(This is an excerpt from an article I originally published on Seeking Alpha on November 14, 2016. Click here to read the entire piece.)

{snip}

These quotes came from Mark Carney, governor of the Bank of England (BoE), in response to questions during the Q&A period of the November Inflation Report. I believe Carney reminded the audience that currency markets are trying to price in future possibilities with nothing to go on but guesses and speculation. Moreover, Carney got just about as close as possible to asserting that the markets have guessed incorrectly at this point by overly discounting the British pound (FXB). {snip}

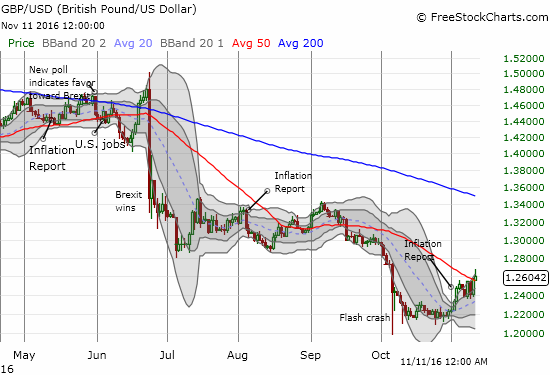

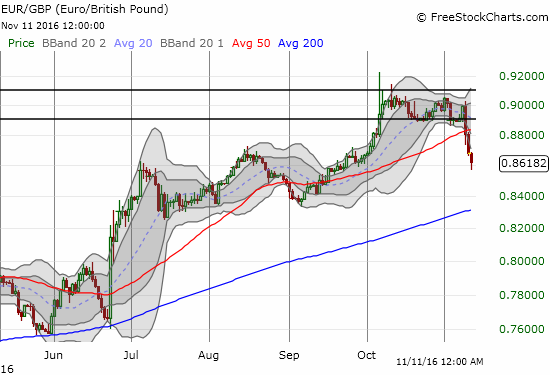

When I last wrote about the prospects for a counter-trend trade on the British pound, I pointed to the euro (FXE) versus the pound as a more effective indicator for sentiment on the pound than GBP/USD. {snip}

With EUR/GBP so far extended, I decided to close out my short EUR/GBP. {snip} I still see more potential gains for the pound ahead. For example, during the November Inflation Report the BoE failed to deliver on its promise to cut rates again before year-end. In fact, the BoE removed another rate cut from consideration altogether although a participant in the press conference had to push Carney into a confirmation. The statement on monetary policy did not address this issue directly and just left implied that no rate cut was forthcoming.

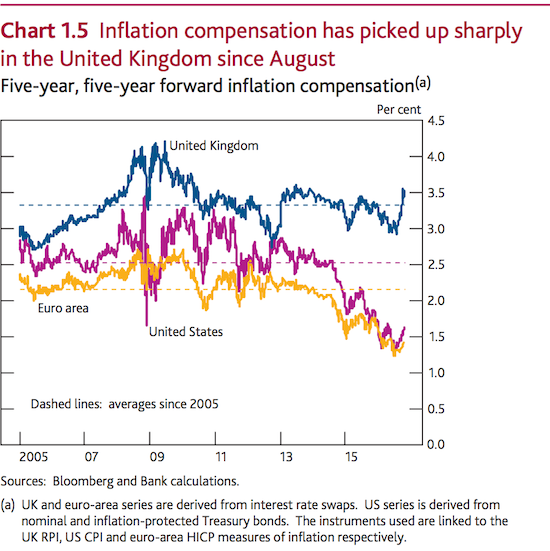

{snip} NOW, inflation appears as a slightly bigger threat…

{snip}

Source: Inflation Report, November 2016

The Inflation Report puts all the blame on the currency for the hotter read on inflation:

{snip}

Overall, the BoE cannot decide whether the fall in the currency is on net positive or negative. {snip}

Regardless, inflation sticks out as the main reason for the BoE’s change of heart on a rate cut because the Bank made it clear on multiple occasions that, on balance, its expectations for growth remain unchanged from August. This assessment is important because in August the Bank claimed that if “the outlook remained broadly consistent with the one set out in the August Report” it would cut rates again before year-end.

{snip}

So the outlook from August was essentially left unchanged. Yet, no rate cut was forthcoming as previously promised to follow from an unchanged outlook.

The current momentum benefits from a November 3rd court ruling giving Parliament a say in Brexit negotiations. {snip}

I also believe more upside may be ahead because of the post-election momentum. {snip}

Overall, I believe the Bank of England finds itself in a tough spot. {snip}

Source: Toblerone official Facebook page

Toblerone bars that formerly weighed 170 gram have been slashed to 150 grams: https://t.co/PtXervfhP9 via @CNNMoney

— elle (@elleboca) November 9, 2016

Be careful out there!

Full disclosure: net long the British pound

(This is an excerpt from an article I originally published on Seeking Alpha on November 14, 2016. Click here to read the entire piece.)