The Canadian dollar (FXC) is at an interesting juncture. Strong economic data has strengthened the currency but the Bank of Canada (BoC) has applied brakes on currency’s rally. The Canadian dollar weakened in the wake of policy statements in October and December. The last word of 2017 went to the economic data as hot inflation numbers confirmed overhead resistance for USD/CAD at its 50 and 200-day moving averages (DMAs). USD/CAD closed out the year at a two month low and a lot of downward momentum.

Source: FreeStockCharts.com

From a technical perspective, note that USD/CAD rallied from its intraday low on Friday and formed a hammer pattern. A continued push higher from here would likely take the pair at least back to the upper boundary of the lower Bollinger Band (BB) channel.

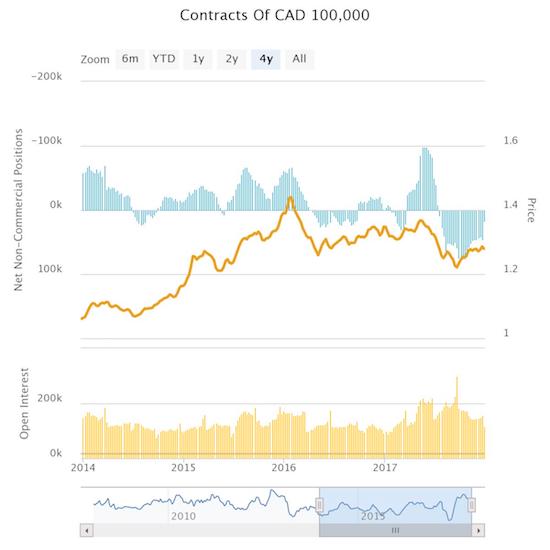

Interestingly, speculators backed off their bullishness going into year-end despite the strong economic data and rising oil prices. The declining trend in bullishness is important given the current cycle of net long contracts has been very prominent relative to the last four years dominated by bearishness.

Source: Oanda’s CFTC’s Commitments of Traders

Here is a quick review of some of Canada’s key fundamental data and events for December.

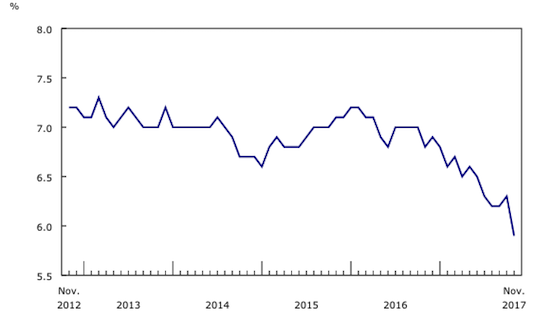

December 1: Employment Report

At 5.9%, the unemployment rate dropped to its lowest level since February 2008. The bulk of the employment gains came in Ontario where the unemployment rate dropped to its lowest level since July, 2000.

Source: Statistics Canada

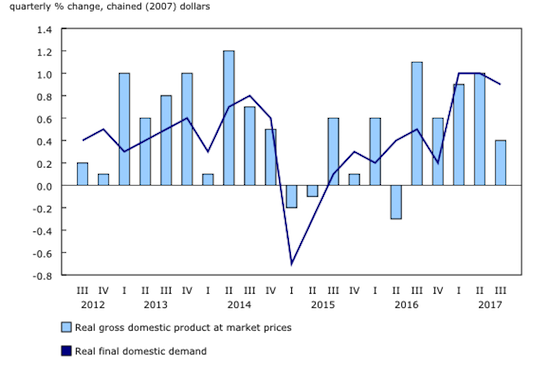

December 1: GDP report

Third quarter real GDP rose 0.4% from the second quarter and 1.7% on an annualized basis. This was the lowest quarterly gain since GDP growth went negative in the second quarter of last year. The jobs data likely overshadowed the GDP data.

Source: Statistics Canada

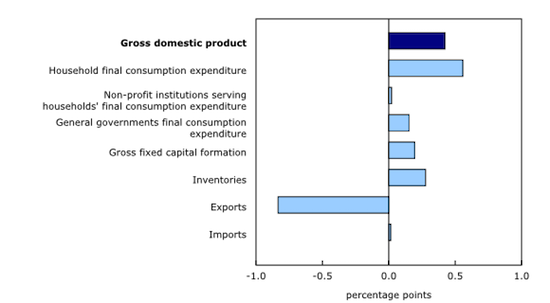

A large drop in exports was the main drag on GDP. Exports plunged largely thanks to declines in the automotive sector from work stoppages and model changes. Exports last declined in the second quarter of 2016. This sudden weakness could motivate the Bank of Canada to keep talking down catalysts that might strengthen the Canadian dollar. All other sectors showed gains with household expenditures leading the way.

