(This is an excerpt from an article I originally published on Seeking Alpha on September 25, 2016. Click here to read the entire piece.)

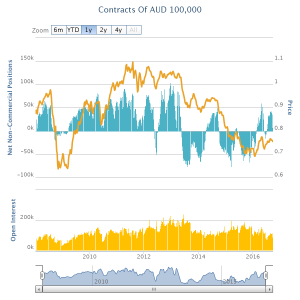

The latest data on speculator forex positioning showed a sudden and abrupt change in sentiment on the Australian dollar (FXA). {snip} If this sharp drop in net longs turns into net shorts, the odds of a renewed sell-off in the Australian dollar notably increase.

The chart below shows that, generally, the Australian dollar slides when traders go from an extended period of net bullishness to net bearishness WHILE the net shorts grow. {snip}

Click for a larger view…

Source: Oanda’s CFTC Commitments of Traders

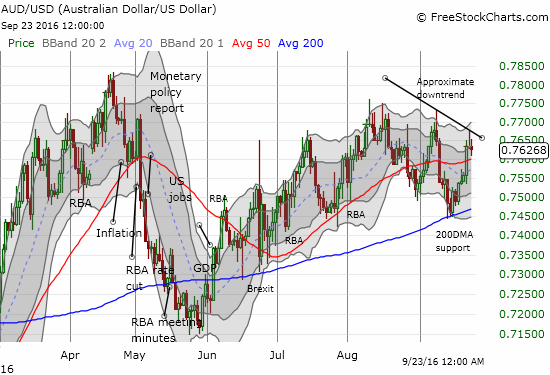

It is very possible that the latest sharp change in sentiment simply marked prudent risk reduction ahead of the September meeting of the U.S. Federal Reserve. {snip}

As an example, newly positioned RBA Governor Philip Lowe addressed Australia’s House of Representatives Standing Committee on Economics on September 22nd and provided a relatively upbeat review of the economy. Most notably, Lowe estimated that 75% of Australia’s decline in mining investment is over. The associated economic drag from that decline is thus lifting soon.

{snip}

Given this decline in mining investment has been a major drag on the Australian dollar, I readily concede that the runway for staying bearish on the Australian dollar is not likely a long one. Moreover, on-going monetary accommodation around the globe continues to encourage traders and investors to take the risk of plowing money into Australia:

{snip}

Ironically, if the U.S. Federal Reserve finally gets around to another rate hike in December, 2016 as futures market predict, that event could mark the BOTTOM of whatever sell-off is coming for the Australian dollar. {snip}

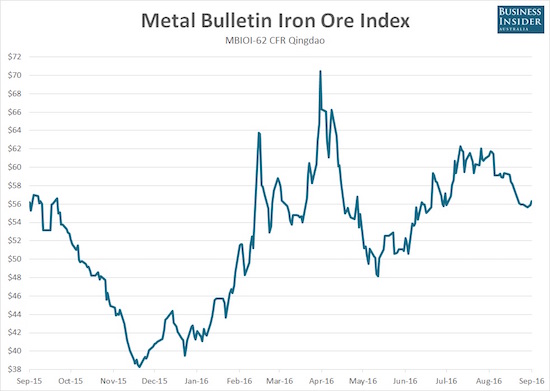

Lowe never referred directly to iron ore, but certainly 2016’s rally in iron ore has helped keep the Australian dollar higher than it otherwise would have traded. {snip}

Source: Business Insider Australia

{snip}

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: net short the Australian dollar

(This is an excerpt from an article I originally published on Seeking Alpha on September 25, 2016. Click here to read the entire piece.)