It is increasingly clear that President Trump and his administration will relentlessly pursue a goal of balanced trade with the rest of the world. Trump sees negative trade balances as an absolute bad, and his fiery political rhetoric highlights that positioning. If my interpretation is correct, then I want to stay net long the U.S. dollar as long as this drama continues to play out. Even a significant improvement in the U.S. trade balance should provide a strong tailwind to the U.S. dollar.

At a basic level, a negative trade balance (deficit) increases the supply of a currency in the global financial system and, all else being equal, drives down the relative value of the currency. The country with the deficit sends its currency into the market (an increase in supply) in exchange for goods. A positive trade balance (surplus) decreases the supply of a currency in the global financial system and, all else being equal, drives up the relative value of the currency. The country with the surplus sends goods in exchange for its currency. The buyers of those goods create demand for that currency in order to purchase the goods.

Of course, in the real world, there are a LOT of factors that impact the value of a currency and the size of a trade balance. Sometimes countries pursue policies which deliberately weaken their currencies in order to support exports of goods. In extreme cases, like Switzerland, governments will actively intervene in currency markets to achieve trade goals. The measurability of the impact of currency policy on trade outcomes is hotly debated (for example, see “‘Currency manipulation’ and world trade“).

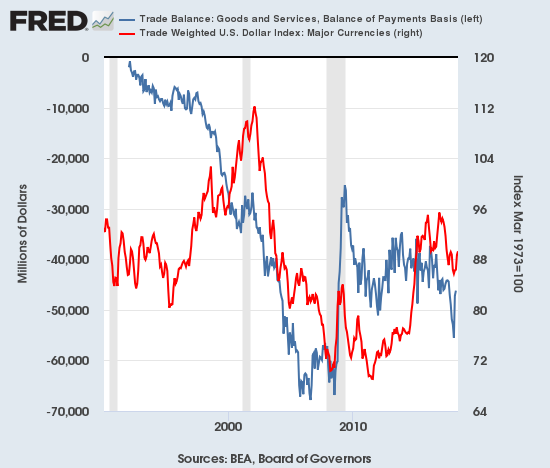

Still, from 2000 to 2014, the U.S. experienced a very strong correlation between its trade balance and the relative value of the U.S. dollar. The big break in 2014 occurred as the European Central Bank (ECB) aggressively dropped its policy rate into negative territory and ramped up quantitative easing efforts just as the U.S. was preparing to go in the opposite direction. The direct correlation seems to be in the process of re-establishing itself in the last two years so. In the chart below I used the dollar index measured against major currencies as this is closest to the tradable U.S. dollar index (DXY).

Source for charts: U.S. Bureau of Economic Analysis and U.S. Bureau of the Census, Trade Balance: Goods and Services, Balance of Payments Basis [BOPGSTB], retrieved from FRED, Federal Reserve Bank of St. Louis; and Board of Governors of the Federal Reserve System (US), Trade Weighted U.S. Dollar Index: Major Currencies [TWEXMMTH], retrieved from FRED, Federal Reserve Bank of St. Louis; June 11, 2018.

Several caveats lie ahead for a stronger dollar. The biggest wildcard is of course the U.S. Federal Reserve’s monetary policy. Financial markets are currently pricing in just two more rate hikes for the rest of the year. Less than that and the dollar should weaken. More than that and the dollar will strengthen. The latter was the case during much of the last rally in the U.S. dollar. The Fed releases its next pronouncements this coming Wednesday. The ECB follows with its own show the following day.

Politics is, of course, another large wildcard. On June 8th Marketplace published a great piece following U.S. trade policy over the last 30 years, encompassing five Presidential administrations. Trump’s policy stance runs counter to the trend from previous years of freer trade. More importantly, Trump’s stance clashes with some of the traditional orthodoxy of his Republican party. To the extent these clashes play out in a political process, then financial markets are likely to react and reverse and react again in several cycles as the political drama plays out. In the middle of the volatility, I hope to find good short-term and long-term trading opportunities using the U.S. dollar as a base.

From Marketplace’s reference to President Ronald Reagan (quote taken from a radio address in 1988 – see the video below)…

“Reagan and Canada’s then-Prime Minister Brian Mulroney had recently signed the Canada-U.S. Free Trade Agreement. Reagan told the American people, ‘We should beware of the demagogues who are ready to declare a trade war against our friends, weakening our economy, our national security and the entire free world all while cynically waving the American flag. The expansion of the international economy is not a foreign invasion. It is an American triumph.'”

Source: TradingView.com

Source: TradingView.com

Be careful out there!

Full disclosure: net long the U.S. dollar