Source: Statistics Canada

Employee compensation was a bright spot with 1.3% nominal growth. This growth rate was the strongest in three years and certainly supported the strong showing in household expenditures.

December 6: Bank of Canada decision on monetary policy

The Bank of Canada made no changes to monetary policy. The main headline was the Bank’s conclusion that the economy is progressing pretty much as expected in the October Monetary Policy Report. Given the strength in the economy, the Bank of Canada acknowledged that rates will have to go up over time, but again, it will proceed with caution:

“While higher interest rates will likely be required over time, Governing Council will continue to be cautious, guided by incoming data in assessing the economy’s sensitivity to interest rates, the evolution of economic capacity, and the dynamics of both wage growth and inflation.”

The two primary points of caution should focus on the performance of exports – extremely critical to the Canadian economy, and the health of residential housing which experienced its second straight quarter of declining investment (from the third quarter GDP report).

December 7: Heavy duties on the export of Canadian lumber to the U.S.

Canadian exports will get no help from U.S. duties. On December 7th, the U.S. International Trade Commission “…made a final finding that exports of softwood lumber from Canada injure U.S. producers, virtually ensuring that hefty duties on imports of the building material will remain in place for five years. The decision will impose anti-dumping and anti-subsidy duties affecting about $5.66 billion worth of lumber…”

Canada disagrees with the premise of the ruling that the government subsidizes its lumber producers. Home builders are worried that the ruling will increase material costs.

The Canadian dollar weakened slightly on the news as USD/CAD rose into 200DMA resistance. The market’s concern over the news obviously failed to persist. In 2016, the U.S. actually ran a trade surplus with Canada totaling $12.1B in goods and services. Lumber is a tiny fraction of the $307.6B worth of goods and services that Canada exports to the U.S. (The Census Bureau provides a monthly breakdown of trade in goods with Canada).

December 21: Consumer Price Index (CPI)

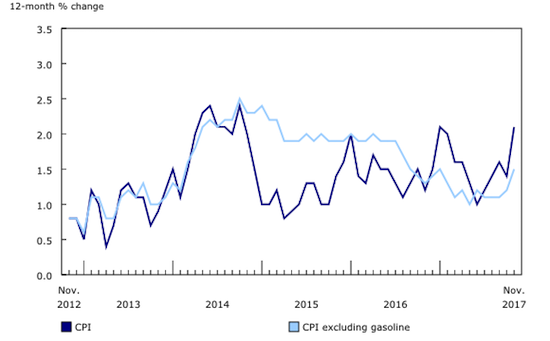

Canada’s CPI continued its upswing from the June low of 1.0% by hitting 2.1% in November. The CPI was last this high in January, 2017. Excluding gasoline, the CPI hit 1.5% and was last that high in January. Unlike the overall CPI, the CPI excluding gasoline has been much higher since 2014.

Source: Statistics Canada

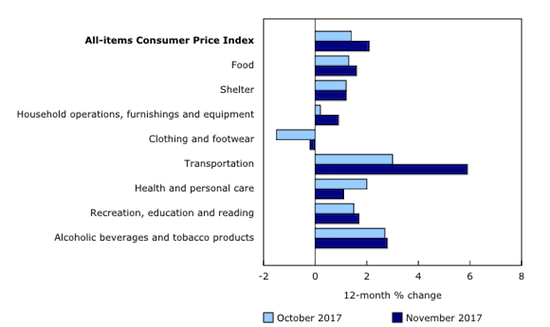

The price gains were broad based. Clothing and footwear was the only component to decline in the CPI. The same distribution occurred for October.

Source: Statistics Canada

As I noted above, the market reacted sharply to the inflation data. The Canadian dollar strengthened (with USD/CAD making a final confirmation of declining 200DMA resistance and breaking down below 50DMA support) presumably in anticipation of a Bank of Canada that will be forced to act sooner than expected. Whether the BoC actually feels compelled to respond remains to be seen given its conclusion that short-term and temporary factors are the primary cuplrits:

“Inflation has been slightly higher than anticipated and will continue to be boosted in the short term by temporary factors, particularly gasoline prices.”

Be careful out there!

Full disclosure: no positions

The Loonie isnt stronger the dollar is simply much weaker….

I considered pointing out the U.S. dollar’s overall weakness, but didn’t want to lengthen the article. Moreover, the fundamental data had a distinct impact on USD/CAD that is independent of USD and all about CAD. Those reactions could sustain lower levels on USD/CAD even when/if the USD regains its footing.