(This is an excerpt from an article I originally published on Seeking Alpha on March 8, 2016. Click here to read the entire piece.)

On March 1, 2016, Glencore (GLNCY) announced its preliminary 2015 earnings results. During a media conference call, CEO Ivan Glasenberg declared a bottom for commodities. In the subsequent investor/analyst conference call, Glencore’s executives said nothing about a bottom in commodities and instead were quite clear in their abundance of caution and eagerness to continue fortifying the company against further weakness in commodity prices. Glencore’s reversal is instructive as it provides a tale of caution: the current run-up in the price of at least some commodities may be running well ahead of the fundamentals on the ground. (I am particularly focused on iron ore in this observation).

In the investor/analyst call, Glasenberg presented along with Glencore’s CFO. Together, the two executives were quite clear that the company is doing what other mining companies continue to do – brace the company for the potential for lower commodity prices. Glencore went so far as to reassure investors and analysts that its “free cash flow will remain comfortably positive at materially lower price levels.”

{snip}

Glencore’s instructive reversal made sense given large miners like BHP Billiton Limited (BHP) did not announce its measures of fortification as the beginning of a bottom in the market. {snip}

BHP’s comments on metallurgical coal, copper, and iron ore are all revealing:

{snip}

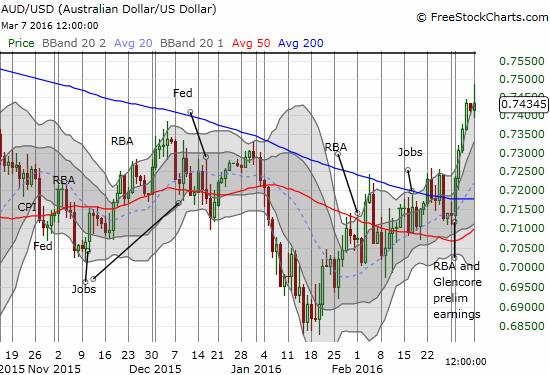

Source: FreeStockCharts.com

So while Glencore backtracked on its declaration of a bottom, the market is definitely trading like the bottom is receding in the rearview mirror. {snip}

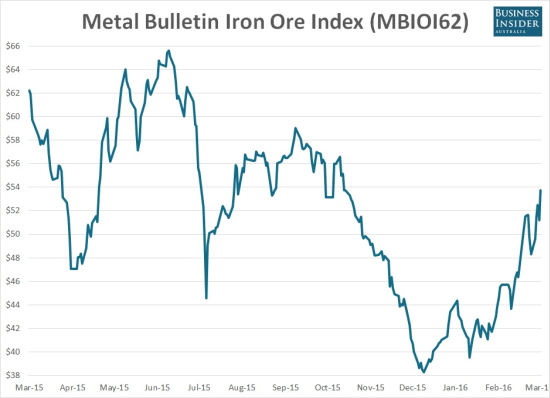

Source: Business Insider Australia

Commodity currencies like the Canadian dollar (FXC) and the Australian dollar (FXA) are adding to the signals of a bottom. {snip}

Source: FreeStockCharts.com

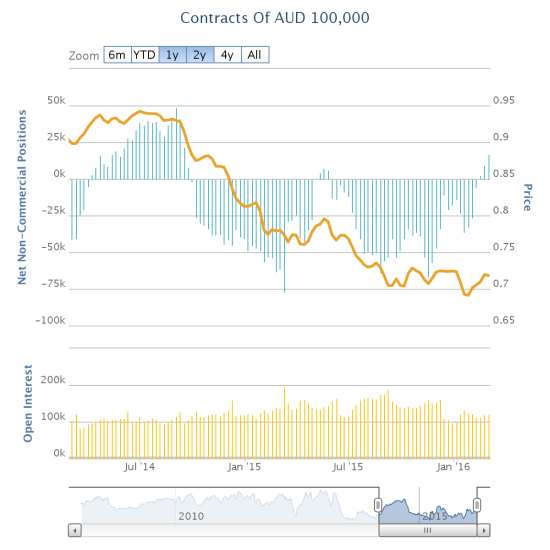

Source: Oanda’s CFTC’s Commitments of Traders

{snip} Perhaps once Glencore carries through on production cuts, and especially if other producers follow suit, I will pull out my Commodity Crash Playbook and put a firmer stake in the ground on a bottom in a sustainable bottom commodities.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on March 8, 2016. Click here to read the entire piece.)

Full disclosure: short USD/CAD, long FXC, long and short various positions against the Australian dollar, short put and call options on USO and long call options on USO