoother than the bursting of the historic housing bubble from the last cycle. During that time, speculative fever and fraudulent mortgages artificially drove demand and prices sky-high and also motivated builders to help produce a glut of housing supply. Currently, housing supply is very tight as cautious builders tightly control their operations and existing homeowners choose to hold onto their homes. Moreover, mortgage-holders tend to have solid credit ratings, and the overall economy is still strong.

The above chart also shows that, at an aggregate basis, the economics of housing can favor renting over buying for many years before macro-economic trouble erupts. The duration is likely related to the inclusion of an investment component on the rent side. I strongly suspect few households use this kind of investment strategy (for example, in 2017 only 52% of Americans said they were invested in stocks and that percentage has been in decline). The difference between owning and renting must be invested in a diversified portfolio of stocks and bonds. When the BH&J Buy vs. Rent Index last crossed from favoring buying to renting in 1999, a correction in housing prices was felt most sharply in a few over-heated markets. The index did not even reverse until reaching its bubble-driven extreme in 2007.

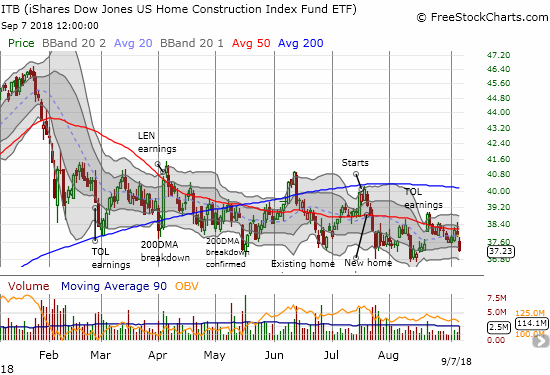

While the implications of this cross-over are not catastrophic, this event still provides more explanatory context for this year’s sustained pullback in the prices of home builders. For the near to intermediate-term, rallies are unlikely to last and more downside is likely ahead once builders and the macro housing data more clearly relay the narrative of a topped out housing market.

Source: FreeStockCharts.com

In August the National Association of Realtors (NAR) saw hope in the rising inventory of Seattle and Denver. The NAR has long complained about the extremely tight supply of housing and concurrent decline in affordability. The BH&J Buy vs. Rent Index suggests the NAR may want to be careful about its interpretation of rising inventories. Denver has never been more expensive on a rent-vs-buy basis. Rising inventories likely signal waning appetite for buying.

Seattle is not as bad as Denver on a relative basis, but the metro area has favored renting over buying for about two years. The current ascent in the index is climbing the same slope from the early years of the housing bubble. So, again, rising inventories in Seattle are likely a result of the increasingly unattractive economics of buying rather than a welcome increase of supply to eager home buyers.

Perhaps it is telling that the NAR did not provide an update on Seattle and Denver in its last existing home sales report.

While the Denver and Seattle housing markets are increasingly favoring renting, they are not leading the country in poor housing economics. That honor belongs to Dallas. Dallas is the most alarming of all 23 metro areas covered in the index (Houston is not far behind). The housing economics in the Dallas metro area are at historic extremes in favor of renting. Like Denver, Dallas has effectively been in bubble territory for at least the past year. (I am defining a bubble as a historic extreme in the index favoring renting over buying).

Source for charts of the Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index: Florida University College of Business

Expensive housing markets like San Francisco, Los Angeles, and New York City are, surprisingly, not in bubble territory as measured by the BH&J Buy vs. Rent Index. New York City even has a market that still favors buying over renting. However, extremely high rents at least partly explain the more favorable index ratings in these markets. In other words, BOTH renting and buying are very expensive in these markets.

The following video provides a detailed explanation of the BH&J index…

Be careful out there!

Full disclosure: long ITB call options