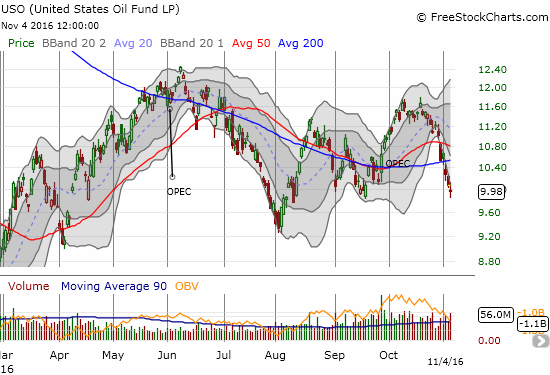

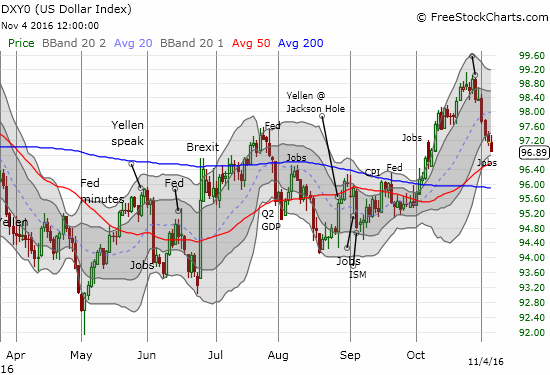

In a previous post on the stock market, I noted how commodity-related plays were apparently benefiting from a sagging U.S. dollar index (DXY0). I failed to note that oil was (and is) a glaring exception.

Oil futures fell around 9% for the week. This plunge was enough to completely reverse last month’s rally for United States Oil (USO) celebrating the prospects for OPEC price manipulation.

Source for charts: FreeStockCharts.com

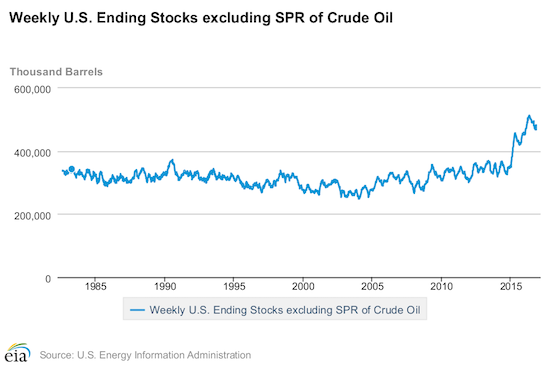

On Thursday, November 3rd, Reuters reported that on-going squabbling between Saudi Arabia and Iran threatened an OPEC agreement on production caps. Iran wants to make up for lost revenue, and Saudi Arabia will ramp up production to drive prices lower if Iran fails to get on board with production limits. Oil prices were also pressured on November 2nd when the U.S. Energy Information Agency (USEIA) reported that stocks of crude oil jumped sharply by 14.4M barrels – this increase was the largest build in EIA inventories in 30 years.

Source: The U.S. Energy Information Agency (USEIA)

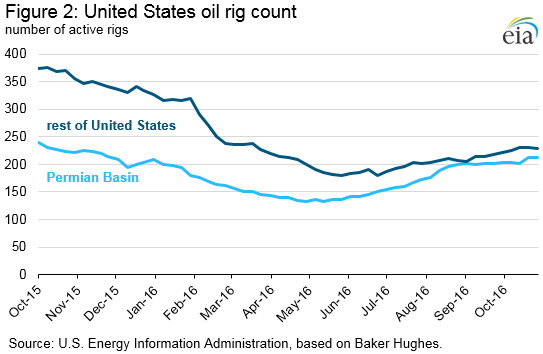

Also in the background is a steady recovery in U.S. rig counts which are responding to the rally in oil prices since the trough in January/February of this year.

Source: The U.S. Energy Information Agency (USEIA)

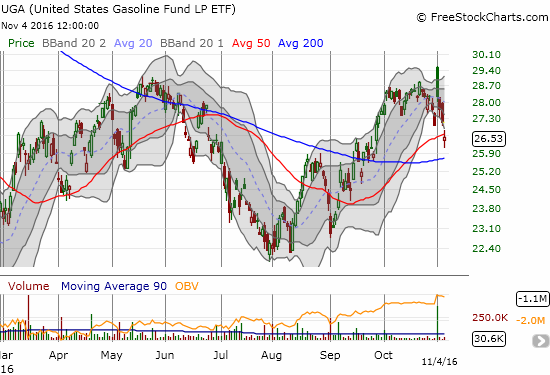

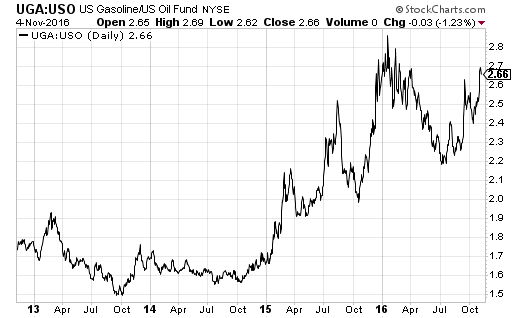

All this action in the oil patch presents me with an opportunity to get back on board with the USO versus United States Gasoline (UGA) pairs trade that I described three months ago. In late September, I took profits on the UGA side of the trade only to watch the ETF continue its 200DMA breakout after the OPEC-inspired rally. UGA now trades within 2.6% of my selling point.

Source: FreeStockCharts.com

Assuming UGA continues to fall in the coming week, I am targeting a repurchase around 200DMA support. With USO trading at levels last seen September 20th, I am anticipating restarting the pairs trade with a net overall advantage. The profits on the UGA shares I sold covered about half the total cost of the USO puts I still hold and leave me with a small net overall profit.

Key to my trading opportunity back in August was a sharp pullback in the ratio of UGA to USO. That ratio is currently in rally mode again. I am assuming that the next pullback in this ratio will present the next buying opportunity with UGA declining at a higher percentage than USO.

Source: StockCharts.com

For the next go-round, I plan to stay committed to the pairs trade for an extended period of time guided by the upside and downside targets that I described in the earlier piece detailing the overall strategy. I chose the pairs trade strategy as a way to profit from moves in oil without committing to a bullish or bearish bias. When I sold the UGA shares, I succumbed to the urge to anticipate a trading direction. At that time, the momentum arrow pointed downward as OPEC’s efforts to collude sat on edge of failure. I was wrong at that moment, but now I hope to take advantage of this latest downward momentum from a looming failure to collude.

Be careful out there!

Full disclosure: long USO puts and long a separate USO hedged position