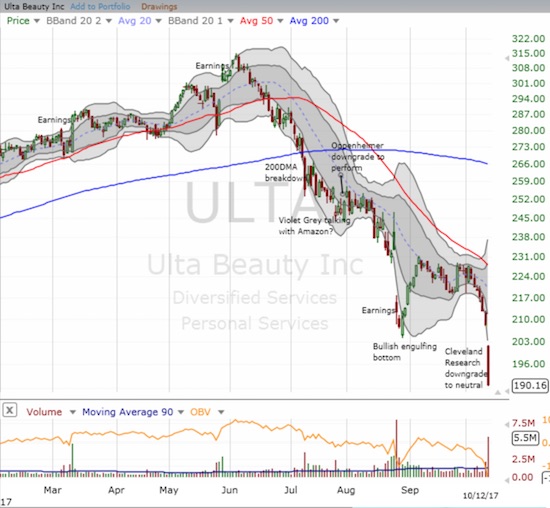

I first wrote about Ulta Beauty (ULTA) in early September, 2016 after it confirmed a bearish breakdown from support at its 50-day moving average (DMA). I never traded the stock and missed the entire recovery and 31% gain to the last peak and all-time high in early June, 2017. It took another bearish breakdown for ULTA caught my full attention again. This time the stock not only confirmed a 50DMA breakdown but also broke down below its 200DMA for the first time since early 2016. Sensing a change in the character of trading in the stock, I made bearish trades on ULTA as well as a hedged trade. In just a few more days from there, I was convinced that ULTA was mired in a bearish mood: “ULTA has yet to get hit by Amazon Panic, but the chart certainly makes me think that previously comfortable investors are trying to ease their way out the stock ahead of any such surprises.”

From there, ULTA lost another 25% as it delivered a poorly received earnings report and now a devastating downgrade from an analyst.

Source: FreeStockCharts.com

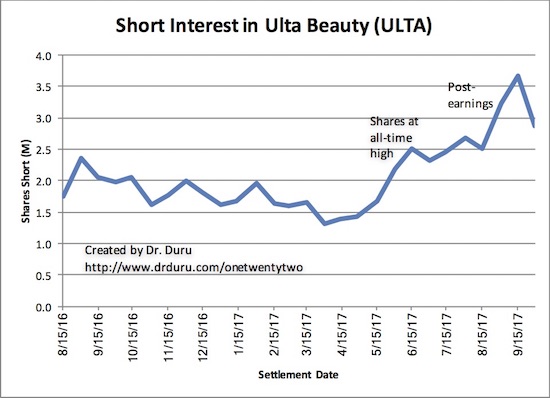

The significance of ULTA’s chart lies in the signals sent by sellers. The complete reversal of May’s earnings gain that went along with the 50 and 200DMA breakdowns was signal flare number 1. The weakness going into earnings was the second signal flare. Signal flare #3 was the most telling as investors and traders scrambled anew to get out of ULTA – perhaps sensing or even being aware that a significant downgrade was on the way. Despite my bearishness, I managed to make a timely trade on ULTA’s rebound from August earnings. I closed out the trade with a warning that buyers likely exhausted themselves. While looking for the next bounce in ULTA, I missed the acceleration of bearishness that preceded the big downgrade (a failure in reseting price alerts).

This kind of downward “swoosh” presents great trading challenges. On the one hand, ULTA is significantly oversold as it trades well below its lower-Bollinger Band (BB) on a surge of selling volume. On the other hand, the selling confirms a deepening bearishness that will likely receive follow-through – if not Friday, then “soon.” I manage these scenarios with a hedged trade of call and put options under the assumption that more big moves, whether up or down, are still to come. Either way, ULTA looks like a very broken stock in desperate need of a positive catalyst. Until such news arrives, my bias will remain bearish on ULTA.

Source: StockTwits

Source: NASDAQ.com

Be careful out there!

Full disclosure: long ULTA call and put options