By now, traders should know the drill on these highly anticipated events that promise dire potential consequences…

- Traders build positions in anticipation of or to hedge against the potentially “adverse” outcome of the highly anticipated event.

- An outcome interpreted as adverse occurs and markets respond accordingly.

- The expected response to an adverse outcome turns out not to be sustainable as the forces of reversal exert themselves relatively quickly.

- After the dust settles, the main instrument to gauge the adverse outcome performs (much) better than it did ahead of the highly anticipated event.

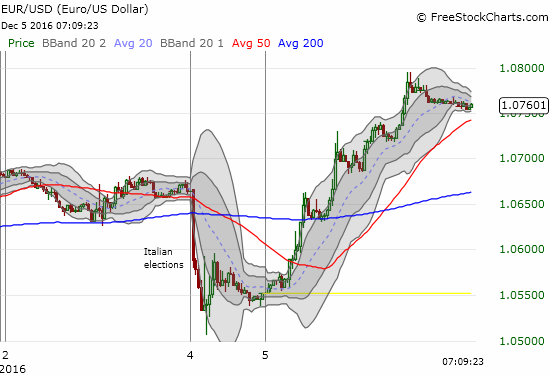

This dynamic was on full display with Brexit and the U.S. Presidential election. This same dynamic has apparently played out with Sunday’s headlines regarding the elections in Italy. The euro (FXE) was under pressure after the U.S. Presidential election before bottoming at the end of Thanksgiving in the U.S.; apprehension over Italy’s coming elections was often cited as a driver of incremental euro weakness (not just against the U.S. dollar). After the election results, currency trading in Asia began with a sharp move downward for the euro. By the time the dust settled, not only had the euro stabilized, but against the U.S. dollar, the euro hit its highest level in almost three weeks.

Source: FreeStockCharts.com

This rebound is what I call a euro “flush.” Pent-up negative sentiment found a climactic release in the immediate aftermath only to exhaust the last of the selling pressure on the euro. This tendency for the news to mark the END of a sympathetic trade, rather than the beginning or even continuation of it, is what partially motivated me to close out event-driven trades that I have described in earlier posts. Those trades were long the U.S. dollar and short the Japanese yen.

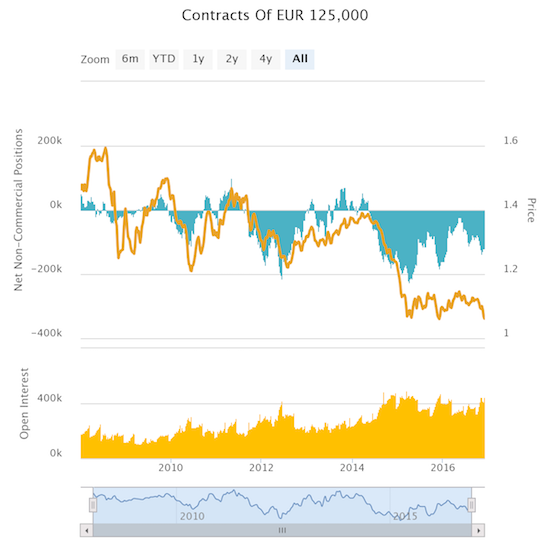

So what now? Speculators have remained net short the euro for the last 2 1/2 years. The latest build-up in shorts never matched the heights of earlier cycles. So, I assume euro bears MIGHT rebuild at cheaper prices and/or any short-covering will come to a quick end. Yet, the near 2% move higher for EUR/USD also likely caused a lot of damage that takes time to heal. I am starting a fresh short on EUR/USD at a much smaller scale than the position I closed out a few weeks ago as I still have every reason to prefer the U.S. dollar to the euro ahead of the Federal Reserve’s December meeting next week.

Source: Oanda’s CFTC Commitments of Traders

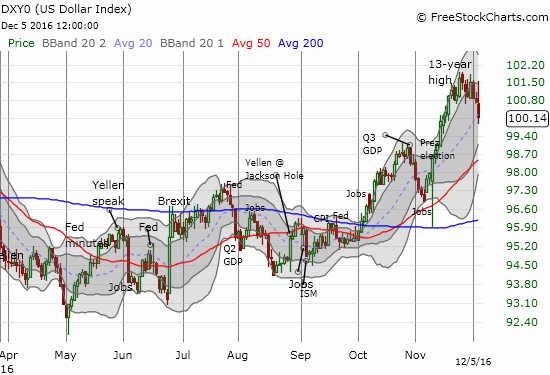

As I anticipated at the end of November, the U.S. dollar index (DXY0) has topped out and begun consolidating. As a result, I have switched my trading on the U.S. dollar to day-to-day trades that play a presumed tight trading range…including EUR/USD. I expect some kind of bounce now that the U.S. dollar index is retesting the 100 level right at the uptrending 20-day moving average (DMA).

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: short EUR/USD