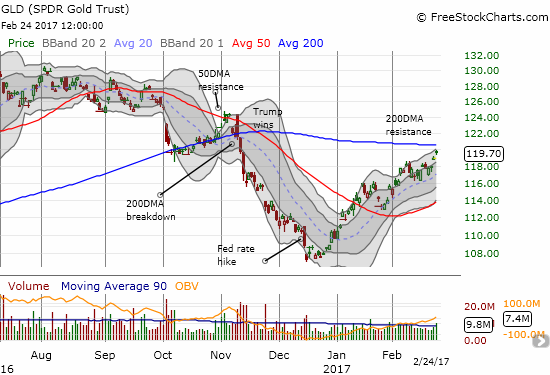

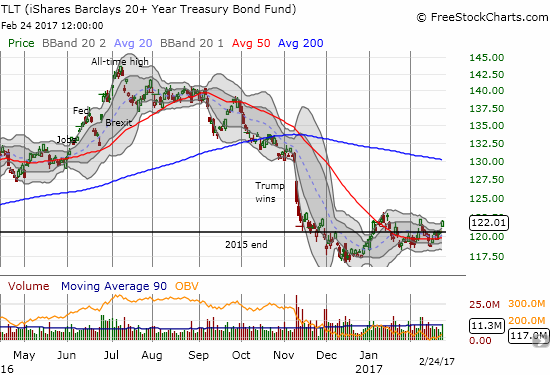

It is hard to believe that just six weeks ago I proposed a pairs trade of gold versus bonds with the SPDR Gold Shares (GLD) toying with resistance at its 50-day moving average (DMA) and the iShares 20+ Year Treasury Bond (TLT) doing the same. Now, GLD has already hit the next line of resistance at its 200DMA. TLT is sitting almost right where it was six months ago; TLT looks like it is consolidating and readying for an important breakout. The next big move or moves seem at hand.

This is an even better setup for a pairs trade than the last time around. Typically, I would play such a setup by going short the equity that has rallied strong into resistance and go long the paired equity which has yet to expend its rocket fuel. This would mean going short GLD and long TLT. However, it is just not in my nature to EVER short gold. So, I will make an exception here and simply repeat my last pairs trade setup: long GLD and short TLT.

The thesis for this trade remains the same. Here is my claim from January:

“Looking backward, I see now that the SPDR Gold Shares (GLD) quietly carved out a bottom after the U.S. Federal Reserve hiked interest rates last month. Suddenly, a repeat of the response to 2015’s rate hike seems possible. GLD is already trading well above where it opened just ahead of the Fed. GLD’s 20DMA turned upward this month, and GLD printed a 50DMA breakout last week. A new high above the 50DMA will confirm the breakout and get me interested in making fresh short-term trades to the long side on GLD. Granted, this bottoming process perplexes me a bit. I interpreted the rise in gold after 2015’s rate hike as indicative of market fears that the Fed’s planned hikes for 2016 would crush the economy and lead to looser monetary policy all over again. This time around, 11-year high consumer sentiment, bullish stock market sentiment, and expectations for a robust Trumpflation economy all seem to work against the knee-jerk fears that come with a rate hike cycle. I admit that the chorus of bullishness seems strange given Wall Street supposedly prefers a divided government that gets little done, but I am content to follow the technicals…

Interest rates have followed the U.S. dollar lower, and iShares 20+ Year Treasury Bond (TLT) has followed gold higher. A pairs trade between call options on a gold-related play and put options on TLT looks very attractive. I think dramatic moves in both are bound to occur in coming weeks or months as the Trump administration and Congress cooperate on launching an aggressive agenda.”

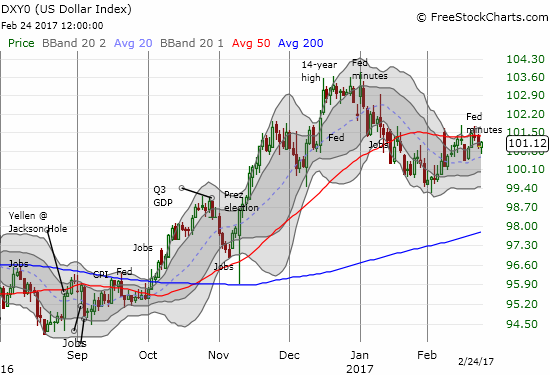

Like TLT, the U.S. dollar index (DXY0) has gone just about nowhere in the past 6 weeks. With gold sprinting higher, I would have expected more weakness in the U.S. dollar index.

Source for charts: FreeStockCharts.com

For now, I consider the U.S. dollar the wildcard in the gold versus bonds pairs trade. The drama in forex continues to build as the Trump administration sends mixed messages about its assessment of the landscape. U.S.Treasury Secretary Steven Mnuchin returned to toeing the tradition followed by all his predecessors by affirming the benefit of a strong dollar over the “long-term.” From Reuters:

“For longer-term purposes, an appreciation of the dollar is a good thing, and I would expect longer-term, as you’ve seen over periods of time, the dollar does appreciate…

In the short term, there are certain aspects (of a strong currency) that are positive about the dollar for our economy and there are certain aspects that are not as positive…A lot of the appreciation of the dollar since the election in particular is a sign of confidence in the Trump administration and the economic outlook for the next four years.”

Mnuchin’s boss, President Donald Trump, soon after attacked China for being a world champion currency manipulator. Again from Reuters:

“In an exclusive interview with Reuters, Trump said he has not ‘held back’ in his assessment that China manipulates its yuan currency, despite not acting on a campaign promise to declare it a currency manipulator on his first day in office.”

Trump is on record for accusing several of the U.S.’s major trading partners of manipulating their currencies lower: China, Japan, and Germany. Trump thinks the U.S. has gotten a raw deal that he seeks to fix although he has proposed nothing concrete yet.

Stay tuned on this one. Big fireworks are sure to come this year out of these tensions. The pay-off is in avoiding commitment to a particular direction. This setup makes the pairs trade particularly valuable and powerful. I will launch this latest pairs trade in the coming week (you can follow on twitter with the hashtag #122trade). The gold component will be a trade around my existing core position in GLD.

Be careful out there!

Full disclosure: long GLD, long and short various positions on the U.S. dollar