(This is an excerpt from an article I originally published on Seeking Alpha on August 3, 2016. Click here to read the entire piece.)

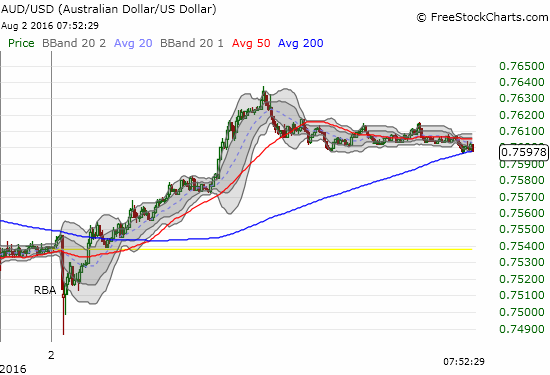

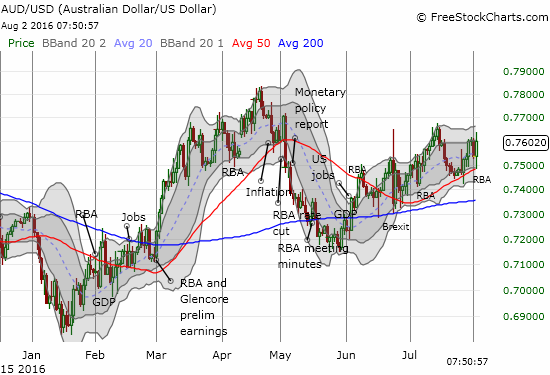

The Reserve Bank of Australia (RBA) kicked off central bank action for August with a rate cut to a fresh record low of 1.50%. Financial markets were anticipating a cut with odds bouncing between 55% and 70% for most of the past month. So while it might be no surprise that the Australian dollar (FXA) only experienced a small and temporary drop in response to the rate cut, it SHOULD be a surprise that the RBA finds itself with an even stronger Australian dollar than it had at the end of July’s meeting. {snip}

Source: FreeStockCharts.com

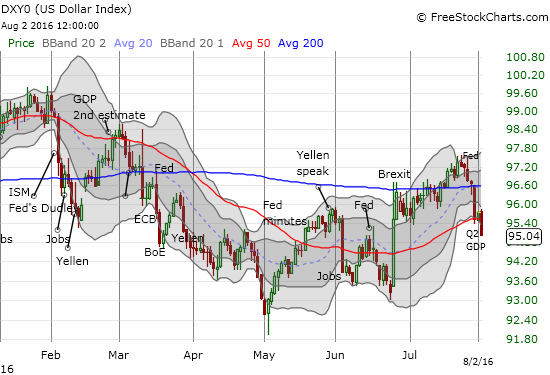

{snip}

Source: FreeStockCharts.com

The market’s bullish reaction to the RBA rate cut suggests the cut itself was practically immaterial to trading decisions except to create a contrary response (note that speculators flipped bullish on the Australian dollar over the previous three weeks). {snip}

In familiar form, the RBA did not provide specific guidance about its thinking for future rate cuts. {snip}

If not for this “excuse” paving the way for a rate cut, one could read the RBA’s statement out of context and wonder why the RBA cut rates at all. {snip}

{snip}

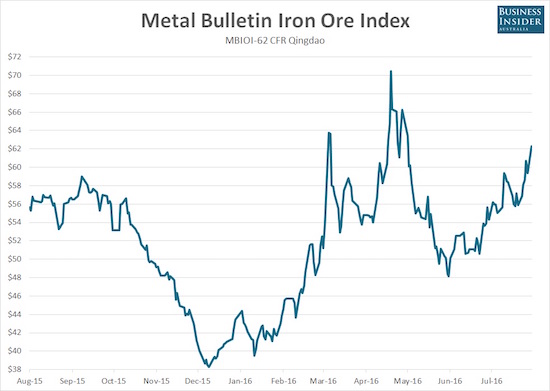

Yet, a key difference between Australia and the rest of the industrialized world that moved aggressively on monetary policy is that Australia never suffered a recession. The commodity boom, especially in iron ore, that exploded from the financial crisis even produced a confidently resurgent Australian economy. Despite a subsequent sharp decline in the terms of trade, there have still been varying occasions for optimism in the Australian economy. In fact, Koukoulas himself has expressed the very same predilection for optimism even to the point of suggesting that the RBA should hike rates. {snip}

In total, I think the RBA’s relative tentativeness on monetary policy is perfectly understandable. Surely the RBA sees the same conditions that cause Koukoulas to bounce frequently from strident and comprehensive optimism to monetary alarm. {snip}

Oh, and those commodity prices? Well, iron ore has developed a stubborn resilience this year in the face of firming steel profits and prices. {snip}

Source: Business Insider Australia

My 2016 trading strategy on the Australian dollar has fluctuated all year from bearishness to hedging to opportunistic bullishness…{snip}

Be careful out there!

Full disclosure: Net short the Australian dollar

(This is an excerpt from an article I originally published on Seeking Alpha on August 3, 2016. Click here to read the entire piece.)