“The slowdown in aggregate demand contributes to the fall in inflation. Yet, exchange rate movements due to recently heightened global uncertainty and volatility pose upside risks on the inflation outlook. The Committee decided to implement monetary tightening to contain adverse impact of these developments on expectations and the pricing behavior.” – The Central Bank of Turkey, November 24, 2016

Turkey’s central bank is in an awful bind. Turkey’s economy is getting squeezed at the same time its currency collapses. A little over a week ago the central bank chose what it thinks is the lesser of two evils and hiked interest rates in an attempt to support the Turkish lira.

“a) Overnight Interest Rates: Marginal Funding Rate has been increased from 8.25 percent to 8.5 percent, and borrowing rate has been kept at 7.25 percent,

b) One-week repo rate has been increased from 7.5 percent to 8 percent,

c) Late Liquidity Window Interest Rates (between 4:00 p.m. – 5:00 p.m.): Borrowing rate has been kept at 0 percent, and lending rate has been increased from 9.75 percent to 10 percent.”

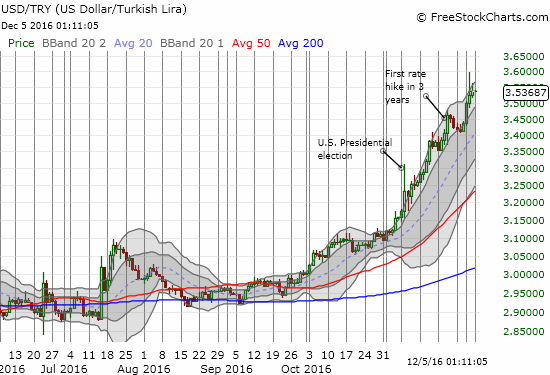

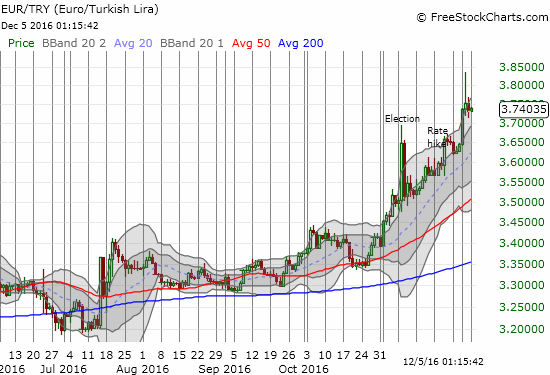

Unlike the rate hike nearly three years ago, THIS rate hike has so far failed to stem the bleeding in the lira. The Turkish lira continues to lose rapid ground to the likes of the U.S. dollar (USD/TRY) and even the euro (EUR/TRY).

USD/TRY is up about 15% since the end of October. The rally took a brief pause shortly after interest rates went up, but the rally picked right back up last week with just as much intense ferocity as before.

Here is a weekly chart for more perspective.

Source for charts: FreeStockCharts.com

The weekly view highlights well the parabolic move since November’s big breakout. Parabolic moves are not supposed to last for long, and this expectation held true in early 2014. The lira los so much, so fast, that the central bank was forced to act swiftly and forcefully. One could argue that the latest move to save the currency is not nearly as urgent and as big as the move in 2014. However, at some point I do fully expect this parabolic move higher to exhaust itself even on it own. As a result, I decided to take on the risk of building a small position short USD/TRY in anticipation of a pullback.

So far, I have had to marvel at strength of the parabolic move. I have even had to hedge periodically against my position with quick trades in and out of long EUR/TRY. If USD/TRY manages to surpass the latest all-time high of around 3.60 that stretched the pair well above its upper-Bollinger Band (BB), I will have to consider backing down from this trade and changing strategy. That strategy would go to a more passive approach which waits for USD/TRY to cross below a threshold to trigger an accumulation of short USD/TRY. Right now, that point would be about 3.48 because it completely reverses USD/TRY’s move from the day it soared to 3.60.

Tensions should be high when the central bank announces its policy for 2017 at a press conference on Tuesday, December 6th.

Stay tuned!

Be careful out there!

Full disclosure: net long the Turkish lira

Spot on, Doc! Do you foresee now that it will go down to 3.32-3.34 levels?

Easily. It *should* retest the 50-day moving average uptrend in a “normal world.” That would be all the way down around 3.25. USD/TRY sank nicely in the wake of the central bank’s meeting on the 6th. I have not yet caught up with that news….