(This is an excerpt from an article I originally published on Seeking Alpha on April 5, 2017. Click here to read the entire piece.)

The International Cocoa Organization (ICCO) recently released its monthly market report for February. February was of course the month of an accelerated price decline for cocoa. Cocoa hit, and retested, a 3 1/2 year low priced in British pounds and a 9-year low priced in U.S. dollars. It was at the end of February that I ventured to call for a bottom. The ICCO’s forecast of a “significant supply surplus” seems to defy that call for a bottom:

{snip}

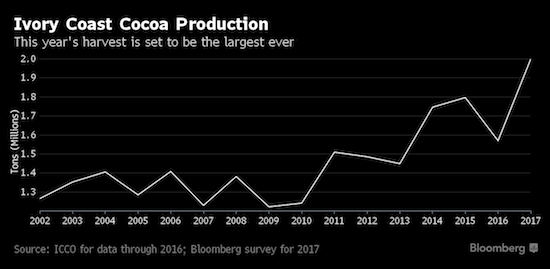

Forecasts from the Ivory Coast also seemed to contradict any expectations for a bottom in prices. {snip}

Source: Bloomberg

The Bloomberg respondents referenced favorable weather conditions for their optimistic outlooks. Bloomberg also noted the increased number of new and more productive cocoa trees which achieve production in 18 months instead of the typical 5 years. {snip}

Interestingly, just last week Reuters Africa chose to focus more on the regions of Ivory Coast experiencing poor growing conditions to warn of potential problems with Ivory Coast production. {snip}

…This is a critical juncture for crop conditions AND the price technicals.

Source: FreeStockCharts.com

Ghana is not off the hook for potential problems. {snip}

Overall, I think cocoa has delivered encouraging price action under these circumstances. {snip}

This juncture is a time for evaluating positions. {snip}

I fully recognize that the downside risk is real even if that scenario is not my base case. {snip} The long-term chart below provides a stark reminder of the implications of further downside: a break of recent lows could trigger a fresh sell-off in cocoa, perhaps as low as $1500 per ton. {snip}

Source: Bloomberg

Be careful out there!

Full disclosure: long NIB

(This is an excerpt from an article I originally published on Seeking Alpha on April 5, 2017. Click here to read the entire piece.)